The Tipping Point

Expert Dr. Jim Jones shares his extensive research on Emerita Resources Corp. to tell you why he believes this is only the tipping point for the company and what catalysts he sees up and coming.

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJ:FSE) is a Canadian natural resource company engaged in the acquisition, exploration and development of mineral properties with a primary focus on exploring in Spain.

I call this "The Tipping Point" because there are a multitude of catalysts coming in the next few quarters that I believe will have a profoundly positive effect on investor sentiment as well as on the market cap of the company.

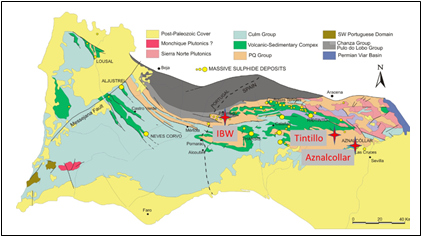

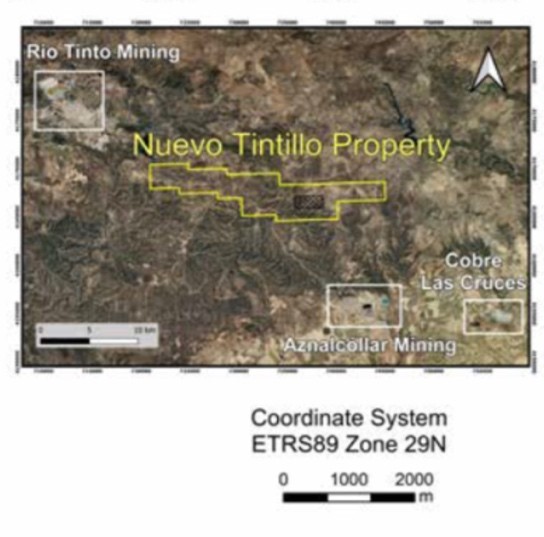

The company has 100% interest in the Iberian Belt West (IBW), 100% interest Neuvo Tintillo Project and is in the final stages of the validation of its bid for the Aznalcollar Project located in the famous Iberian Pyrite Belt in southern Spain.

EMO.V (0.71), EMOTF (0.53 USD)

Market Cap: $144 million CDCurrent cash balance: +$24 million CDNumber of drills turning: 14 (largest program in Spain)Third largest landholder in the Iberian Pyrite Belt of Spain, no royaltiesYou can see the corporate presentation here.

Emerita Resources is by far my favorite comeback story in the Jr. mining sector over the last decade. This David vs. Two-Headed Goliath saga is worthy of its own HBO mini-series.

I call this "The Tipping Point" because there are a multitude of catalysts coming in the next few quarters that I believe will have a profoundly positive effect on investor sentiment as well as on the market cap of the company.

This will be compounded by the macroeconomic environment I foresee evolving in 2023 as the world continues to push towards infrastructure/green energy spending, supply shortages, and growing demand in key base metals and the priority of the security and access to supply chains globally.

