Throwing the golden baby out with the covid bath water - Gold Wins / Commodities / Gold & Silver 2020

The dollar is the mostimportant unit of account for international trade, the main medium of exchangefor settling international transactions, and the store of value for centralbanks. The Federal Reserve is the lender of last resort, as in the 2008–09financial crisis, and is the most common currency for overseas borrowing bygovernments and businesses.

Investors want to owndollars when the proverbial poo hits the fan, or a wrench is thrown into themachinery of the global economy - pick your metaphor they all fit thecoronavirus crisis.

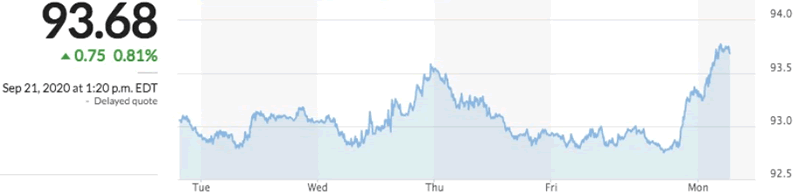

On Monday the US dollarindex, DXY, soared as investors flocked to safety amid a global stock marketrout resulting from rising covid-19 cases, especially in the UK and Europe.

The threat of newpandemic-related lockdowns is prompting concerns about the global recovery. TheDow dropped more than 500 points, Monday.

Adding to the riskaversion is the death of US Supreme Court justice Ruth Bader Ginsberg, whichhas thrown Congress into turmoil regarding when a new justice will be voted on;their failure to pass a $1 trillion stimulus package, and dwindling prospects ofone during the campaign season; and rising economic and military tensionsbetween the US and China.

US stock market indicesare having their worst month since March, with volatility seemingly back on therise, after bottoming out in mid-August.

Gold and silver pricesnormally benefit from stock market weakness, but not this week. In what lookslike a repeat of March, when precious metals followed equities over a cliff, onMonday gold and silver prices plumbed six-week lows in mid-day trading. Kitco reported October gold futuresdown $53 at $1,900.20/oz, and December Comex silver falling $2.48 at$24.64/oz.

As of this writing, spotgold’s last bid was $1910.70/oz; spot silver’s was $24.71.

“What we’re seeinghere this morning for the dollar is largely a risk-off safe haven bid,” saidErik Bregar, head of FX strategy at Exchange Bank of Canada in Toronto, addingthat the trigger was in the European morning on rising fears of a new U.K. nationwidelockdown.

“It’s scary stuffthat reminds you of March,” he said.

We’ve seen this moviebefore

That month, when thecoronavirus began spreading beyond China, bonds, the Japanese yen, the Swissfranc, even gold, the world’s oldest safe haven, were no match for the dollar,as the virus caused widespread dislocation in the form of business closures,layoffs, and requests for governmentbailouts.

After hitting a 7-yearhigh on March 9 of $1,674.50 per ounce, gold prices retreated, as traders soldbullion to cover losses in other asset classes, amid a three-week marketmeltdown.

Of course, gold priceswould go on to notch record highs over $2,000 an ounce, in August, on the backof dollar weakness. Since March, the buck has been on a steady decline.

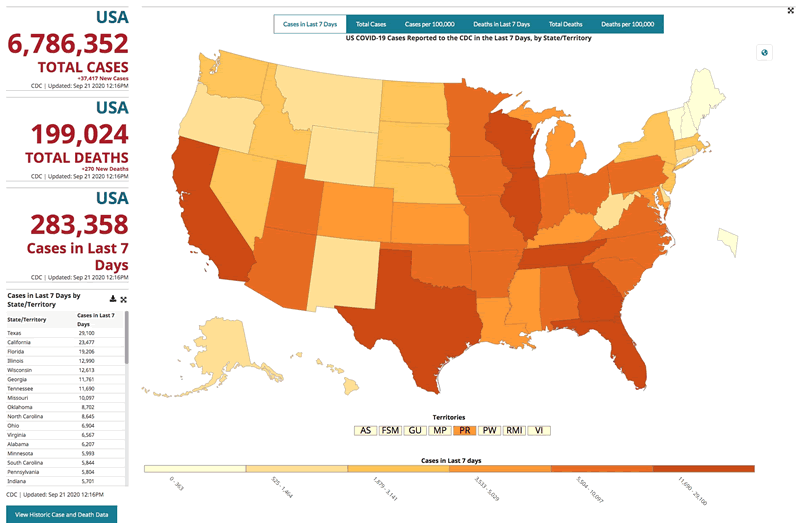

Its retreat has beendirectly correlated to America’s failure to control the virus. States that reopenedtoo early saw a resurgence of infections. By May there was a pre-summer surgeof 20,000 cases a day, overwhelming hospitals and causing an economic tailspinfrom Wall Street to Main Street. As summer comes to a close, daily case numbershave doubled to 40,000 a day, as the virus migrates from major cities to the USheartland. Eleven states and Puerto Rico are still showing a positivity rate of10% or higher, CBS News reported Monday. Health expertswarn of another wave heading into the fall and winter flu season.

