These are the three main trends to shape the diamond industry in 2019

Image: Petra Diamonds.

This year will likely go down in history as the one when lab-grown diamonds, made for decades as an inexpensive alternative to mined stones for industrial purposes, finally cracked the consumer market, largely thanks to millennials' evolving shopping tastes.

The entry of new actors in the synthetic sector, particularly giant producer De Beers and its Lightbox brand, has created even greater awareness for lab diamonds and is spurring more consumer activity.

Gem-quality lab-created diamond production for use in jewellery now exceeds 1.5-million carats of polished annually, according to independent diamond industry analyst Paul Zimnisky. And it's expected to grow even further in 2019.

So where does the industry go from here? In its eighth annual global diamond report, Bain & Company and the Antwerp World Diamond Centre, outline three key industry trends that will be influential in shaping the future of the diamond sector:

1. Increasing influence of digital technologies:

Emerging and maturing digital technologies are affecting all parts of the value chain, the report says, enabling diamond producers, midstream players and retailers to increase efficiencies within their operations.

A good example of this trend are the blockchain projects launched this year, aimed at helping consumers confidently identify the origin of their diamonds. The most significant, "Tracr", even saw the sector two giants - De Beers and Alrosa - joined forces to test a pilot testing the blockchain technology-based platform.

2. Growing presence of lab-grown diamonds:

"Lab-grown diamonds are clearly here to stay," says Olya Linde, partner at Bain & Company and lead author of the report.

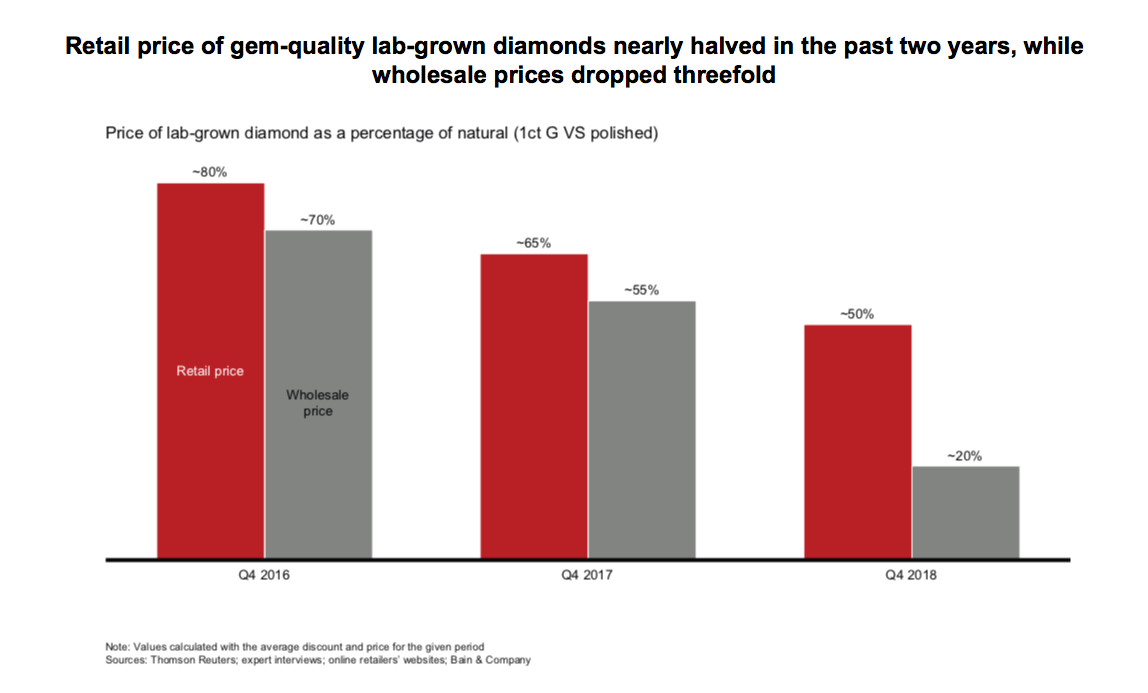

De Beers' launch of Lightbox, a retailer of lab-grown diamonds, and the U.S. Federal Trade Commission ruling on diamond terminology were major news in 2018.

