The U.S. Is Not an Economic Island

By Rick Ackerman, Rick's Picks / July 15, 2019 / news.goldseek.com / Article Link

It will increasingly draw capital from outside the U.S., since the economies of Asia and Europe are deteriorating rapidly. China's attempts to stimulate domestic spending have failed, and unsold cars are piling up on the lots. As for Germany, the erstwhile economic engine of Europe, its GDP most recently grew at an annualized rate of 0.7%.

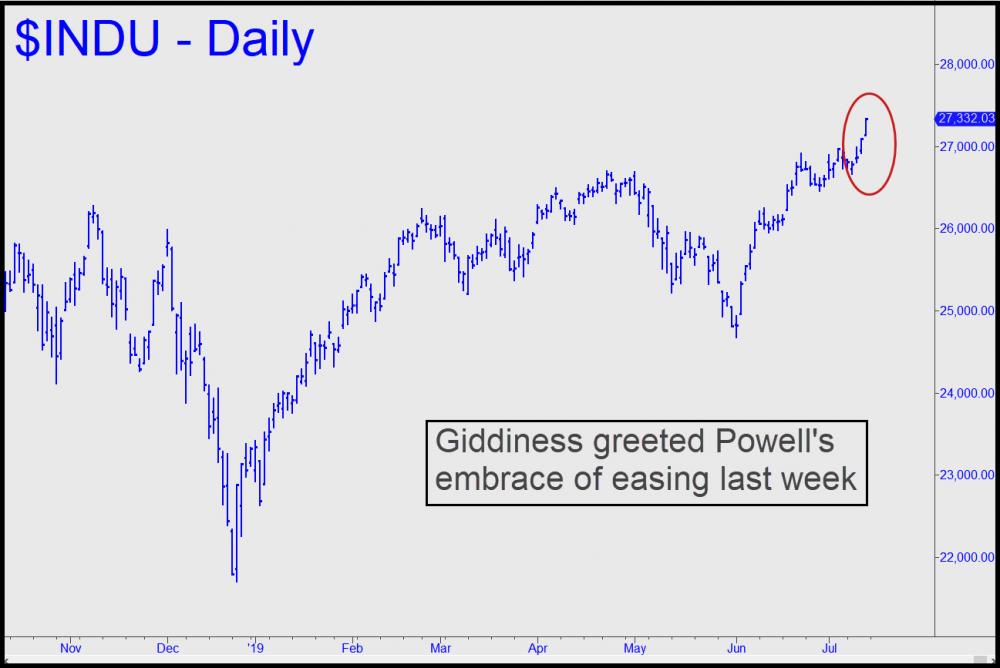

Don't Get TrappedThe U.S. is not an economic island, and GDP growth is certain to slow as America's major trading partners sink into recession. It seems predictable nonetheless that U.S. stocks will continue to move higher, at least for a while, for the reasons noted above. This will occur with further softening in interest rates and GDP falling. Wall Street may be able to pretend for yet another few months that the U.S. will skirt recession. But when rates on Ten-Year Treasurys drop below 1% and head into negative territory sometime in 2020, the jig will be up. At that point there will be no denying that America's economy has fallen into the same liquidity trap that has long vexed Japan and which has spread to Europe, if not yet China. The resulting epiphany will cut the Dow in half so swiftly that anyone still in stocks when they begin to fall will be trapped. U.S. Treasury paper is where you will want to be by no later than September, even if it means missing the potentially spectacular last gasp of the ten-year-old bull market.

Recent News

Immediate trigger for crash was new Fed Chairman pick

February 02, 2026 / www.canadianminingreport.com

Gold stocks slump on metal price decline

February 02, 2026 / www.canadianminingreport.com

Is the gold market starting to turn 'irrationally exuberant'?

January 26, 2026 / www.canadianminingreport.com

Gold stocks explode up as equity markets languish

January 26, 2026 / www.canadianminingreport.com

Gold stocks outpace flat large caps

January 19, 2026 / www.canadianminingreport.com