According to the Centersfor Disease Control (CDC), there are currently 6.8 million cases in the UnitedStates, and the death toll is almost 200,000.

All of which makes thedollar’s apparent comeback puzzling. How can the US and it’s currency still be thoughtof as a safe haven, with all that is going on?

Stimulusstalemate

Let’s begin with thestalemate in Congress over the passage of a second stimulus package. Lawmakersremain deadlocked over a measure to provide another round of $1,200 checks,after most recipients saw the money they received from Congress’ $2.2 trillionCARES Act dry up over the summer.

The record bill providedhundreds of billions in extra food aid, unemployment benefits, and stimuluschecks for workers and their families, including expanding UI to millions ofworkers who under existing rules would not have qualified.

Some economists believeif aid isn’t restored, the US economy will slip back into recession (in Marchthe economy sunk into its deepest recession since the Great Depression). Othersthink that further deficit-financed stimulus will come at the expense of higherdebt and higher taxes; the national debt is currently at an eye-popping $26trillion. The federal deficit in fiscal 2020 has tripled to $3.3 trillion, onpandemic-related aid.

The disagreement over howto proceed is playing out in Congress. The $3.4 trillion HEROES Act, passed bythe Democrat majority in the House, would restore the $600 federal supplementto weekly unemployment benefits, which ended in July, and would provide freshfunding for small businesses and cash-strapped state/ local governments.Republicans have offered reduced aid packages, ranging from $300 billion to $1trillion.

Notorious RBG

With the death of SupremeCourt Justice Ruth Bader Ginsburg (“Notorious RBG” to liberals, a meme to thelate rapper “Notorious BIG”), and the need to put together a funding bill tokeep the government open by the end of September, it looks increasinglyunlikely that the GOP-dominated Senate will come to a deal anytime soon.

President Trump onSaturday said he would announce a nominee imminently, even releasing a list ofpotential picks. Democrats argue that the winner of the Nov. 3 election shouldchoose the nominee. Biden and others have pointed out that the Republican-ledSenate in 2016 used the same rationale to block Barack Obama’s nomineefollowing the death of Associate Justice Antonin Scalia. That’s “I’m in politics”,folks.

The more important pointis what could happen if Trump, either before the election or after, should hepull off the win, nominates another conservative to the bench. (Trump appointedconservative justices Neil Gorsuch in 2017 and Brett Kavanaugh in 2018). Naminga third would stack the Supreme Court with 6 conservative-minded judges to 3,thereby decisively tilting the ideological balance of the court to the right,for decades. It would almost certainly be the most lasting, and damning, legacyof the Trump administration.

In short, this is a bigdeal.

In the United States theSupreme Court plays an important role in ruling on legislation sent to it by adeadlocked Congress. In the 2000 election, for example, the court ended aFlorida recount and made George W. Bush President. Now, with partisanship inWashington at historical highs, parties will look to the court to resolve politicaldisputes.

Among the highest-profileis the Affordable Care Act. A challenge to the law known as Obamacare isscheduled for Nov. 10. A decision by the highest court in the land is bound toaffect the healthcare of millions of Americans, including pre-existingconditions. Other issues likely to be brought to the court, include votingrights, the future criminal justice, workplace benefits, the rights ofimmigrants, tax rules, and most explosively, reproductive rights.

Recent polling suggeststhat a majority of Americans would preserve the landmark Roe vs Wade SupremeCourt decision protecting a pregnant woman’s liberty to have an abortion, but 28% would overturn theruling.

If conservatives try tostrong-arm liberals into re-considering a woman’s right to an abortion, Ibelieve the ensuing protests will light the entire US on fire.

Americannightmare

Stacking the court withconservatives will also exacerbate social divisions in America - something wealready see happening with the coronavirus crisis.

CBC quotes from Adam Cohen’s book‘Supreme Inequality’, which states that historically, the US Supreme Court hasfavored the wealthy and the powerful, the rare exception being the 1960s whenthe court was led by Justice Earl Warren.

