This Rare Gas Is Now Worth 100X More Than Natural Gas / Commodities / Metals & Mining

Supply shortages…

Supply shortages…

That’s what is fueling the market right now.

Oil companies are making out like bandits…

Natural gas prices are skyrocketing…

And commodities like lithium, cobalt, and aluminum have soared to newheights.

But it’s not all sunshine and roses for some industries.

The auto industry has seen its production plummet due to the globalsemiconductor shortage…And top automakers are saying it’s not going to endanytime soon.

But semiconductors and commodities aside…

There’s one resourcethat no one is talking about.

And it could have amassive impact on the world as we know it.

It’s used in everything from medical devices and cryogenics to space travel andeven powering the internet. It’s a major element in a number of key supplychains.

In fact, it’s even listed as a critical material to U.S. economic andnational security.

It’s a non-renewableresource…and our supply is running dangerously low.

The New York Times says…

While CNBC warns…

And the BBC highlights…

Say what you will about the space race, web3, or the metaverse…

A helium shortage notonly stops those innovations in their tracks…It could also derail the technologywe’ve all become accustomed to.

Streaming services…

Cell phones…

Electric cars...

Nothingmay be possible without it.

And if you thoughtnuclear fusion was going to save the planet from rising emissions…

Without this noble gas, you can kiss that dream goodbye, as well.

Helium: The MostImportant Resource No One is Talking About

Many people see heliumas just the stuff inside birthday balloons…But that isn’t even the tip ofthe iceberg.

It’s actually a key component in the tools you and I use every single day.

In fact, if you’re reading this right now - it’s because of helium.

That’s because it is a key ingredient in computer chip manufacturing.

It’s also a vitalelement in telecommunications.

Helium is what has allowed us to go from that annoying 56kb dial-up internetconnection to…

This:

This is significant because, without helium, some of the biggest companiesin the world might not even exist.

Netflix…

Google…

Even Amazon.

Bid farewell to your Sunday afternoon binge-watching sessions…

And definitely forget about ordering that really cool-looking kitchen tool thatpopped up in your Facebook newsfeed a few minutes ago.

But we’re just getting started.

Helium is also used in MRIs, space travel, nuclear fusion, and much, much more.

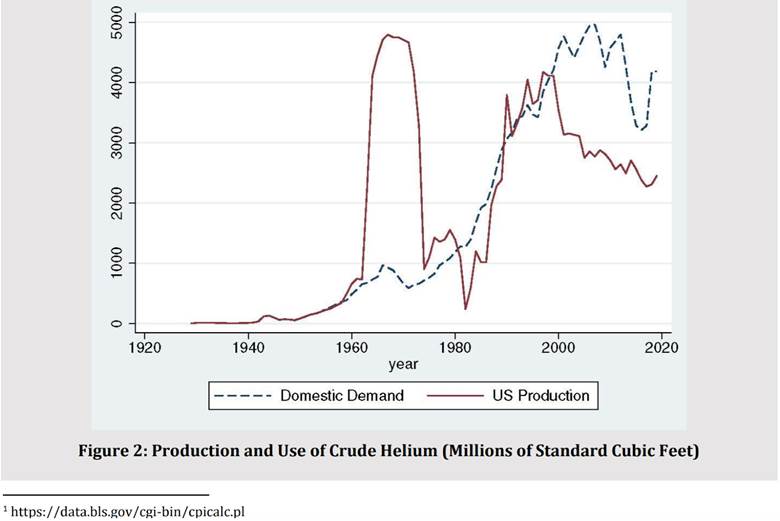

And as I mentioned earlier; it’s running out.

Growing demand from BigTech and other innovative industries has created a massive supply imbalance…

And, in turn, paved the way for a fast-moving growth opportunity for anyexploration and development company that can show potential for significant newhelium discoveries.

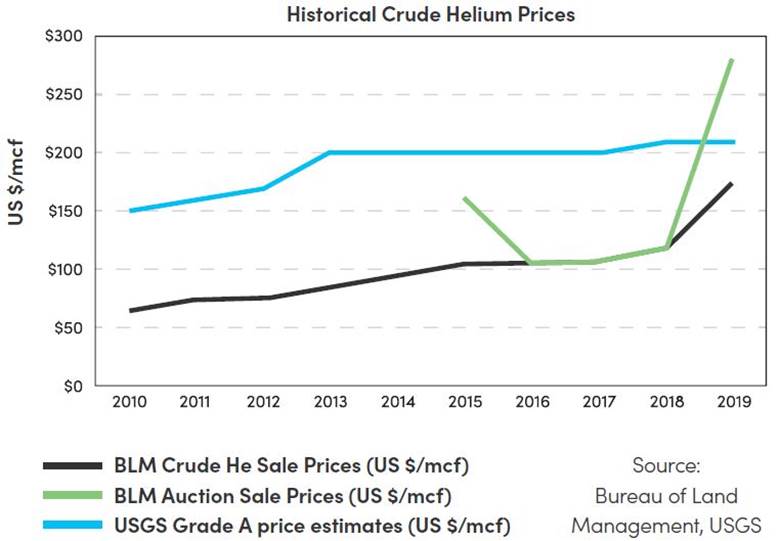

In 2019 alone, heliumprices soared by 135%, hitting $280/Mcf…

And today, refined helium is selling for $600-650.00 USD per mcf.

