The Technical Case for a Plunge into Molten Hell

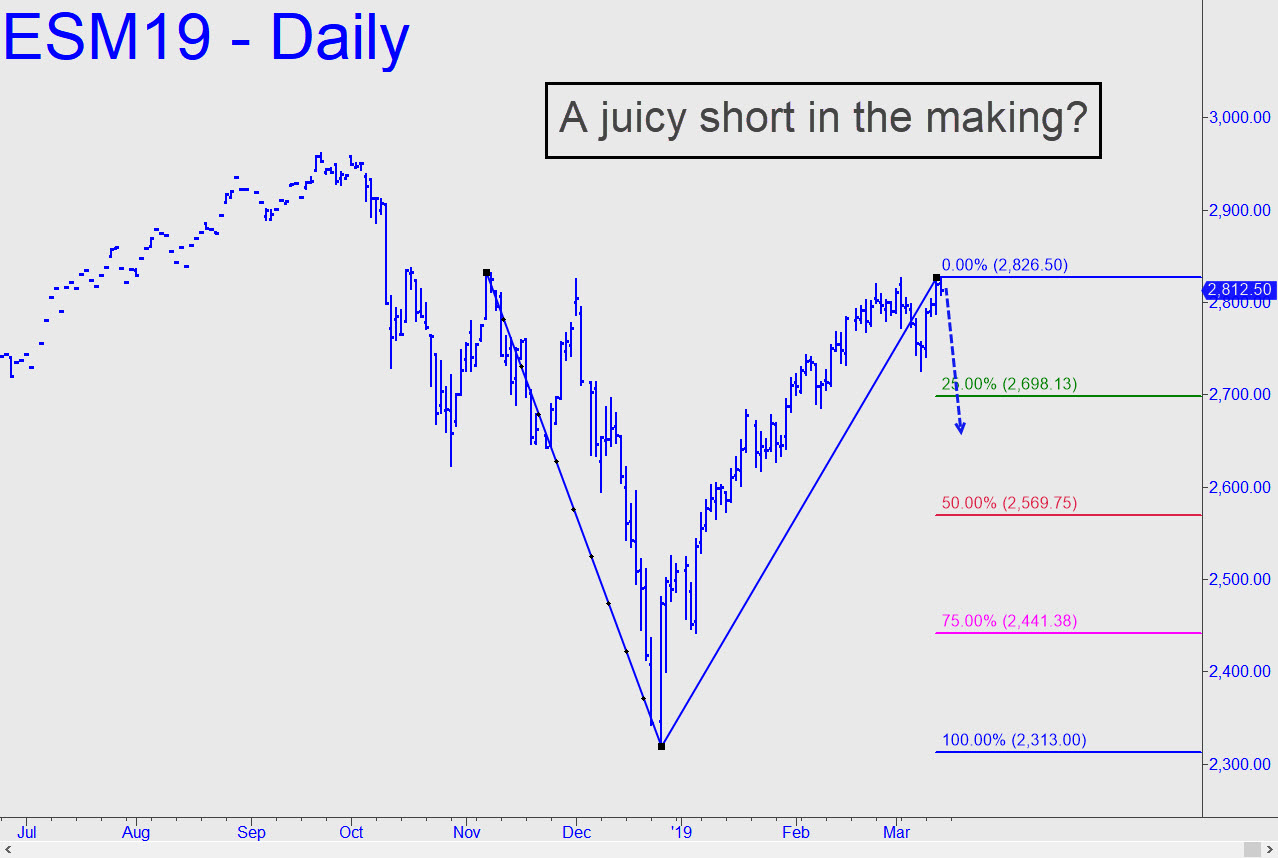

Face it, this monster could veer wildly in either direction right now, and even an Einstein could not confidently predict which. My heart's desire is to see the S&Ps plunge into the molten pit of hell by summer. The 2313.00 target shown suggests that, at least from a technical standpoint, this is possible. Presumably, the years-overdue collapse would drive out the crooks who have rigged shares while leaving the virtuous, widows and pensioners untouched. Thus cleansed in fire, Wall Street and the banking system would regenerate themselves and return to health; investors would enter a new era where accounting methods are honest, the behavior of stocks reasonably predictable, our economic and political lives guided by plain sense.

In the meantime, a trader could get his ass kicked, as your editor did Thursday, betting that the scenario above will commence within the week. The E-Mini S&Ps are positioned precariously enough (click on chart inset) so that it's not such a bad gamble. The 'CI' stands for a 'counterintuitive' trade intended to flout the raucously bullish mood of the day. But the futures have been so squirrelly lately that one can only infer many traders have flocked to the 'Don't pass' line, eager for the broad averages to seven-out. Is there a less stressful way to do this? Check out my strategy in VXXB, which tracks short-term S&P 500 volatility. It is close to a possible turning point, and although call options are not cheap, owning a few of them beats getting flogged all day long by S&P futures in rabid-badger mode. I

f you don't subscribe, click here for a free two-week trial that will give you access to everything. And please do stop by the Trading Room to say hello.