These charts show just why copper price fundamentals are so strong

Image: Codelco via Flickr

When Richard Adkerson, boss of Freeport-McMoRan, presented to the BMO Capital Markets conference in Florida last month he showed a slide headlined World class copper discoveries are extremely rare.

Adkerson said the Phoenix-based company has been putting these graphs in investor slide decks "for years".

Only one project - Oyu Tolgoi's underground expansion - will crack the top ten in the coming decadeApart from showcasing the fact that the world's largest copper producer owns three of them, the graphs also highlight one of the central factors underpinning bullish fundamentals for the copper market.

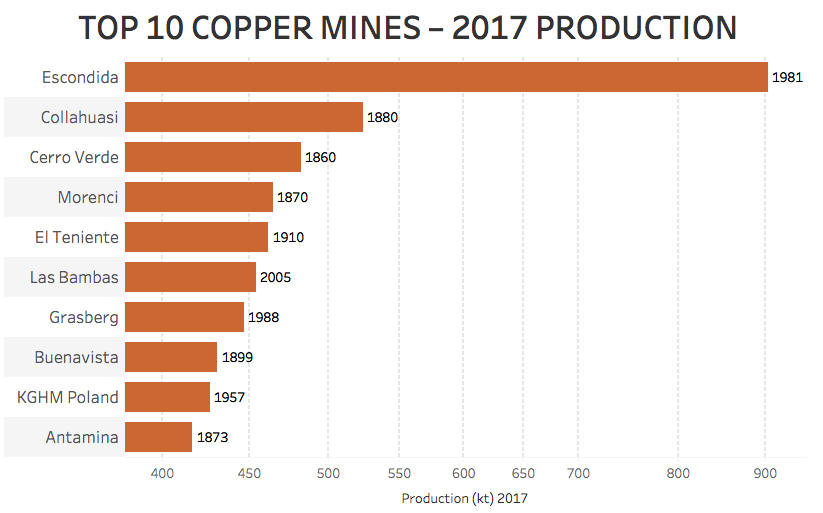

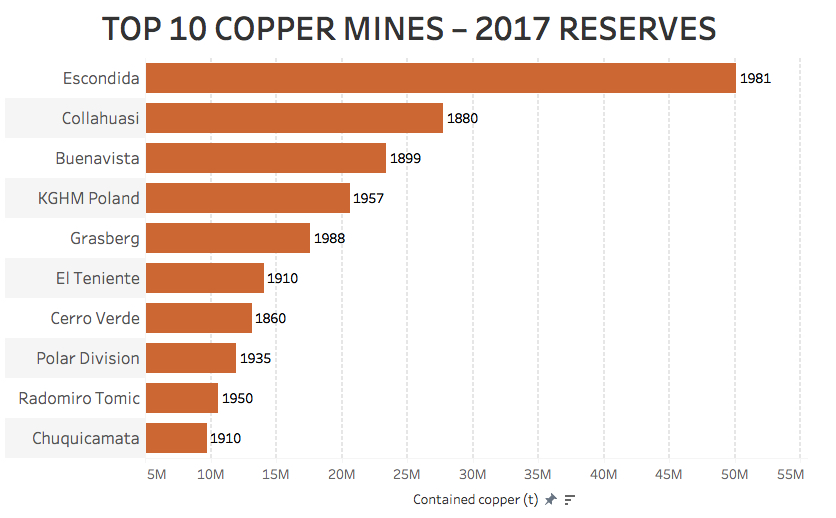

Source: Company reports, MiningIntelligence, Wood Mackenzie. Notes: Annual copper production 2017 except Codelco's El Teniente and KGHM Poland operations = first 9 months 2017 annualized. KGHM Poland consists of Rudna, Polkowice-Sieroszowice and Lubin mines. Reserves as at end-2017 except KGHM, Codelco mines at end-2016. Grasberg reserves include Block Cave under development and undeveloped Kucing Liar deposits.

Steady copper supply is dependent on a few giant deposits that were discovered many generations ago and have been mined for decades - the median age for 2017's top ten copper mines in terms of production is 95 years.

Even when you measure the age of these mines starting at the commercial production date (for instance, 2016 for Las Bambas) or when current operations started (for example, 2001 for Antamina), the average is more than four decades.

The ten largest mines constitute nearly 25% of annual world production and last year a strike at Escondida, disruptions at Grasberg and protests at Las Bambas meant almost 7% of world production went offline at the same time. That six of the top producers and largest deposits are located in Peru and Chile also adds a twist to the supply picture.

At today's copper price the reserves of the top 10 deposits are valued at more than $1.4 trillion. Based on the average copper price over the course of 2017, these mines earned more than $30 billion last year from the orange red metal alone.

The 400,000 tonne club

With the cut-off for 2017 at 400ktpa, only one project - Oyu Tolgoi's underground expansion - will crack the top ten in the coming decade. The Mongolian mine is expected to reach peak production of 560ktpa by 2025 after a $5.3 billion investment from Rio Tinto.

Source: Company reports, MiningIntelligence, Wood Mackenzie. Notes: Annual copper production 2017 except Codelco's El Teniente and KGHM Poland operations = first 9 months 2017 annualized. KGHM Poland consists of Rudna, Polkowice-Sieroszowice and Lubin mines. Reserves as at end-2017 except KGHM, Codelco mines at end-2016. Grasberg reserves include Block Cave under development and undeveloped Kucing Liar deposits.

Capacity at First Quantum's $6 billion Cobre Panama project which is scheduled for commissioning during 2018, was recently expanded, but the target is still 350ktpa placing it outside the top 10.

Another major copper mine Quellevaco in Peru is set to go into production next decade, but output at the Anglo American project tops out at 225ktpa.

NuevaUnion, a Goldcorp-Teck joint venture in Chile is expected to average production of 190ktpa when it enters productions some time next decade.

Cobre Panama and Quelleveco are likely to be the only new entrants in the Top 20 largest copper mines over the next decade where production above 200ktpa guarantees entry.

The Sarcheshmeh copper complex boasts reserves of 8.9m tonnes of copper and is also being expanded, but the mine's annual output will remain below 300ktpa according to Iran's state-owned company in a 2015 investor presentation.

Russia's Udokan boasts reserves of 15m tonnes of contained metal. It has the potential to be a 400kt-plus annual operation, but doubts about the viability of the project in the country's east remain.