This Stock Market Alarm Also Sounded Before Black Monday

The last time it sounded was around the August 2015 "flash crash"

The last time it sounded was around the August 2015 "flash crash"

Last week, the three major market indexes fell into "correction" territory -- defined as at least 10% off their recent highs -- at the same time. It was the first time the Dow Jones Industrial Average (DJI), S&P 500 Index (SPX), and Nasdaq Composite (IXIC) were in correction territory simultaneously since around the August 2015 "flash crash." Prior to that, the broader stock market signal hadn't sounded since January 2008, during the financial crisis, according to data from Schaeffer's Senior Quantitative Analyst Rocky White.

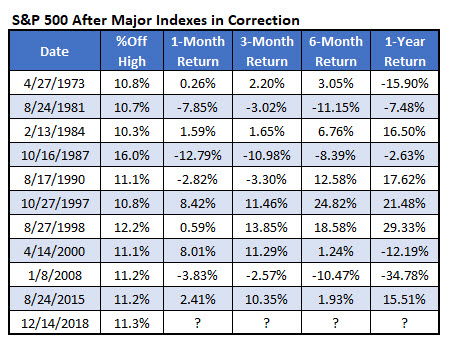

Below are all the times the three indexes moved 10% from their highs at the same time, looking at data since 1972 (the first year we have Nasdaq data). The first "alarm bells" sounded in April 1973, which was the only signal for eight years. It's also notable that the signal went off on Oct. 16, 1987 -- just one session before "Black Monday" on Oct. 19, 1987. Likewise, the correction signal went off in April 2000, around the start of the dot-com bubble bursting.

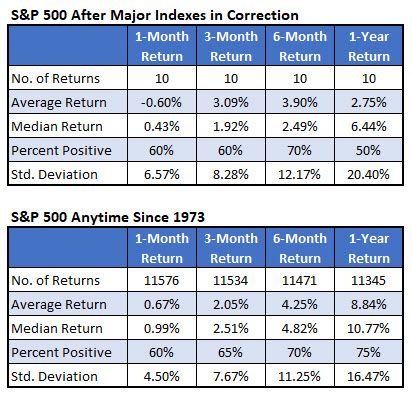

It's no surprise, then, to find that these steep, simultaneous pullbacks have preceded notable stock market sell-offs in the past. After the 10 signals, the S&P 500 was down another 0.6%, on average, compared to an average anytime return of 0.67%, looking at data since 1973. One year later, meanwhile, the index was up a weaker-than-usual 2.75%, and higher just half the time. That's compared to an average anytime one-year gain of 8.84% and a 75% win rate.

The outlier is the three-month marker, with the index generating a better-than-average gain of 3.09%, compared to 2.05% anytime. It's also worth noting that greater-than-usual volatility tends to persist after signals, looking at the Standard Deviation columns in the chart below.

In conclusion, if past is prologue, stocks could be in for a wild ride. From a specific technical standpoint, bulls are hoping previous 2018 lows hold, and the SPDR S&P 500 ETF Trust (SPY) $255 level could emerge as the next line of defense, per Schaeffer's Senior V.P. of Research Todd Salamone's latest Monday Morning Outlook. However, the latest short interest data indicates the shorts haven't even begun to smell blood yet, which could put a lid on stock rallies.