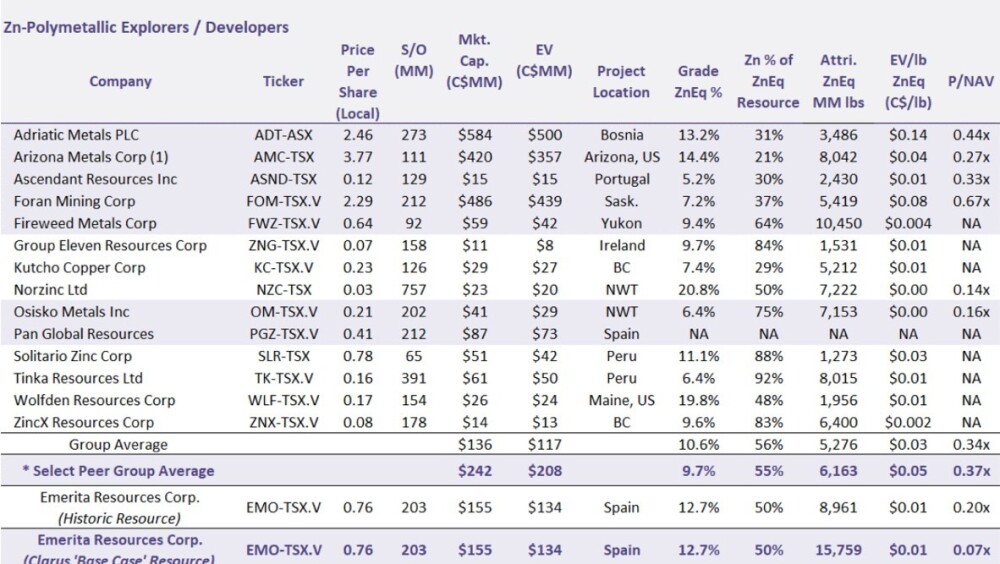

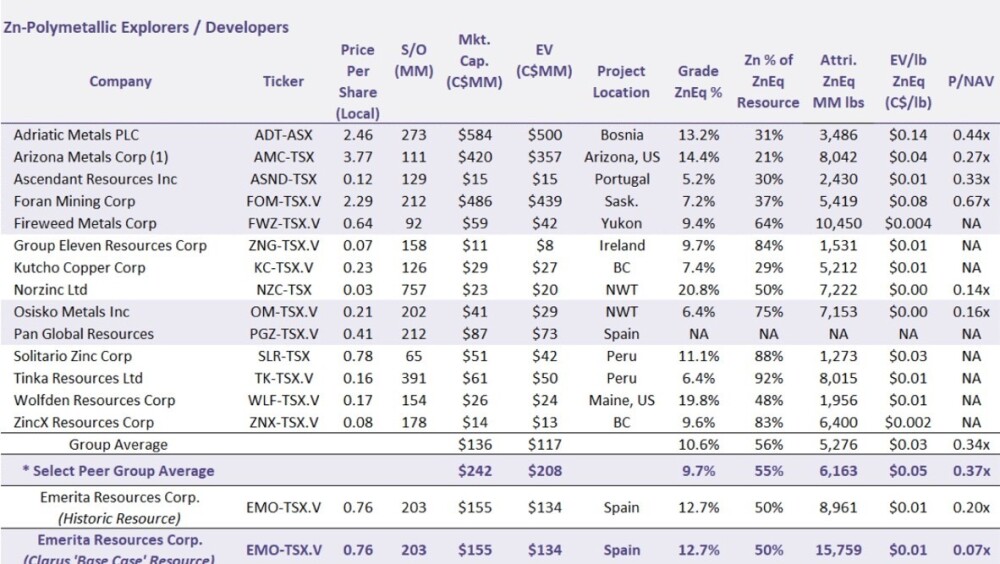

The stock is now extremely over-sold and trades at a robust 80% discount to its peers just on the historical resources of the Romanera Deposit drilled by majors decades ago.

Emerita's share price would have to rise 3-4x to trade with peer evaluations just on that. The current share price also assigns zero value for the El Cura Deposit and its coming drill program, gives zero value for the confirmation and expansion drilling done on the La Infanta deposit and discovery of La Infanta North, assigns no value for the coveted Neuvo Tintillo land package with its multiple discovery targets being worked on for a drill program in 2023, no value for the other 8 land tenders won that increases IBW's scale and upside, no value for the overwhelming evidence that they will win the Aznalcollar Tender, no value for the 70,000 meters currently being drilled on Romanera by 13 drill rigs which have already proved grades were under-reported and the high-grade portion of the deposit will increase both inside and extends beyond its historical borders, gives zero value for having well over $20 million in the treasury that provides a long runway well past issuing the coming 43-101 in Q1 2023 on IBW.

-

The Past...

Approximately seven years ago, Emerita Resources submitted bids on two world-class land packages in Spain's Iberian Pyrite Belt (The IBW Package and The Aznalcollar Package.), which are endowed with seven high-grade deposits containing close to 100Mt of high-grade zinc, and lead, copper, gold, and silver worth several billion dollars in today's commodity prices.

In the final round of the competition for the IBW against Trafigura/Matsa, they shockingly lost even though their bid was technically superior. In the case of the Aznalcollar Package, even though they were the only qualified bidder in the final round of the competition, the tender was awarded surreptitiously to a Grupo Mexico subsidiary that never qualified to enter the bidding process.

Emerita immediately launched legal challenges through the criminal and administrative courts, and in 2020 Emerita was officially awarded the IBW Package by the Superior Court.

The Aznalcollar Package is in the final stages of being resolved, a Criminal Court trial date is expected to be announced eminently, five Superior Court judges and three levels of court have rules "crimes were committed in the awarding of the Aznalcollar Tender" 16 defendants will face those serious charges including jail time, no further appeals from the defendants will be heard, they must stand trial.

A judge and courtroom have been appointed. The trial, once it has begun, is estimated to take three to four weeks to conclude.

"It is important to note that three levels of courts in Spain have determined that

crimes were committed during the tender process and have ruled that the accused

must stand trial. With respect to the title to the Aznalcollar property, Emerita's

external Spanish legal counsel has advised the Company that under Spanish law, if

there is commission of a crime in awarding a public tender, that bid must be

disqualified, and the tender must be awarded to the next qualified bidder. Emerita

is the only qualified bidder in this particular tender."

"the Provincial Court, in reviewing the case during the previous appeal process,

has indicated that the other bid did not meet the requirements laid out in the

tender process and should have been disqualified on that basis alone."

"According to Emerita's external Spanish legal counsel, this is a very important step

since trials in Spain do not typically proceed to this stage without a high certainty

of guilt, and it is very rare that accused are found not guilty at this stage."

Emerita Resources is an Iberian Pyrite Belt Spain Focused VMS exploration/development company that spent the better part of the decade leading up to June 28, 2020, in obscurity as it waged two independent lawsuits against the two major mining companies who were awarded the valuable public tenders in Spain that Emerita had superior bids on.

The proceeding legal battles for the IBW Land Package and the Aznalcollar Land Package would stretch on for years causing Emerita's share price to erode as the market assumed they would never survive long enough to see justice served, the company fell into obscurity and was thought would eventually run out of capital and go the way of the dodo bird.

The Market Was Wrong, Very Wrong

Emerita proved to be more akin to the mythical Phoenix, the market, and those they would eventually defeat in court and are awaiting the judge's gavel vastly underestimated the determination of the management team lead by David Gower (ex-global exploration manager for Falcon-Bridge/Noranda).

His team keep the company alive by shedding assets, cutting costs, consolidating and recapitalizing the balance sheet, and when treasury became dangerously low key management forfeited their salaries and loaned the company funds out of their own pockets that later would be written off, all the while rebuffing a few vulturous take-under offers.

The team held the line and believe that one day justice would be served. This was obviously not a sustainable business model, but against the odds, it worked; they were right.

Five years later, on June 28, 2020, the Superior Court of Spain officially ruled against Trafigura/Matsa and awarded Emerita the IBW land package, which holds at least three polymetallic high-grade deposits endowed in zinc, lead, copper, gold, and silver, open for expansion, and the potential for new discoveries on the "first time in history" large consolidated land package.

