The second half road to nowhere

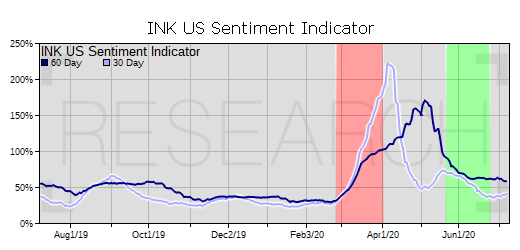

(Originally published on July 8, 2020) - Today we are going to focus strictly on interpreting what our US insider sentiment indicators are now signalling. Our key US Indicator which measures sentiment towards the average stock in America has firmly established a bottoming pattern. That means insider buying has bottomed out, typically a short-term bearish signal as such a pattern often happens near market tops. Moreover, we have seen above-average insider profit-taking in dollar terms. This has taken place right before many firms enter insider trading blackout periods. In plain English, that means insiders are taking money off the table while the going is good.

The major risk to our bearish signal is the possibility that insiders are early. Last week, we suggested that the June 8th S&P 500 high of 3,233.13 is going to be a tough nut to crack. We still believe that to be the case. However, we cannot rule out one last gasp higher before a correction. From current levels, we expect, at best, average real returns from US stocks over the next year.

Should inflation return to America, the Basic Materials sector is one area where investors often turn for some protection. Like the broad INK US Indicator, our Basic Materials Indicator is also putting in a bottom. As such, we are downgrading it to fair-valued. Insiders are signalling average real turns ahead for the group, and a correction from here is also a good possibility.

Meanwhile, the Energy sector remains undervalued although our sector indicator has put in a bottom suggesting short-term weakness ahead.

When both inflation and growth are low, investors often turn to the Information Technology sector. Indeed, that has been the playbook so far in 2020 for many investors with the PowerShares QQQ ETF hitting new all-time highs. However, insiders are taking money off the table in droves. We expect a correction shortly in technology shares based on our signals.

Finally, it is hard to believe that we can have a sustainable bull market without the participation of the banks. On that front, we find little comfort from insider signals as our banking indicator is heading down even as bank stocks fall. That is not typically a good sign.

Generally, insiders are signalling that the stock market is on a road to nowhere over the next few months. It would not surprise us if somewhere along that road over the next few weeks stocks take a turn south.

Originally published on INK Research July 8, 2020.