Three Reasons Why Waiting for "Cheaper Silver" Doesn't Make Cents / Commodities / Gold and Silver 2021

If you're still waiting to buy physical silver to start a stash, you're now playing financial Russian Roulette... with fourrounds in the cylinder.

The chat rooms talk about buying silver andgold when they decline in price. "If silver goesdown to 22, I'm all in!" "When these 'excessive' premiums drop a fewdollars, I'm backing up the truck."

1) Emotion and Sentiment

Believe it or not, buying on a price dropgoes against human nature.

It is a bit strange, because if you go tothe store and find your favorite grass-fed beef on sale, you'll probably seehow much you can stuff in the freezer. But back to the metals.

How many people do you know who purchasedsilver in the spring of 2020 when it fell briefly to $12? Or in 2008 when itfell to $9... before rising to $50 less than three years later? Did you?

Another big change, seemingly contradictory-- is that increasing numbers of well-studied investors are buying whether theprice goes up or down,with retail supply getting continually whittled away.

Their sentiment seems not as heavilyimpacted as others, who remain fearful of declines, or -- as is still the casewith most Americans -- are not yet aware of how quickly government-inducedinflation is eating away at the value of their pensions and the greenbacks intheir wallets.

During market turbulence, the newsinvariably causes a decline in sentiment, making it difficult even for those ofus who've been in these markets for many years, to go ahead and buy.

One of the most important characteristicsof an investor who succeeds long term over the majority who do not, is theability to "Buy when others are selling and sell when others arebuying."

It's like the habit of going to the gym. Atsome point it never gets any easier. No matter how strong your originalmotivation was, it still can be hard to push yourself out the door and keep atit.

To handle buying more silver when sentimentis negative -- like it is now -- simply go out, as Galactic Update's StewartThomson says, and "Buy less than is rational." How much is lessimportant than keeping the habit.

This is where a periodic auto-buysetup works so well. The decision haspreviously made and, since it's automatic, less second-guessing gets in theway.

2) Premiums

A decade ago, the premiums didn’t changemuch. Now there’s a different metric. When the price drops, people buy more.

Supplies dry up because silver miners areproducing less and just as important, legitimate sellers -- who are not tryingto gouge anybody -- raise premiums because they’re paying way more for supply.If they sell what they have for a silly paper price unreflective of marketreality, then they have no product.

To make matters worse for the contrarianwho’s waiting for a price drop, premiums rise to the point that their cost goesup even more than the drop in the physical price. For example, the going ratefor American silver Eagles used to be about three bucks over a bullion coin ofthe same weight.

These days, an Eagle can set you back at least $10 over spot. So if you’rewaiting for $22 silver (and, should it actually get there), you’ll pay $32 percoin for the privilege -- That's if you can find any.

Blame Canada. Ifyou’re one of our unfortunate neighbors to the north, and you didn’t buy anysilver some years ago when the Cando was trading at par with the US dollar, younow get to pay an extra 20% because of a much less favorable exchange rate.

A double-cost "premium" by adifferent name? Pardon our Canadian friends for having a hard time “backing upthe truck” just now!

3) Supply vs. Demand

In the Old Days when the price dropped, youcould simply go in and get what do you wanted, because people stopped buyingand there was plenty around, in part due to global silver production running asurplus each year.

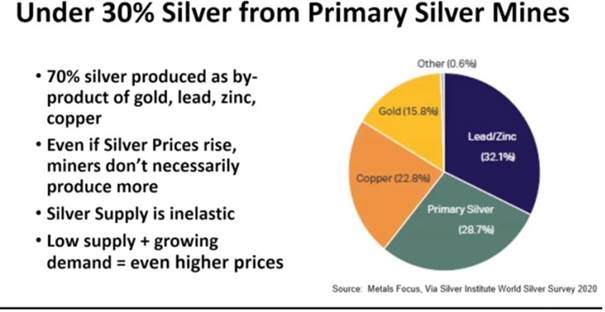

Yields at the relatively few primary silverminers have been dropping for over a decade, but the decline in total ouncesproduced just started showing up in the annual figures during the last fewyears.

2021 is likely to mark the fourthconsecutive year in this pattern. Thus, a profoundly altered and systemicsupply metric is now in play.

An Historic Anomaly.Tying all of this into a bow are two structural changes -- each "afirst" for anyone now alive.

As mentioned above, we're well into astructural ongoing supply decline -- made worse because most silver used inmodern applications is not recoverable, and is thus lost for reuse. The trickleof additional new silver production coming online is simply not going to changethis anytime soon. Slammed against this drop is a sea wave of new demand fromboth investors and industry.

Like palladium, which went through the samesupply demand alteration (deficit) on a smaller scale, the result before longis going to be an upside price explosion.

Also, whether or not you believe in"conspiracy theories," silver, unlike any other commodity on theboard has, for the past few decades been massively "manipulated" byshort sellers who push paper silver derivatives into the market in order tokeep the true price well below where, all things considered, it should be.

In the process, they profit by theresulting volatility in both directions.

The distortion between price and value hasbeen so out of kilter for so long that it's safe to say none of us really has ahandle on what that price should be. Before long, we're likely to find out…

All in all, hanging around for “More affordable” silver prices doesn’t reallymake cents. It doesn’t make dollars either.

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.