Things moved quickly after that historic win. Legendary resource investor Eric Sprott bought an 11% stake in the company, permits were granted for IBW, $20 million was raised in just three hours at $1.10/share, permits were granted, drill programs began, and expanded to the current 14 drills turning, historically resources have been proven up and continue the grow outside the historical footprints, more public tenders were won growing the company to become the third largest landholder in the Iberian Pyrite Belt.

The Criminal Court and Administrative Court began aggressively moving Emerita's legal case for the World-Class Aznalcollar Land Package forward toward a resolution.

Over a relatively short period of time, five Superior Court judges and three levels of the court ruled that "crimes were committed in the awarding of the tender" to Grupo Mexico. More criminal charges were added and upgraded in severity, and more defendants charged increased the number that will face the judge two-fold; the Criminal Court ruled no more appeals would be heard and those 16 must stand before the court, a lead judge was appointed, and a courtroom assigned.

Currently, all that remains now is a court date to be set.

It must be recognized that the landslide victory of the Anti-Corruption Government in Spain has been a big catalyst for Emerita getting justice.The regional government recently by legislation making underground mining a preferential economic activity.Euro-Zone recently set up a $3.1 Billion Fund that offers grants and loans to support development and mining in the Iberian Pyrite BeltThose three points listed above are extremely bullish developments for Emerita and also a boon for the whole mining industry in Spain.

Andalucia Region Targeted for Strategic Mining Investment by European Union

There have been two important developments with respect to the mining industry in the Andalucia Region, Spain, where the Company's projects are located, during the past week.

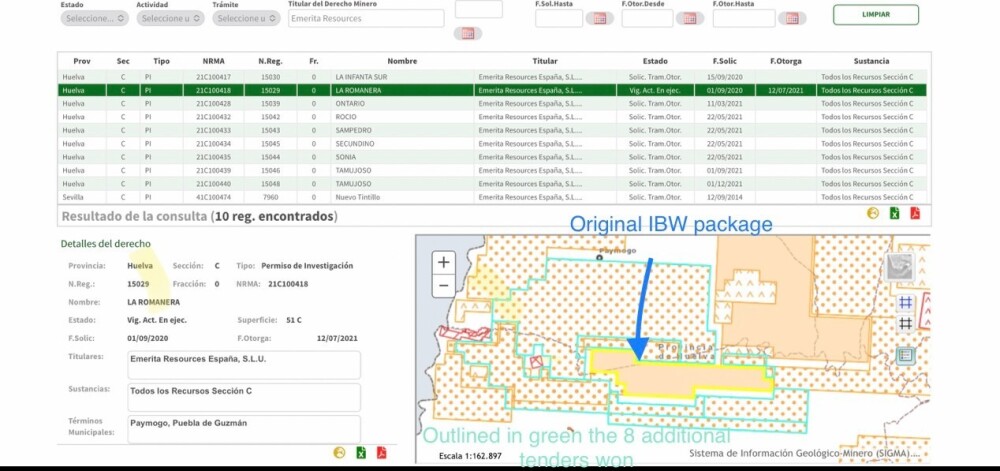

The Junta of the Andalucia Region passed a law designating underground mining as a strategically important industry in the region that will be permitted in all areas of the region. Mining development will have priority as an economic activity.The European Union has passed an initiative as part of its plan to rebuild the economy post the COVID-19 pandemic whereby the Iberian Belt, which is located primarily in Andalucia and extends westward to Portugal, will receive a strategic investment of ?,?3.10 billion for mine development and related activities. The Ministry of Economic Transformation, Industry, Knowledge and Universities has promoted the project for the metal mining and metallurgy sectors in Andalusia to apply for funds from the "Next Generation of the European Union" (funds established for the economic rebuilding of the EU post the pandemic). The strong mining industry and recognized geological potential hosted in the Iberian Pyrite Belt, within the provinces of Seville and Huelva, will be the focus of the program."Since the victory over Trafigura/Matsa for the IBW (prior named La Romanera Package), Emerita Resources has won nine additional public tenders and has grown into the third largest landholder in Spain's coveted Iberian Pyrite Belt, the most economically productive Volcanogenic Massive Sulphide (VMS) Belt in the world.

Eight of those nine tenders have increased the IBW's original land scale by over three times, adding to their inventory a multitude of historical workings and mineral occurrences, including the Los Silos Copper Mine within the Ontario Land Package, which produced at +4% Cu located west of the Romanera Deposit, it sits on the same volcanic horizon that created the IBW's 3 known high-grade deposits.

On October 7, 2021, the following press release hit the market, and the stock almost tripled in a matter of days:

"TORONTO, Oct. 07, 2021 (GLOBE NEWSWIRE) - Emerita Resources Corp. (TSX - V:

EMO; OTC: EMOTF) (the "Company" or "Emerita") announces that the Administrative

Court of Andalucia (the "Administrative Court") (please see the Company's press

release dated November 25, 2015, for further details) has notified the Company that it

will be making a ruling in the administrative case initiated by Emerita in 2015. The

application to the Administrative Court was filed by Emerita in 2015 because Emerita

considered the awarding of the Aznalcollar project pursuant to the public tender

process to be unfair, arbitrary, and inconsistent with the well-defined rules and laws of

the tender process and Spanish law.

The Company perceives the Administrative Court's notice as a very positive

development as Emerita's external Spanish legal counsel ("Counsel") has advised the

Company that the Administrative Court has the authority to make a determination to

award the Aznalcollar project to Emerita.

This administrative process is separate from the ongoing criminal proceedings (see the

Company's press release dated October 6, 2021) regarding the alleged crimes

committed in the awarding of the Aznalcollar tender, and this gives Emerita another

path forward to obtaining the rights to the Aznalcollar project.

