Things Just Got Even Better For Gold

The falling dollar index has paved the way for even higher gold prices.

Euro currency strength is further confirmation of gold's positive outlook.

Gold mining stocks are also showing signs of further recovery.

With a plethora of positive factors behind it, gold has out-shined most assets in recent weeks. But just when it looked like perhaps gold had reached the limits of its upside potential, a new development has further extended it. The U.S. dollar continues to significantly weaken, which in turn has increased gold's important currency component while also boosting the outlook for other commodities. We'll discuss gold's brightening prospects in light of this development in today's report. We'll also take a look at the latest progress in the gold mining stock market.

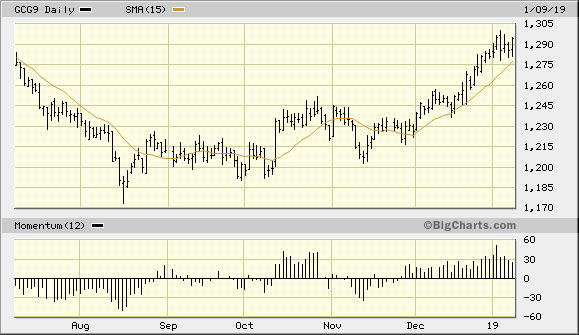

After hitting a temporary impasse, the gold price looked to be setting up for a corrective pullback after its impressive gains of the last eight weeks. The February gold futures graph shown here illustrates gold's consolidation above its rising 15-day moving average in the last few days. However, even though gold is still in the midst of a "pause that refreshes," the odds have increased that we'll see even higher prices for the yellow metal at some point in the coming weeks. Even if the gold price temporarily dips under its 15-day MA in the coming days, the next major directional move should be to the upside for reasons we'll discuss here.

Source: BigCharts

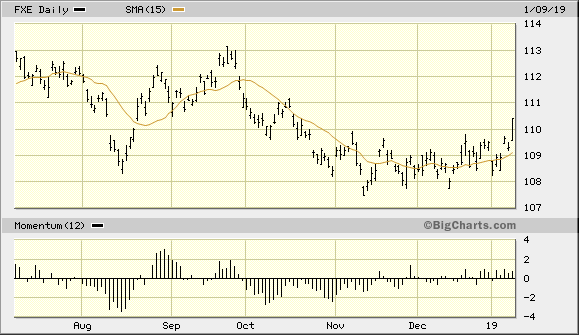

The single biggest factor in support of a higher gold price is the continued weakness in the U.S. dollar. The dollar had a big setback on Wednesday as traders moved into other currencies like the euro. Below is the Invesco CurrencyShares Euro Currency Trust (FXE), which underscores the recent strength in the euro currency. This is an important consideration for the yellow metal since euro strength historically correlates to a stronger gold price.

Source: BigCharts

The latest dive in the dollar index also suggests that the next phase of gold's recovery will be based on an improved currency component rather than on fear. As we've talked about in recent reports, gold's "fear factor" has been the primary reason for its gains since August as investors have been worried over emerging markets weakness and the U.S. interest rate outlook. Now that these fears are at least temporarily diminishing, investors can expect to see increased gold demand based on a falling dollar. The dollar's value has diminished in recent weeks as investors are no longer treating the currency as a safe haven. The sharp decline in stock market volatility has also coincided with the dollar's downward acceleration.

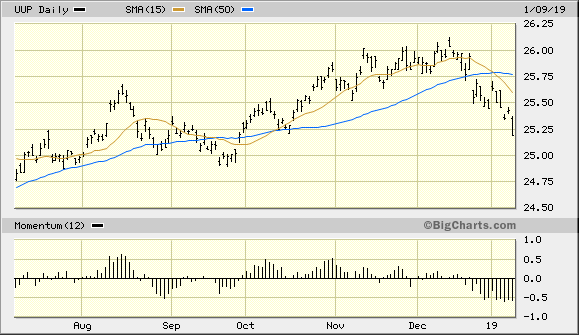

Increasing weakness in the dollar is visible in the following graph of the Invesco DB U.S. Dollar Index Bullish Fund (UUP), which is my favorite dollar proxy. As this clearly illustrates, the dollar ETF continues to fall below its 15-day and 50-day moving averages as the intermediate-term (3-9 month) outlook for the greenback is weakening. And as gold investors are well aware, the weaker the dollar becomes the more it increases gold's upside potential.

Source: BigCharts

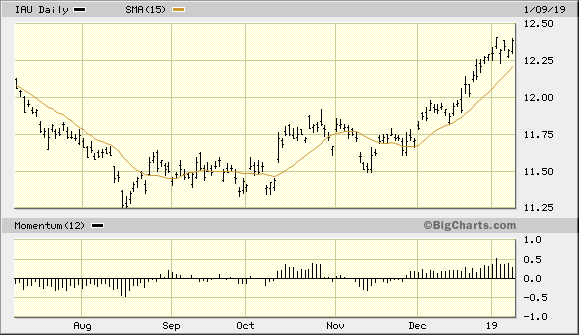

Meanwhile, the iShares Gold Trust (IAU) remains in a rising trend as of Jan. 9 as measured by the rising 15-day moving average. Although IAU is still in the midst of a consolidative pause, the price line for this ETF should soon increase based on the latest weakness in the dollar. As previously discussed, the recent pause in IAU has allowed the important 15-day moving average (below) to get closer to IAU's price line, which is encouraging from a technical perspective. It should also result in IAU being less vulnerable to a bear raid in the coming days while the broad equity market rallies.

Source: BigCharts

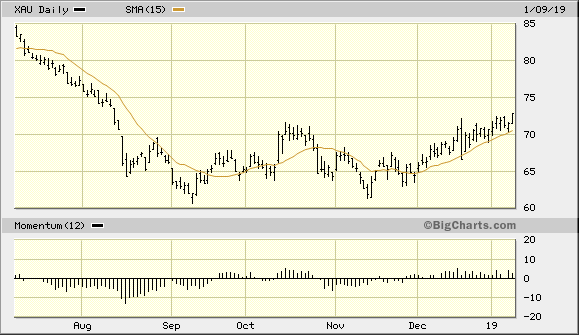

Turning our attention to the gold mining stocks, the PHLX Gold/Silver Index (XAU) continues its slow, steady rise despite encountering recent resistance at the 72.00 level. This price level marks the approximate upper boundary of a 4-month trading range. As I've argued in previous reports, a decisive breakout above the 72.00 level will likely galvanize additional short covering in the actively traded gold stocks and give the bulls some additional support. The fact that the U.S. dollar continues to weaken is another factor that should support the gold mining stocks in the weeks ahead.

Source: BigCharts

In conclusion, investors should continue to remain optimistic on gold's intermediate-term recovery prospects. Along with a weakening dollar, other commodities are beginning to rally including the beleaguered crude oil price. A weaker dollar will help boost the broad commodity market outlook, which in turn will convince fund managers and investors that the outlook for inflation-sensitive assets has improved. This in turn will further strengthen gold demand in what amounts to a virtuous cycle.

On a strategic note, traders should remain long the iShares Gold Trust after recently taking some profit. I recommend maintaining the stop loss for the remainder of this trading position to slightly under the $12.10 level on an intraday basis. A violation of $12.10 in the IAU would mean that price has fallen under the technically significant 15-day moving average, in turn signaling a shift in the immediate-term trend.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts