Three reasons why BHP invested in Midland Exploration

In his April 16th Discovery Watch broadcast, John Kaiser provides an overview of recent news flow out of the James Bay area of Northern Quebec. He kicks things off with the Monday news of BHP Billiton Canada's $5.8 million investment into Midland Exploration (MD). Why would BHP, the largest copper producer in the world, be interested in this tiny Canadian junior?

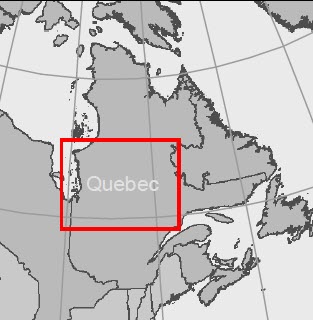

James Bay, Quebec mining area (source Azimut Exploration)

Mr. Kaiser believes there are three reasons.

First, they were impressed by last October's announcement where Midland described the high copper values, the distribution of the boulders, and all the other geological aspects of it. Two, they love the climate in Quebec in terms of government support for infrastructure, the tax credits. It's a province that has the support of the government for mining exploration...but most importantly, and this is what really struck me when I talked to Gino Roger...if there is any company that knows everything there is to know about copper systems it is BHP, and apparently, they cannot catalogue...what is so far known about the Mythril system according to known deposit styles. There [are] similarities with some stuff, and they may have some highly confidential suspicions about what this is all about, but in their view, this is something new. This is something out of left field and the scale of it is large and the grades are high, so they said we have to be here.

Mr. Kaiser reports that BHP is also helping Midland with age-dating of the mineralization at the Mythril project which could reveal important information, such as whether it is a very old system, or whether there are younger systems that have intruded older rocks.

Midland has been drilling and results could come out as early as May. In terms of what Midland needs to deliver for a proof of concept, Mr. Kaiser notes that some similarities have been drawn between Mythril and the Aitik mine in Sweden which he characterizes as having a copper grade of about 0.25% plus a gold kicker. However, Mr. Kaiser suggests Midland will have to come out with results that are better than that. We have no doubt that many speculators and industry watchers have their fingers crossed that they do.

Mr. Kaiser ends the first segment off by assessing the state of the junior prospect generator business model which he suggests is having a hard time keeping up the attention of investors.

In his second segment, he discusses recent news from Azimut Exploration (AZM) which has the Pikwa project next door to Midland's Mythril. On Monday, the company released results of a survey of the Pikwa along with diagrams. Mr. Kaiser is generally encouraged with what he saw. Investors seem to be warming up to the news as well with the stock up almost 25% since Friday.

The final segment touches on the recent takeover of Lorraine Copper by Sun Metals (Mostly Sunny; SUNM).

Disclosure: I hold shares of AZM. This post originally appeared on INKResearch.com.