The Company will provide details of the Administrative Court's ruling once it has been

issued."

It seemed that the awarding of Aznalcollar was very close at hand; the reality of Emerita owning a world-class tier-one asset was quickly bid into the stock price as it topped $4.14, gaining almost 300% in days.

Emerita had filed an appeal to the Administrative Court to include the Criminal Court findings. By doing so, if the Admin Court went ahead and ruled only addressing the administrative irregularities in their decision, Emerita could challenge an unfavorable outcome otherwise, without an appeal on the record, the Admin Court decision would be final regardless of the Criminal Court findings.

It was a tactical hedge that was miscommunicated to the market. Over the next few months, it was unknown if the Admin Court would deny Emerita's appeal and rule based on the multiple disqualifying administrative irregularities against Grupo Mexico or include the vast number of criminal charges levied against the 16 defendants in deciding the fate of the Aznalcollar Tender.

One thing was for certain the Admin Court was going to do something at any moment. On May 2, 2022, the Admin Court decided to wait and include the Criminal Court findings strengthening Emerita's already incredibly strong case.

"TORONTO, May 02, 2022 (GLOBE NEWSWIRE) - Emerita Resources Corp. (TSX - V:

EMO; OTC: EMOTF) (the "Company" or "Emerita") announces that the Administrative

Superior Court of Andalusia (Seccion Primera Sala de lo Contencioso-Administravo del

Tribunal Superior de Justicia de Andalucia) has agreed to Emerita's request to

withhold its resolution with respect to the Aznalcollar administrative case until the

Criminal Court trial is resolved. This is viewed by Emerita's Spanish legal counsel as an

important ruling as it ensures that the criminal process, where most of the evidence

has been collected, will be sufficiently advanced so that the evidence of the criminal

trial can be used in the administrative case."

Background

On September 30, 2021, the Administrative Court unilaterally lifted the suspension of the administrative case involving the Aznalcollar public tender. Prior to that, the Administrative Court was awaiting the completion of the criminal case.

On October 14, 2021, Emerita appealed the decision of the Administrative Court as it was concluded that the relevant facts were essentially identical in both cases and, therefore, the Administrative Court should wait for the facts to be resolved in the Criminal Court, where most of the evidence was compiled. This is the normal process in the vast majority of cases where the Criminal and Administrative courts are in proceedings related to the same case.

The Administrative Court has now concurred with Emerita that the facts in the criminal case and the administrative case are substantially similar and has decided to

suspend issuing its resolution pending the outcome of the criminal trial.

With this decision, it is expected that the evidence of the criminal case will be fully available to the Administrative Court in the administrative case. The Administrative Court has already reviewed the case in order to make the determination that the cases are substantially similar and as such Spanish Counsel does not anticipate a significant delay beyond the completion of the upcoming criminal court hearings for the Administrative Court resolution.

According to Emerita's Spanish counsel, an ambiguous or unclear administrative ruling could have potentially weakened the legal arguments in the criminal trial. Emerita's request that the Administrative Court withhold resolving the administrative case until the criminal case was resolved was part of Emerita's strategy to ensure that both the Administrative and Criminal cases benefitted from the extensive evidence collected in the criminal case as well as preserving Emerita's right to appeal in the administrative case had a decision in such case preceded a resolution in the criminal case.

The date for the criminal hearing has not yet been set due to Covid backlogs; however, the judges and the court have been named, and a date is expected in the near future once a suitable period of court time is available. Due to the number of people charged, the criminal hearing is expected to require approximately 2-3 weeks of court time.

According to Damian Lopez, Corporate Secretary for Emerita, "The Company views this decision as very positive. The criminal case has been supported unanimously by five judges that have articulated the irregularities in detail. The Administrative Court indicating that it considers the facts to be substantially the same as the Criminal Court, supports the expectation that the cases will be resolved in line with the court rulings we have seen to date."

The traders that had been in the stock fled, the share price declined, the macroeconomic climate decayed as a war in Europe erupted, the Fed aggressively hiked interest rates, and energy prices spiked out of control coupled with supply disruptions and fears of a global recession. Sentiment crashed, and those who were in the stock for a quick win of the massive rerate that would likely accompany that announcement of Aznalcollar being awarded to Emerita fled.

Selling begets selling as investors have lost sight of the world-class land packages and deposits Emerita won over the last 18 months, that the company has a treasury of $24 million, is running the largest drill program in the belt, and will be issuing a 43-101 in Q1 2023.

Today's opportunity...

The stock is now extremely over-sold and trades at a robust 80% discount to its peers just on the historical resources of the Romanera Deposit drilled by majors decades ago. Emerita's share price would have to rise three to four times to trade with peer evaluations just on that.

The current share price also assigns zero value for the El Cura Deposit and its coming drill program, gives zero value for the confirmation and expansion drilling done on the La Infanta deposit and discovery of La Infanta North, assigns no value for the coveted Neuvo Tintillo land package with its multiple discovery targets being worked on for a drill program in 2023, no value for the other 8 land tenders won that increases IBW's scale and upside, no value for the overwhelming evidence that they will win the Aznalcollar Tender, no value for the 70,000 meters currently being drilled on Romanera by 13 drill rigs which have already proved grades were under-reported and the high-grade portion of the deposit will increase both inside and extends beyond its historical borders, gives zero value for having well over $20 million in the treasury that provides a long runway well past issuing the coming 43-101 in Q1 2023 on IBW.

Yesterday, Emerita Resources has 14 drills working, three warehouses, relocated its global headquarters the Seville, employs over 200 people from the local communities where their projects are located, and sponsors local educational and athletic development programs.

