These are the African countries investors should pay attention to

About half of all the African countries either host significant operating mines or have advanced exploration projects, yet investors tend to shy away due to perceived risks such as high levels of corruption and political uncertainty, a new report shows.

There is an urgent need to refill the mining project pipeline of African countries with early stage exploration projects of all shapes and sizes.There are many rankings that aim to help companies choose the best countries to set up shop in the region, such as Canada's Fraser Institute annual report and Transparency International's corruption index, but London-based finnCap has come up with one of its own.

The investment bank analyzed the 25 (roughly) countries in Africa that have working mines or or advanced exploration projects, incorporating the best known rankings available, but factoring each country's geological potential and their current security risk.

So, what did they conclude?

The first and main finding is that there is an urgent need to refill the mining project pipeline of all African countries with early stage exploration projects of all shapes and sizes.

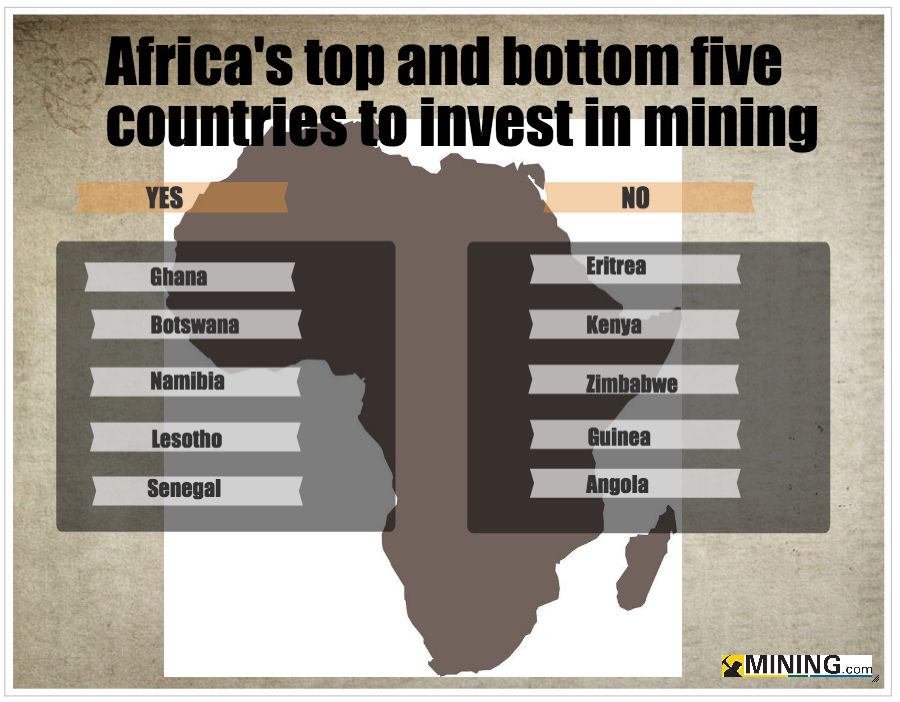

But where to start? According to finnCap, investors would be better off in Ghana, Botswana, Namibia, Lesotho and Senegal, which already have companies successfully operating inside their borders. These include, just to name a few, Kennedy Ventures (Tantalite Valley tantalum mine) and Weatherley (Tschudi copper mine) in Namibia, as well as Firestone Diamonds (Liqhobong diamond mine) and Gem Diamonds (Lesteng diamond mine) in Lesotho.

At the bottom of the bank's list figure Eritrea, Kenya, Zimbabwe, Guinea and Angola, which also have a few known names present in their mining sector. Those include Avocet (Tri-K gold project) in Guinea, ASA Resource Group (Freda Rebecca gold mine and Bindura nickel mine) and Caledonian (Blanket gold mine) in Zimbabwe, and Base Resources (Kwale mineral sands mine in Kenya.

There is a lot of money to be made if country risk and entry timing can correctly be judged."There is a lot of money to be made if country risk and entry timing can correctly be judged," the reports says, citing as an example Randgold Resources' success story in Mali, which started off with a small gold mine back in 1995 when the country had had no mining industry other than some artisanal operations.

Within five years, Randgold's Morila gold mine (jointly owned and managed with AngloGold) had become one of the world's more profitable mines and laid the foundations for the growth of the business.

So the lesson for investors should be to always look at the risk/reward balance, the analysts say. Does outstanding geology beat corruption and security issues, including but not limited to the threat of the radical Muslim insurgencies? This mostly comes down to the quality of company management and their in-country experience, they conclude.