[Cohen] said thecourt has recently been a major driver of American inequality — stripping awayunion powers, allowing corporate money into politics and undermining theintegration and funding of schools in minority areas.

The economic fallout fromcovid-19 includes over 13 millionunemployed, as of August - better than the +40 million jobless in May but still higherthan pre-pandemic February - and unprecedented debt levels taken on by statesand the federal government.

As usual the burden fallsmost heavily on the poor, who are unlikely to have jobs allowing a “work fromhome” option, and can ill-afford to buy stuff on Amazon in lieu of shopping atthe mall. Add the plight of these individuals to the decreased purchasing powerof the average consumer, due to rising food and gas prices, and more expensiveimports owing to the billions worth of trade war tariffs still on many of them,and you have a declining standard of living for Joe and Jane Sixpack.

Adding to the economicpain, many US cities have experienced unrest following the police killing of ablack man in Minneapolis. Some protests have escalated into violence andlooting. This week the US Justice Department threatened to cut funding to NewYork City, Seattle and Portland, saying the three liberal cities are allowinganarchy and violence on their streets. In a joint statement, New York MayorBill de Blasio, Seattle Mayor Jenny Durkan and Portland Mayor Ted Wheeleraccused the Trump Administration of playing politics and said withholdingfederal funds is illegal, CBC reported.

Will China dumpTreasuries?

Back to the dollar andgold, US Treasuries are a safe haven amid the coronavirus and othergeopolitical tensions. They were attractive in comparison to the trillions ofnegative-yielding sovereign debt sloshing around. But with yields at recordlows and 0.25% to 0% interestrates expected until 2023, bonds are a poor investment. If foreign investors slow or stopbuying US Treasuries, as Russia and China did in 2019, the United States is inreal trouble. Without purchasers of US debt (Treasuries) the US has no way offinancing its annual deficits and $26 trillion pile of debt, without printingmoney. Printing money on a large scale causes hyperinflation.

A worsening US economywill turn investors away from bonds and Treasuries - no more financing for USdebt. The dollar will fall further and commodities will rise, including goldand silver, pushed higher by investment demand for gold-backed ETFs andphysical metal.

Could that actuallyhappen? It’s hard to say but in June of this year, China sold $9.3 billionworth of US Treasury bonds. In a 12-month period, China’s holdings - atUS$1.074 trillion, China is the second highest holder of US government bondsafter Japan - dropped 3.5%.

Not enough to sound thealarm of a widespread sell-off, but there are recent indications that moreChinese T-bill liquidations are coming. According to ‘GlobalTimes’ a state-backed newspaper, Beijing continues to weigh options toinsulate itself from tensions with Washington. And don’t kid yourselfabout that money – it comes straight home to roost in the form of inflation.

It is no secret thatrelations between China and the US have deteriorated. In July, the US orderedthe abrupt closure of the Chinese consulate in Houston, citing the need to“protect American intellectual property and private data.”. There is no end tothe trade war, despite a “Phase 1” agreement in January, in fact Trump justsigned into law a bill imposing sanctions against Chinese individuals, banksand businesses that are helping Beijing’s Hong Kong crackdown. Billions worthof import duties on either side remain. A commitment from China to buy anadditional $200 billion worth of US goods will probably never be honored.

Chinese telecom giantHuawei is accused of being a trojan horse letting China spy on countries thatuse its 5G technology. The US has convinced other countries, most recently theUK, not to use Huawei’s 5G equipment.

And of course, thecoronavirus has been front and center in an ongoing propaganda battle over whois to blame for the pandemic.

We have also writtenextensively on the escalating tensionsbetween the US and China in the South China Sea, where China holds historical claimsdespite international treaties to the contrary (ie. the UN Convention on theLaw of the Sea). Ongoing maneuvers in the waters off its southern coastlinedemonstrate that Beijing is willing to flex its muscles in a region it sees asstrategically and economically critical. China has built man-made islands andconstructed port facilities, military buildings and even airstrips onthem.

Secretary of State MikePompeo called China’s territorial claims in the South China Sea “completelyunlawful” and pledged US support for countries that want to challenge Beijing.

The United Statessupplies weapons to Taiwan despite not having diplomatic relations with theisland and its government. China sees Taiwan as a breakaway territory that mustbe re-united with the Chinese Mainland; its independence is not recognized byBeijing. A forced reunification would almost certainly cause a war betweenChina and the US; the Americans would never allow Taiwan, a key tentacle of USinfluence in that part of the world, to be overtaken by the Chinese. Yet thereare increasing calls from China to end Taiwan’s independence by the 100thanniversary of the Chinese Communist Party in July, 2021.