All while production is slowing…

Now, more than ever, helium is a low-volume, high-value commodity.

But it doesn’t tradelike one.

You see, there are noETFs to bet on helium…and no commodity market.

Even helium companies themselves are few and far between.

Many of the top producers aren’t even public because they’re soprofitable.

But one small-capexplorer is poised to change that.

The Small Company MakingBig Moves In The Helium Space

Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) is a little-known helium explorer looking for oversizedreturns in the coming years.

Recently, the explorer announced that it had completed initial open-holelogging and drill stem testing on its first two helium wells on its 100%-operatedGreater Knappen project…

And to say that the results were promising…would be an understatement.

This could be just the beginning for Avanti, as well.

The Greater Knappen property is 69,000 acres…and estimates suggest itcould potentially hold as much as $1 billion worth of helium.

To put this opportunity into perspective, Avanti Energy’s entire market cap isjust $82 million at the time of writing.

Already, just a few miles away from the Greater Knappen property, a competitoris producing as much as 55,000 cubic feet of helium per day.

And the company is seeing payback on their well investments in as little as sixmonths' time.

To us, that’s not just impressive, it’s inspiring.

Avanti’s helium reserves could be even better, with a possible heliumconcentration of as high as 2%, while its competitor’s concentration rate is1.4%.

What that means is that Avanti’s exploration costs could see a return in aslittle as THREE months if its explorationand development efforts are commercially successful.

At the moment, these wells are projected to cost just $1.5 million to drill…andcould potentially run for 10 or even 15 to 20 years!

If achieved, that wouldbe an incredible return on investment, especially considering the fact thathelium demand is set to rise even more in the coming years.

Think about this…a single space launch uses about $12 million worth ofhelium…

Elon Musk’s SpaceX alone is planning a total of 52 launches this year.

And that’s nothing compared to NASA, the single biggest buyer of helium.

NASA consumes approximately 75 million cubic feet annually to coolliquid hydrogen and oxygen for rocket fuel.

Between tech innovation, the future of energy, and the red-hot space race, thehelium market is set to increase by 11% every year through 2037.

That’s a lot of marketto grab for a small-cap like Avanti Energy Inc (TSX:AVN.V; OTCMKTS:ARGYF).

An Experienced Team Of ExplorationAnd Production Experts

We believe the team behind Avanti Energy is second to none.

In this industry, experience is everything - and these guys are veterans.

In fact, some of the team members were involved in the early stages of the discovery of theMontney Formation, one of the premier natural gas formations in North America.

Avanti CEO, Chris Bakker, has more than 20 years of experience in oil andgas working as a commercial negotiator for major facilities and pipelinesin the Monteny gas play.

We expect his expertise to truly shine in the world of land acquisition,exploration, and drilling. And this is exactly what he’s already doing withAvanti: locking down highly prospective land.

Presidentof the company, Rob Gamley, is not only well connected, but he’s also a trustedadvisor and board member for other companies in the resource space.

GengaNadarju, Vice President - Subsurface of Avanti, has another 20 years ofexperience in oil and gas.

And their Senior Geophysicist, Richard Balon, has 30 years under his belt inthe Western Canadian Sedimentary Basin alone.

Add inDirector - Geoscience Dr. Jim Wood, Ali Esmail, and Kevin Morrissette, andyou’re looking at a well-rounded, veteran team of industry heavyweights.

Combined, this veteran team has over 100 years of experience in the resourcespace, and if their latest drilling results indicate anything to us, it’sthat they know what they’re doing.

AvantiIs Turning Heads

AvantiEnergy Inc (TSX:AVN.V; OTCMKTS:ARGYF) is making waves in the helium space, thanks toits experienced leadership.

With a solid newsflow and better-than-expected drilling results, analystsare eyeing a major opportunity in this up-and-comer.

Beacon Securities, for example, noted that Avanti “now has a contiguous landblock that may support several years of drilling.”

“Ifsuccessful, numerous development wells would follow with production in H2/22once facilities are configured and installed,” Beacon notes, adding that“critical mass” has been achieved with Avanti, which now has a “key asset onwhich its world-class technical team can explore.”