The IBW 14 Drill Rig On-Going Program

Emerita Resources fully funded 14 drill rig program is scheduled to complete a minimum of 70,000 meters by the end of Q4 2022, driving toward issuing a maiden 43-101 Compliant Resource Statement in Q1 2023. The company intends to follow up with a PEA/PFS in late 2023 that will likely contemplate a 5000t/d mill being fed by the multiple high-grade deposits at IBW.

Upon conclusion of the 43-101, the company will have an estimate of over $10 Million in the treasury which substantially mitigates the risk of dilutive financing for some time and a runway of multiple catalysts to rerate the stock.

The focus of the drill program (13 drills) is on the confirmation and expansion of the Romanera Deposit, assays have been arriving consistently every three weeks. They have successfully proved with multiple drill holes that the gold grades exceed the historical by an average of 100%, the silver grade by over 30%, and that the high-grade mineralization extends beyond the historical resource shell.

Example of Gold and Silver grades outperforming the historical at Romanera Deposit:

"14.3 meters grading 7.61 g/t gold, 311.1 g/t silver, 3.0% zinc, 2.9% lead, 0.4%

copper from 134.2 meters depth (see Figure 2). Included in the intercept is: 7.8

meters grading 9.74 g/t gold, 372.9 g/t silver, 0.7% zinc, 2.7% lead, 0.6% copper

from 136.2 meters depth; and 4.6 meters grading 4.56 g/t gold, 235.9 g/t silver,

8.0% zinc, 3.8% lead, 0.2% copper from 144.0 meters."

CEO of Emerita, "We had a sense from reviewing certain of the historical data that the

deposit could be enriched in precious metals. Interestingly most of the upper part of

the deposit, as delineated by historical drilling, was never assayed for gold. This

presents significant upside potential even within the area."

Example of high-grade results outside historical resource shell:

"The Lower Lens was intercepted at 345.7 m, 18.9 m below the Upper Lens and

encountered 26.8 m grading 2.6 % Cu; 0.5 % Pb; 1.1 % Zn; 0.3 g/t Au and 28.6 g/t

Ag, including 14.0 m grading 4.3 % Cu; 0.8 % Pb; 1.7 % Zn; 0.3 g/t Au, and 41.7 g/t

Ag). Historical drills in this area, on the west side of the deposit, stopped short of

the Lower Lens and only intersected the Upper Lens (Figure 3), which places this

intercept outside of the historical resource area."

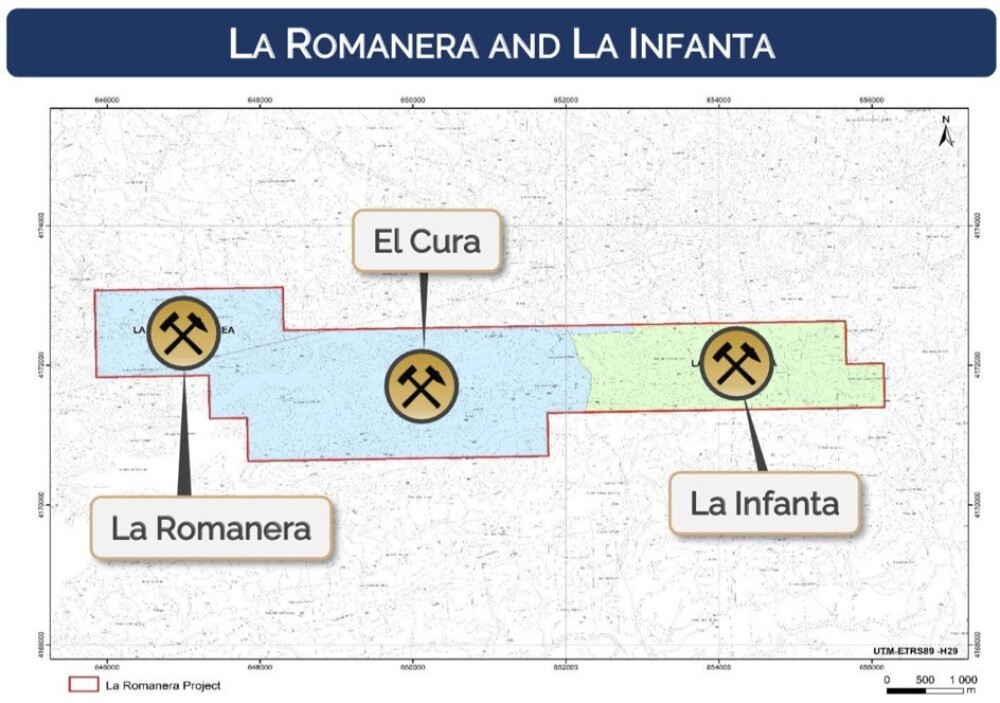

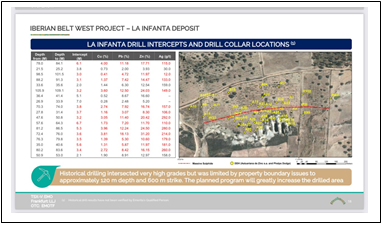

Prior to the shift to the Romanera Deposit, the drilling of the La Infanta Deposit confirmed the historical resource and expanded it to potential 3-4Mt at exceptionally high grades.

The La Infanta deposit is open along strike, and at depth, one drill rig remains on the deposit. On Nov 3, 2022, the company announced The El Cura Deposit is scheduled to begin drilling after Dec 1, 2022, with two drill rigs.

"In addition, we expect to commence drilling the El Cura deposit with two drills after

December 1, 2022, which is after the hunting season in the area. El Cura is situated

between La Romanera and La Infanta deposits."