The anti-China feelingpervading Washington extends to US Attorney General William Barr, who recently brandedDisney, Google, Microsoft, Yahoo and Apple “all too willing to collaborate”with the Chinese Communist Party; and FBI Director Chris Wray, who charged thatBeijing pursues its ambitions through industrial espionage, theft, extortion,cyberattacks, and malign influence activities, CNBC reported.

For its part, China hassanctioned Senators Ted Cruz and Marco Rubio for their legislative actionslinked to the detention and suppression of ethnic minorities in the Xinjiangregion, and threatened to sanction US military contractor Lockheed over itsdefense sales to Taiwan.

While China has certainlydone a lot to poke its stick in Uncle Sam’s eye, we mustn’t forget it was theTrump administration that kicked sand in the face of its Asian adversary.

Attacking the tradedeficit between China and the United States became an obsession with currentWhite House, and the sine qua non behind the trade war that Trump launchedagainst Beijing in the spring of 2018 (the first tariffs, on imports of steeland aluminum, targeted not only China but its other trading partners, includingCanada)

Arguably, these economicirritants were just the appetizer for the main course, a “Cold War II” beingcooked up between the two largest economies.

An increasinglybelligerent US has turned a trade war into a cold war. Diplomacy is gone,replaced by a brash “my way or the highway” mentality.

Is this what we shouldexpect from the printer of the world’s reserve currency?

Gold will win

Given that gold pricesmove in the opposite direction as the US dollar, in predicting what will happento gold, we need to examine the dollar’s short-term prospects.

Analysts at Commerzbankbelieve that the European Central Bank will continue to talk down the euro,because they don’t want the common currency to appreciate, as it would hurt EUexports.

“Thus a currency war hasbegun between the USD and the EUR that other currencies may well join,” theanalysts said.

Much is riding on thisWednesday, when Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchinwill testify to the Senate Banking Committee on coronavirus relief.

Via Kitco, Commerzbank saidthat Federal Reserve Chair Jerome Powell will have his turn to talk down theU.S. dollar as he testifies before Congress this week.

“He is likely tourge members of Congress to approve a new fiscal package now that the Fed hasdone what it can to stimulate the economy with its new monetary policyorientation. Monetary and fiscal policy thus remain extremely expansionary,paving the way for the gold price to make further gains,” Commerzbank analystssaid.

I agree.

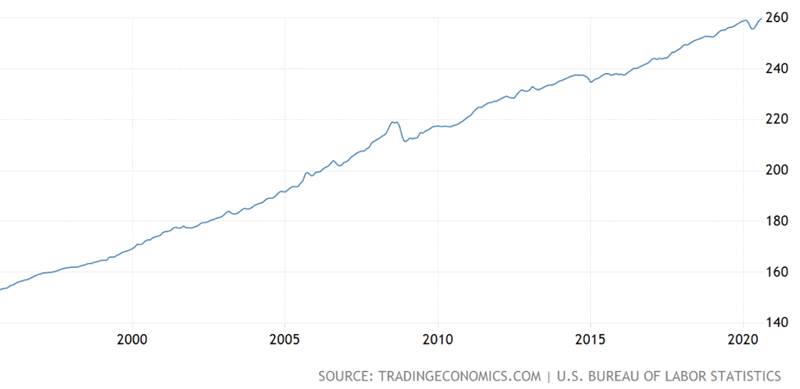

“Lower for longer” is the US FederalReserve’s new mantra for the economy which continues to struggle under theweight of the pandemic. While the Fed normally targets 2% inflation as a way ofkeeping the economy in the Goldilocks zone of “not too hot, not too cold,” thecentral bank recently said it will allow inflation to run hotter, (>2%) tosupport the labor market and the broader economy. This effectively means theFed is less inclined to hike interest rates when unemployment falls, so long asinflation does not creep up as well.

