There's No Fever Like Gold Fever... / Commodities / Gold & Silver 2020

In late December 2019, a bill from the German finance ministry –which had passed the lower legislative house – proposed lowering the "anonymouspurchase limit" for precious metals from €10,000 to €2,000 (about $2,200),a reduction of 80%.

At the current price, one could buy less than one and one-halftroy ounces of gold without activating customer ID paperwork, and forbusinesses – a criminal background check!

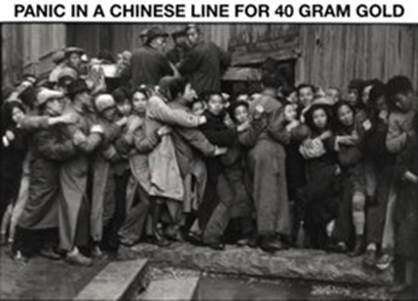

This is an additional decline from the €15,000 mandated just twoyears ago. Set to become law in early 2020, the effect was immediate, as longlines outside a coin shop in Cologne show.

Some of the world's largest banks – including several in Germany– have long made a habit of laundering literally billions of dollars, euros,and assorted financial instruments from questionable customers.

This all begs the question as to how further squeezing "thelittle man" by imposing onerous reporting over relatively tiny amounts ofgold sales is going to accomplish anything constructive.

It turns out that this legislative effort is directly tied toEuropean Union (EU) guidelines laid out in the anti-money laundering directive(AMLD5), requiring member state compliance. And some people wonder whyBritain's Labour Party – whose platform proposed adding still more regulatoryburdens to the population – recently suffered such a devastating defeat.

Bitcoin.com reports the EU's 5th anti-money laundering directivedictates that "non-transparent assets, accounts, and even private safetydeposit boxes will now be subject to state information gathering by law."

A user on Reddit remarked:

"They don't want normal peopleto bank run their scam paper. Gold and hard assets is how you protect yourselffrom inflation. They (the governments/banks) want to know every single personthat tries to get out of their cage..."

"...Gold is thusseen as one of the final hedges against irresponsible government policy, andthe proposed new limits on precious metals, will leave residents of Germanywith even fewer options."

A German citizen remarks:

"I live in Germany andthe thing is we have had a full-blown shortage going on for weeks now. Allthese people in the line will go home empty handed. The smart ones have beenexchanging paper for gold weeks and months ago... you have these (off-putting)ones who think the supply will wait for them when they lift (themselves up) inthe last second. The retailers have been sold out for weeks already. It mightclear up in January when the new law is in place, but I am not betting on it.It could also indicate that we are close to something bigger."

Here'sthe rub, and you can take this to the bank…

Authorities in most countries in the world, and sadly becomingmore common by the day in that bastion of "democracy" – the U.S., atevery level equate the desire for privacy with doing something"nefarious." Some of Merriam-Webster's numerous words define the termas "bad, evil, unethical, unlawful, wicked, wrong," etc. Take yourpick.

Ignore the clueless non-observer who reels off the knee-jerkcomment that "If I don't have anything to hide... It's a very dangerousslide from "Innocent until proven guilty" to just the opposite.

It's a corrosive trend that has all too-commonly become theoperative principle of those whom we've elected to serve us, but who have nowdecided, in their finite wisdom, that we should serve them.

Not just "the man in the street." Despitethe excitement (and profit-building opportunities) offered by gold and silver from 2001-11affected not just "the man on the street" but CEOs of most miningcompanies who continue to project the future by looking into the rearviewmirror.

(1948) 40grams (a tael) equals about 1-1/4 oz of gold.

The knock-on effect meant that less money was spent ondiscovery, leading inexorably to lower production.

The overall result is that from the last decade, 2020 Reserves(the highest and most economically recoverable category of known ore deposit)for the world's largest gold mining companies are down fully 26%.

David Morgan has long counseled newsletter subscribers to The Morgan Report, in additionto the tens of thousands who (weekly) receive The Free Morgan Report tostart an accumulation program by acquiring physical gold and silver – viewingits role as insurance first, profit-potential second.

Own precious metals – i.e. honest money – paid for by fiat"paper promises." On numerable occasions, over the thousands of yearsin which it has reliably fulfilled these roles, gold (and silver) have turnedout to be literal life-savers in their own right.

Richard Davies toured Aceh, Indonesia after the 2004 tsunamithat killed 250,000 people. He noted, "I met many survivors who were ableto sell jewelry they were wearing... Wearing a gold bangle is like havingenough cash on your wrist to employ a builder for a year... This traditionalform of finance insulated Aceh and provided its entrepreneurs with rapid accessto cash."

If thisdoesn't get your attention, then you're just not paying attention!

Long before the move into gold becomes a full-fledged"rush," smart money with deep pockets will have been activating theirown accumulation plan.

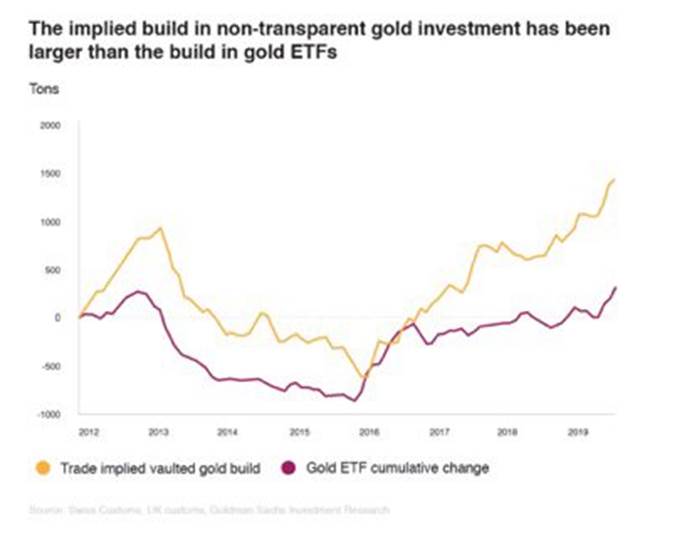

The chart below from Goldman Sachs research indicates what'sbeen going on under the radar. Gold ETF (visible) accumulation – which by theway has now officially reached record levels – is being substantially eclipsedby the build in non-transparent gold investment, as it is ensconced around theworld in private vaults, kept "in hand" near one's residence, orsimply buried in the back yard.

It's not too late to accumulate! These and otherdata points, such as the current low level of U.S. Mint American GoldEagle production – which follows demand – indicate that the majority ofpotential investors have yet to enter the gold space.

Act to strengthen your financial immune system by accumulatingthe desired level of metal now, before the ongoing gold-build morphs into apublic-mania-infused "gold fever." And before the concept offinancial privacy and flexibility has become a relic of the not-too distantpast.

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.