*It's important to note these three deposits begin at/near surface, are located close together, conceptually they will be mined and sent to a single milling complex, their resources will be consolidated, and the development capital will be spread across the total tons lowering the cost per ton and increasing margin per ton.

Neuvo Tintillo Property

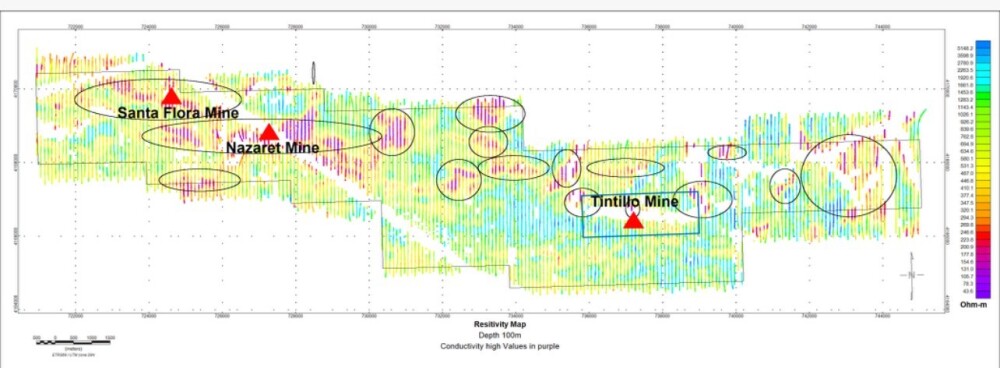

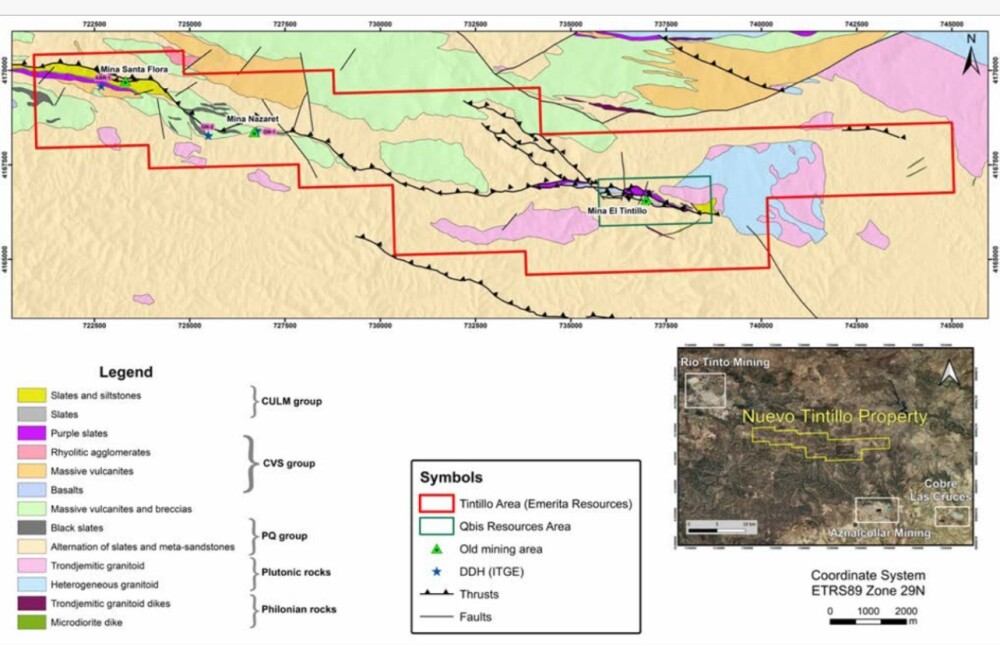

Concurrently to the drill program on IBW and the legality of Aznalcollar, Emerita has a team dedicated to working up drill targets on the massive Neuvo Tintillo Property that is sandwiched between the world-class Rio Tinto Mine and the Los Frailes/Aznalcollar mines.

The Neuvo Tintillo Property encompasses over 24KM of the volcanic horizon that created four world-class mines. Inside the claim boundary, there are eight historical high-grade copper mines/workings, most of which have not seen any systematic exploration and have not been in production since WWI.

Early in 2022, the company conducted a property-wide EM Survey that reveals over 14 targets for further investigation.

Aznalcollar Land Package

The Criminal Court is in the process of scheduling a trial date. (see notes)

Emerita's Flagship, The Original IBW (La Romanera Package)

The IBW Land Package is 100% owned with zero royalties. This is the first time in history that the three high-grade deposits (La Romanera, La Infanta, El Cura) have been consolidated into a large contiguous block giving Emerita the ability to fully delineate the magnitude of each of these high-grade deposits that prior operators were unable to drill out fully due to fragmented ownership and/or the mineralization/lens ran off the small claim blocks and/or the unfavorable pricing environment for Cu, Zn, Ld, Au, Ag decades ago.

Important Facts to Remember About IBW:

The property is fully permitted for exploration, with 14 drills turning.This is the first time in history those three deposits are contained in a single land package, and the area was consolidated.No drilling has been performed in 20-30 years, and in most areas, little to no geophysical surveys were done until now.The historical resources alone total over 14 million tons of high-grade Zinc, Lead, Gold, Silver, and Copper was drilled out by Rio Tinto, Phelps Dodge, and Asturiana de ZincMost of the historical resources across these deposits didn't include full assays for gold and silver and used a lead+zinc cut-off gradeNow all three deposits are in one land package for the first time in history, they can be expanded to their full potential and developed into three mines feeding one mill, 100% owned with zero royalties, conceptually a low-cost high, margin operation that would produce over a decadeDeposits begin at/near surface, making them low-cost to develop utilizing ramp access into ore vs. sinking a shaft compares to peers.The IBW will have a 43-101 filed in Q1 2023, after which a PEA/PFS will begin as they continue to drill.Historical Resources

The resources below are published in mining journals and public filings by Boliden, Rio Tinto, Phelps Dodge, and Asturiana Zinc; the El Cura Deposit is quoted from an internal memo obtained by Emerita from Rio Tinto.