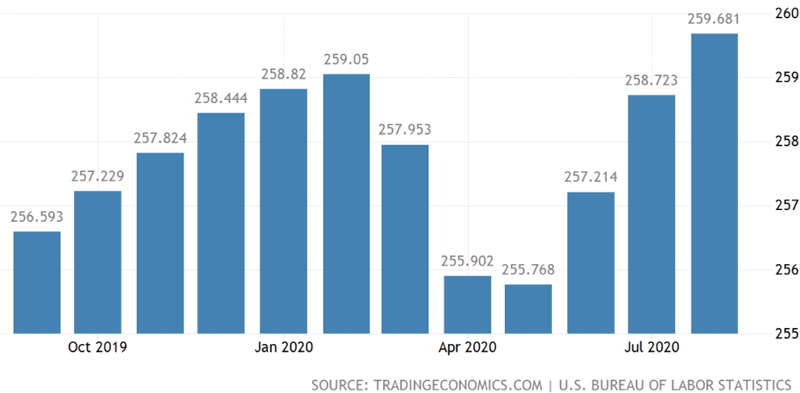

In August the cost of USgoods and services rose sharply, for the third month in a row.

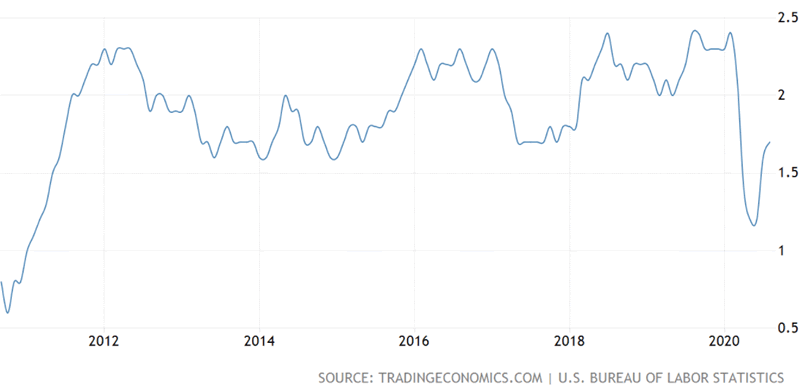

Consumer Price Index (CPI) in the United States

If inflation goes, say,above 3%, yet interest rates remain near zero, that would create bullishconditions for gold - negative real rates (interest rates minus inflation).When US Treasury bond yields turn negative, investors typically rotate theirfunds out of bonds, into gold.

US Core Inflation Rate

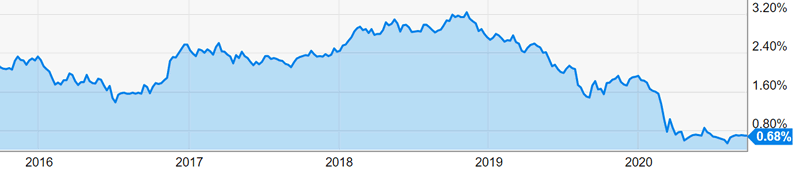

10 Year Treasury Yield

Inflation is creeping up,10 Year Yields, the global benchmark for interest rates, are extremely low, andaccording to the Fed are set to remain so for medium term. Real interest rates,in the US, are negative. And going deeper into the red.

Gold and silver have beenon a tear since mid-March. The factors behind the surges of both metals areworrisome covid-19 infections, geopolitical concerns especially US-China tensions over trade and the SouthChina Sea, inflation expectations on the back of (seemingly) unlimited monetarystimulus, and low interest rates worldwide.

Bullion prices have climbed23% year to date, as investors choose gold as a safe haven amid widespreadeconomic uncertainty created by the pandemic. They believe gold will hold itsvalue better than other assets such as stocks and bonds.

Silver in July gained anastonishing 35%, its best performance since1979, asinvestors sought shelter from pandemic turmoil and low or negative interestrates, while industrial demand for the metal recovered in some parts of theworld.

Gold is also being helpedby skyrocketing US debt levels, as the federal government scrambles to spendits way out of the pandemic. In a previous article we established thestrong correlation between gold prices and a country’s debt to GDP ratio.

Earlier this month theCongressional Budget Office said federal debt held by the public is projectedto exceed 100% of GDP, for the first time since World War Two (in 1946, US debtto GDP was 106%, after years of financing military operations to end the war).

All of this is extremelybullish for gold prices. We might be seeing a pullback this week, as panickedinvestors, fearful of another virus-related market meltdown, “sell everything”.But, as we’ve shown, throwing the golden baby out with the covid laced bathwateris not, imo, a wise move. Those who do so will regret it later, after goldre-gains its footing and soars well past their exit points.

Despite temporary dollarstrength, the bull market case for gold and silver remains very much intact. Ifor one plan to buy the dip and use it as an excuse to purchase more of myfavorite gold and silver stocks.

With results season uponus and several of the companies on my front page currently drilling, it seemslike a great idea.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.