These Two Charts Virtually Scream "Buy Silver" / Commodities / Gold & Silver 2019

The Amount of Dollars in Existence

The Amount of Dollars in Existence

Silver is currently trading around $14.84 anounce. This is around 30% of its 1980 all-time high of $50. However, this is anincomplete representation of what silver is really trading at, relative to USdollars.

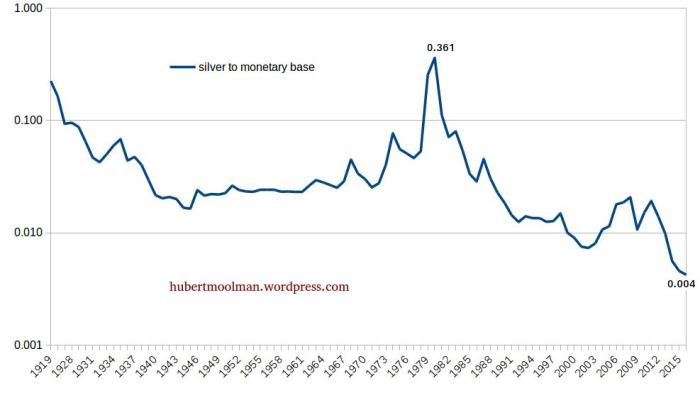

When you look at the silver price, relative toUS currency (the amount of actual US dollars) in existence, then it is at itslowest value it has ever been (see chart below).

Also, it is ridiculous that one ounce ofsilver cost $50 in 1980 when there was about 132 billion dollars in existence,whereas today it is only $14.84 at a time when there is 3 304 billion dollarsin existence (note that I have used rounded numbers which created somedistortion).

The US monetary base basically reflects thetotal amount of US currency issued. Originally, the monetary base is supposedto be backed by gold available at the Treasury or Federal Reserve to redeem thesaid currency issued by the Federal Reserve. This is not the case any more,therefore, the amount of dollars have grown exponentially over the years.

Below, is a long-term chart of the silverprice relative to the US monetary base (in billions of dollars)

Note that the ratio, or price of silver, interms of US dollars in existence, is indeed at its all-time 100-year low.

In 1980, the all-time high was 0.361, whereasthe ratio is currently at around 0.004. The US monetary base is currentlyaround 3 304 billion dollars (or 3.304 trillion). Therefore, if silver wastoday at its 1980 value, relative to the monetary base, it would be around $1193 (3304*0.361).

So, in terms of US dollars in existence,silver is trading at 1.24% (14.84/1193) of its 1980 high – it is the bargain ofthe century.

Silver Long-TermChanneling

On the chart, thefirst phase of the silver bull market was from 1993 to the end of 2001, and thesecond phase is potentially from 2001 to the end of 2015.

It appears that there is a similarity betweenthe two phases. I have drawn some lines, and marked some patterns to show howthe two phases are interwoven and could be similar.

The first phase is marked 1 to 3, in black,and the second 1 to 3, in blue. Both of the phases appear to occur within abroadening channel, from which they both broke down (out of the channel), afterpoint 2.

Outside of the channel there was atriangle-type consolidation. The first phase managed to get back inside thebroadening channel after breaking out of the triangle-type consolidation. Ifthe current pattern follows, then we could have a big rally, after breaking outof the triangle consolidation.

Based on this comparison, buying silver now islike buying silver back in 2003 when it was under $5 per ounce.

For more on this, andsimilar analysis you are welcome to subscribe to my premium service. Ihave also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report.

Warm regards,

Hubert

“And it shall come to pass, that whosoevershall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2019 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.