The resource grade and tonnage below are prior to Emerita's drilling that has proved La Infanta and Romanera extend beyond their historical footprints, and in the case of Romanera the grades were under-reported.

This was the starting point.

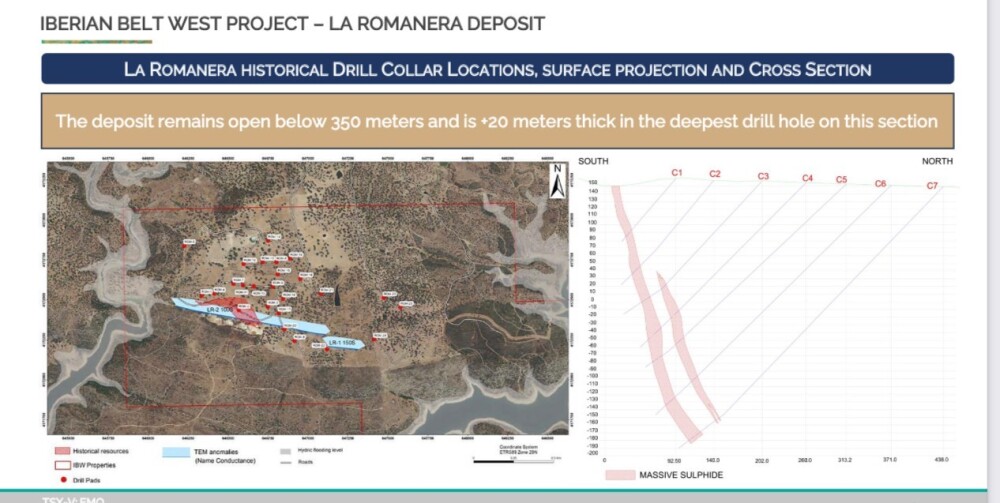

Pre-expansion of the Romanera Deposit

34Mt at 7.4% ZnEq, including a high-grade subset of 11.2Mt at 12% ZnEq.

11.2Mt at 12% ZnEq (high-grade subset only)

99 Million Pounds of Copper

1.355 Billion Pounds of Zinc

608 Million Pounds of Lead

23 Million ozs of Silver

360k ozs of Gold

Potential high-grade subset size +20Mt at 12-16% ZnEq

Important notes:

1) Asturiana de Zinc historical resource was calculated using (lead + zinc cut-off grade) which means zones with good/high-grade copper, gold, and silver that had low-grade lead and zinc values were excluded from their resource calculation.

2) Asturiana de Zinc primarily did not assay for gold and often didn't assay silver or copper. The focus was on open-pit zinc material.

3) Rio Tinto's data set is incomplete; there are multiple massive sulfide drill cores that were not assayed and excluded from their resource calculation, and other massive sulfide drill cores that weren't assayed for gold and/or silver. Their focus was on open-pit copper material.

4) Emerita Resources full assayed results within the historical resource shell have proved the gold values were substantially underreported by 100% and the silver values by over 30% in the historical resource estimate.

5) The full assays from the conformation drilling done by Emerita Resources has proven that tons within the 34Mt historical resource shell will migrate into the high-grade subset, increasing the size of the high-grade subset resource within the historical footprint.

5) Step-out drilling had confirmed high-grade resources beyond the historical drilling footprint.

6) The Romanera Deposit's large high-grade tonnage underpins the IBW and makes the surrounding smaller deposits (La Infanta and El Cura) extremely attractive because they will be fed to the contemplated Romanera Milling Complex.

7) Historical resources defined 450m strike x 350m depth, EM and gravity surveys show the conductor plates extending over 1km of strike and below 550m in depth.

Pre-expansion El Cura Deposit

The El Cura Deposit is scheduled to begin drilling after Dec 1, 2022, with two drill rigs.

Rio Tinto did a small drill program in the 1980s and states in an internal memo:

"El Cura Internal Resource Estimate: 2Mt at very good grades, copper-rich" In the public domain, the following information is available:

"El Cura deposit, located on the left bank of the River Malag??n and in the middle of the

other two deposits had a separate history; it also shows shallow workings from roman

times."

" In El Cura deposit an adit from the 19th century of less than 100 meters,

presumably to intercept the mineralized lenses, is known to be buried. There is also a

60m deep shaft that intercepts two mineralized lenses 900m apart at 47m depth.

Another shaft to the west, also intercepted a lens. In 1946, the explorer Pinedo Vara found

a pile of ore with the following grades 5.7 % Cu, 14.0 % Pb, 24.0 % Zn, 2.0 % Sb, and

580 g/t Ag."

