The Subprime 2.0 Bubble is About to Burst

As we've been outlining for weeks now, Subprime 2.0 is the subprime auto-loan industry. And just as the collapse in the subprime mortgage lending was what signaled the beginning of the housing crisis... trouble in the subprime auto-loan industry will be what signals that the next Debt Crisis is here.

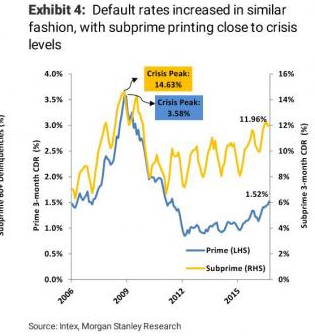

On that note... subprime auto-loan defaults are soaring, hitting 11.96%. The last time they were anywhere near these levels was in early 2008 right before the credit crisis hit.

Even worse, the subprime auto-loan industry is just the tip of the iceberg for our current debt bubble.

All told the world has added $57 TRILLION in debt since 2008... bringing the total debt in the world to $217 TRILLION.

That's means that globally the world is sporting a Debt to GDP of 325%.

And when this Debt Crisis begins, Central Banks will be powerless to stop it as they've already used up most of their ammunition during the 2008 Crisis.

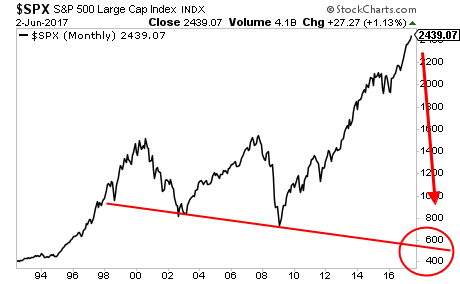

A Crash is coming... and it's going to horrific.

And smart investors will use it to make literal fortunes from it.

To pick up a FREE report outlining how to profit from the coming crash...

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research