Courtesy of Bain & Company.

The effects on natural diamond demand and price will depend on consumer perceptions and preferences. If the mined- diamond industry can differentiate its stones from lab-grown diamonds (perhaps positioning lab-grown diamonds as fashion jewelry rather than luxury items), the effect on natural diamond demand by 2030 will be limited to 5% to 10% in value terms, Linde notes.

Courtesy of Bain & Company.

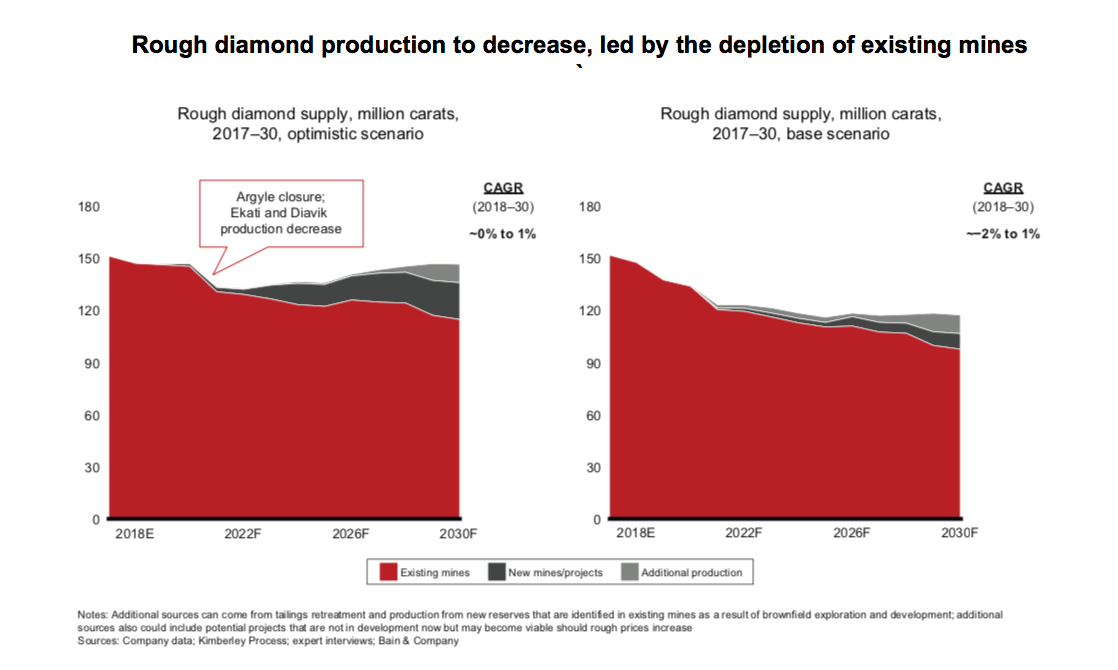

While not named in Bain & Co.'s report, another factor that could tip the balance in favour of man-made diamonds is the fact that some of the world's biggest mines are expected to run dry by 2030. This, some market observers say, may force consumers to choose synthetic stones as mined-diamond could become extremely costly.

3. Shifting preferences of younger generations of consumers:

Young consumers are causing industry players to rethink their sales and marketing strategies. The self-purchase product category continues to grow as Millennial and Generation Z's female spending power increases.

Young consumers are causing industry players to rethink their sales and marketing strategies. (Image: Ian Sane | Flickr.)

"Younger generations are also more inclined to consider the opinions of social influencers, customer reviews and 'likes' when making purchasing decisions," Linde says. "Social media shopping is expected to increase significantly as the spending power of Gen Z rises and many retailers are already strategizing how the shifts in preferences will change their approaches to marketing and operations."

She predicts that continued future demand for diamonds will depend largely on the industry's ability to market its jewellery successfully - specifically, the process of buying and owning one - versus other types of luxury goods and experiences.

Bain & Co. sees a potential positive effect in the overall market from the growing influence of lab-grown diamonds. "If the industry plays its cards right, we believe it could actually benefit from the potential of lab-grown diamonds to potentially increase demand for diamonds in general," the report concludes.