Pre-expansion La Infanta Deposit

800k Tons at 26% Zinc Equiv

29.9 Million Pounds of Copper

222.82 Million Pounds of Zinc

121.62 Million Pounds of Lead

3.81 Million Ozs Silver

Important Notes:

1) Through 2021-22, the historical deposit was confirmed by drilling and expanded

2) The deposit remains open

3) Currently, one drill is conducting infill for the coming 43-101 Report

4) Conceptually, 3-4Mt of highly economic resources defined to date

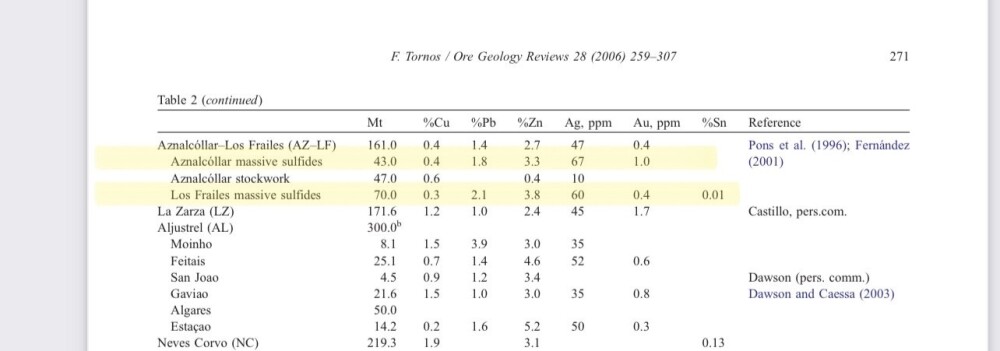

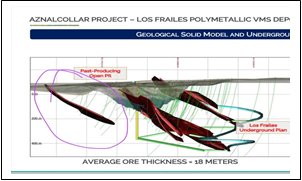

The Tier-1 Aznalcollar Land Package and Its Four Known Deposits

1) Aznalcollar Mine

90Mt of production drilled resources, including a high-grade subset of 43Mt the Pyritic Complex, verified in a 1998 Mining Journal Iberian Pyrite Belt.

High-grade subset of 43Mt

1.38 million ozs gold

93 million ozs silver

3.15 billion pounds of zinc

1.67 billion pounds of lead

416 million pounds of copper

2) Los Frailes Mine (Tender award is put mine into production)

70Mt of production drilled resources, including 28Mt high-grade lens (comprised of 20 million tons pit constrained and 8 million tons below the pit identified mentioned by the CEO in multiple webinars and interviews.), potentially tens of millions of tons below the deepest hole historically drilled where the deposit is +40 meters thick of high-grade.

High-grade subset of 28 Mt

4.1 Billion pounds of Zinc

2.4 Billion pounds of Lead

179 Million pounds of Copper

76 Million ozs of Silver

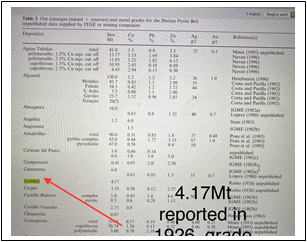

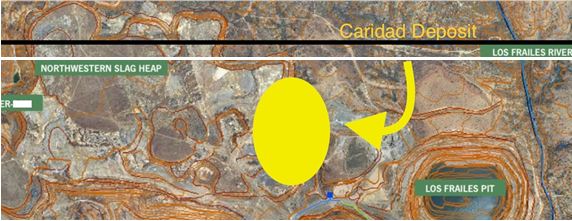

3) Caridad Deposit

4.17Mt

Historically referred to as "copper rich."

4) No Name Lens (located between Los Frailes and Aznalcollar Mine)

Tonnage unknown, Los Frailes type grade historically, circled in purple.

2.6 Facilities of the Mine Site

2.6 Facilities of the Mine Site 2.6 Facilities of the Mine Site

2.6 Facilities of the Mine SitePost Aznalcollar Win

Emerita will own a total of seven high-grade deposits, over 90Mt of historically high-grade resources valued at over $30 Billion USD at today's depressed spot prices, all deposits open for expansion at/near surface in a tier one mining jurisdiction.

What's that worth? Billions empirically by every evaluation model used in the sector.

Note: Drilling has expanded both La Infanta and Romanera beyond the historical tonnage and values.

Q: Will Emerita be awarded Aznalcollar? Judge for yourself.

Where the Aznalcollar Legal Case stands today:

The company is awaiting a court date.A judge and courtroom have been named. See.No further appeals from the defendants will be heard or allowed; see here.Five Superior Court Judges' rules crimes were committed in the awarding of the Aznalcollar Tender.Three all levels of court all have rules crimes were committed in the awarding of the Aznalcollar Tender.In June 2021, new indictments were issued that include the following:

1. Increases the number of accused people from nine to 16.

2. Increases the charges to the following four crimes related to the award of the tender:

Administrative PrevaricationInfluence peddlingManagement fraudEmbezzlement due to unfair managementSee here.

The Administrative Court has ruled that in addition to the multiple administrative irregularities uncovered in the awarding of the Aznalcollar Tender to Minera Los Frailes (Grupo Mexico) that the Criminal Court finding will also be used in their final decision on the Aznalcollar tender dispute. The law states if one crime is committed in the awarding of a tender, that party is disqualified and the tender must go to the next qualified bidder, EMO is the only other qualified bidder for the Aznalcollar Land Package.The Admin Court will use Criminal Court finding to rule on the tender. EMO is the only qualified bidder. A court date is coming. -A court date will be set; the trial itself is quoted as taking approximately three weeks.While we wait for our day in court...

The 14-drill rig program is proving that PM values and scale exceeds historically at Romanera. Infanta has already been expanded, El Cura will begin drilling after December 1, 2022, and Neuvo Tintillo is being worked up toward a drill program in 2023.

A constant flood of assays is coming from the 70,000m leading to a 43-101 in Q1 2023.

Q: What is it worth today based on what's owned prior to the Aznalcollar resolution?

A: Many multiples of the current using pretty much every evaluation model in the industry.

| Want to be the first to know about interestingGold,Critical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Dr. Jim Jones: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Emerita Resources Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Emerita Resources Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.