WithAvanti’s current market cap sitting at about $80M, if the its exploration anddrilling efforts are commercially successful, the company’s valutation could significantlyincrease by this time next year.

And wethink it makes sense to be bullish on Avanti.

Imagine if you had the opportunity to spend $1,500 on an asset that could payitself off in only three months…

And continue to give you $500 per month for the next 10 or more years.

In just a decade, you might have already seen a return of 3,900% on yourinitial investment.

That sort of potential is exactly what Avanti is looking for with its $1.5million wells.

Remember, Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) only has a market cap of around $80 millionright now…

And it might be sitting on as much as $1 billion in potential helium…theresource literally powering our future.

This may just be the beginning of Avanti’s story…

But we think it’s only going to get a lot more interesting from here.

By. Michael Kern

**IMPORTANT! BY READING OUR CONTENT YOUEXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-lookinginformation which is subject to a variety of risks and uncertainties and otherfactors that could cause actual events or results to differ from thoseprojected in the forward-looking statements. Forward looking statements in thispublication include that prices for helium will significantly increase due toglobal demand and use in a wide array of industries and that helium will retainits value in future due to the demand increases and overall shortage of supply;that Avanti will able to successfully pursue exploration of its licenses andproperties; that Avanti’s licenses and properties can achieve drilling andmining success for commercial amounts of helium; that indications of potential for economic helium in Avanti’sinitial wells will predict future results; that Avanti will be able fulfill itsobligations under its licenses and in respect of its properties; that Avantiwill be able acquire the rights to the helium on its prospective heliumproperties; that the Avanti team will be able to develop and implement itshelium exploration models, including their own proprietary models, that mayresult in successful exploration and development efforts; that historical geologicalinformation and estimations will prove to be accurate or at least veryindicative of helium; that high helium content targets exist on Avanti’sprojects; and that Avanti will be able to carry out its business plans,including timing for drilling and exploration. These forward-looking statementsare subject to a variety of risks and uncertainties and other factors thatcould cause actual events or results to differ materially from those projectedin the forward-looking information. Risks that could change or prevent these statements from coming tofruition include that demand for helium is not as great as expected; thatalternative commodities or compounds are used in applications which currentlyuse helium, thus reducing the need for helium in the future; that the Companymay not fulfill the requirements under its licenses for various reasons orotherwise cannot pursue exploration on the project as planned or at all; thatthe Company may not be able to acquire the helium rights on its properties ascontemplated or at all; that the Avanti team may be unable to develop anyhelium exploration models, including proprietary models, which allow successfulexploration efforts on any of the Company’s current or future projects; thatAvanti may not be able to finance its intended drilling programs to explore forhelium or may otherwise not raise sufficient funds to carry out its businessplans; that geological interpretations and technological results based oncurrent data may change with more detailed information, analysis or testing;and that despite promise, results of the recent drilling and exploration may beinaccurate or otherwise fail to result in locating or developing any commercialhelium reserves on the Avanti properties, and that there may be no commerciallyviable helium or other resources on any of Avanti’s properties. Theforward-looking information contained herein is given as of the date hereof andwe assume no responsibility to update or revise such information to reflect newevents or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. Thiscommunication is a paid advertisement and is not a recommendation to buy orsell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners,managers, employees, and assigns (collectively “Oilprice.com”) has been paid byAvanti fifty thousand US dollars for this article to provide investor awarenessadvertising and marketing for TSXV:AVN. The information in this report and onour website has not been independently verified and is not guaranteed to becorrect. This compensation is a major conflict with our ability to be unbiased.This communication is for entertainment purposes only. Never invest purelybased on our communication.

SHARE OWNERSHIP. The owner of Oilprice.comowns shares of Avanti and therefore has an additional incentive to see thefeatured company’s stock perform well. Oilprice is therefore conflicted and isnot purporting to present an independent report. The owner of Oilprice.com willnot notify the market when it decides to buy more or sell shares of this issuerin the market. The owner of Oilprice.com will be buying and selling shares ofthis issuer for its own profit. This is why we stress that you conduct extensivedue diligence as well as seek the advice of your financial advisor or aregistered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com isnot registered or licensed by any governing body in any jurisdiction to giveinvesting advice or provide investment recommendation, nor are any of itswriters or owners.

ALWAYS DO YOUR OWN RESEARCH and consultwith a licensed investment professional before making an investment. Thiscommunication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherentlyrisky. Don't trade with money you can't afford to lose. This is neither asolicitation nor an offer to Buy/Sell securities. No representation is beingmade that any stock acquisition will or is likely to achieve profits.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.