Tiffany's Element of Surprise

This article first appeared in the April edition of the Rapaport Research Report. To download a copy of the report, click here and login with your username and password. Not yet a subscriber? Learn more and subscribe today. RAPAPORT... There is some anticipation for the coming months at Tiffany & Co. A year after joining the company, its celebrated chief artistic officer Reed Krakoff is readying to launch his first new jewelry collection on the job. CEO Alessandro Bogliolo (pictured), who took his position in October, promised the line would "be a very nice surprise for the market, with an addictive kind of product," he told analysts in the company's fourth-quarter earnings call.  The word "surprise" came up a number of times in Bogliolo's remarks on the call, as transcribed by Seeking Alpha, whether referring to Tiffany's product offering, store presentation or customer relations."We're in the business of surprise," Bogliolo said. "So we won't repeat anything that we did last year. We have a long list of projects for 2018 and we want to surprise our customers in a different way."Out of the BoxThat element of surprise enhances the shopping experience and reinforces the relationship Tiffany is able to have with its customers, explained Oliver Chen, an analyst at Cowen Equity Research. Already in 2017, Tiffany introduced some new concepts aimed at wowing even its most loyal customers. Those included opening The Blue Box Caf?(C) on Fifth Avenue - a place to have breakfast at Tiffany, introducing the Tiffany Hardware collection with Lady Gaga recruited as its brand ambassador, and unleashing its out-of-the-box home and accessory collection, which gave a first glimpse into Krakoff's headspace. The collection featured items such as a steel ball of yarn, a coffee cup and an egg basket (pictured below), all branded with the Tiffany logo. Bogliolo was pleased with the collection's sales growth, but even more at the positive consumer reaction to what he described as "meaningful innovation." That has spurred confidence at the company to accelerate the pace of innovation, because it strengthens the connection between the customer and the brand, he explained. More Youth & JoyThat bond wasn't always as strong, and there was a perception in previous years that Tiffany was losing touch with millennials. In fact, Bogliolo acknowledged that Tiffany had lagged in growth behind the European luxury brands. He suggests that the company's "newness" was not distinctive enough to make a difference. Nomura Group analyst Simeon Siegel said there was a shift in mentality at Tiffany in 2017 where the company had become more whimsical under its new leadership; Krakoff's home and accessory line being a case in point.

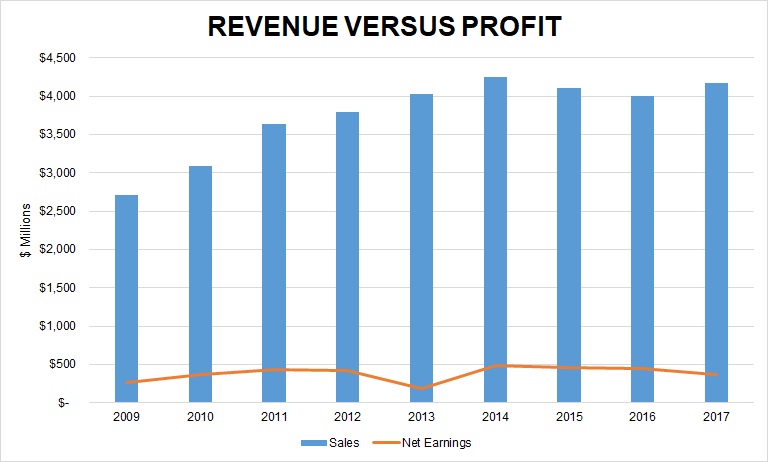

The word "surprise" came up a number of times in Bogliolo's remarks on the call, as transcribed by Seeking Alpha, whether referring to Tiffany's product offering, store presentation or customer relations."We're in the business of surprise," Bogliolo said. "So we won't repeat anything that we did last year. We have a long list of projects for 2018 and we want to surprise our customers in a different way."Out of the BoxThat element of surprise enhances the shopping experience and reinforces the relationship Tiffany is able to have with its customers, explained Oliver Chen, an analyst at Cowen Equity Research. Already in 2017, Tiffany introduced some new concepts aimed at wowing even its most loyal customers. Those included opening The Blue Box Caf?(C) on Fifth Avenue - a place to have breakfast at Tiffany, introducing the Tiffany Hardware collection with Lady Gaga recruited as its brand ambassador, and unleashing its out-of-the-box home and accessory collection, which gave a first glimpse into Krakoff's headspace. The collection featured items such as a steel ball of yarn, a coffee cup and an egg basket (pictured below), all branded with the Tiffany logo. Bogliolo was pleased with the collection's sales growth, but even more at the positive consumer reaction to what he described as "meaningful innovation." That has spurred confidence at the company to accelerate the pace of innovation, because it strengthens the connection between the customer and the brand, he explained. More Youth & JoyThat bond wasn't always as strong, and there was a perception in previous years that Tiffany was losing touch with millennials. In fact, Bogliolo acknowledged that Tiffany had lagged in growth behind the European luxury brands. He suggests that the company's "newness" was not distinctive enough to make a difference. Nomura Group analyst Simeon Siegel said there was a shift in mentality at Tiffany in 2017 where the company had become more whimsical under its new leadership; Krakoff's home and accessory line being a case in point.  Another example that Chen cites was management's decision to change the name of its bridal category to "love and engagement," as a way to speak to younger generations whose definition of love has changed. Bogliolo implies all that was intentional, with management trying to be perceived as more youthful and joyful as it cements its position in the luxury market. "The luxury experience is changing as it's no longer equated with the formal, rich, traditional older people," he explained. "Today, luxury is meaningful to a larger audience, and in that respect Tiffany, because of its DNA or personality, is best set to define the new cost of luxury."Six-Point PlanTo achieve that and stimulate sustainable sales and earnings growth, the new CEO outlined six priorities that would be the focus of Tiffany's investment spending moving forward. They are to: Amplify an evolved brand message. Renew its product offering and enhance the in-store presentation. Deliver a more encompassing omni-channel customer experience. Cultivate a more efficient operating model. Inspire an agile organization. Strengthen its competitive position in key markets.The program will embody increased investments in technology, marketing, visual merchandising, digital and store presentations, which Bogliolo stressed are needed to generate long-term growth, even if it will hinder pretax earnings in the near term. Siegel was encouraged by the move, stressing that management was investing in driving revenue, rather than cutting costs. "When you think about marketing and improving the operation, it would suggest that expense growth is not conservative," he explained. "But you can tie that directly to future revenue."At the very least, the company will be looking to build on the stellar holiday season it recorded at the end of last year - not withstanding that its fourth-quarter earnings were dampened by disappointing January sales. The holiday results gave some validation for the direction management has taken, trying new avenues such as opening pop-up stores to connect with consumers who might not usually visit a traditional Tiffany location. While it will continue such experiments, Bogliolo stressed the company was more focused on its stores - both physical and online - to improve and modernize the customer experience. After all, he stressed, that's where customers can truly engage with the brand. Krakoff's new collection will provide the first meaningful opportunity to do so since the strategic plan was revealed in March. And while the products are expected to reflect the company's new-found whimsical personality, the launch will also be an important step in the company's strategic journey. That is, before more surprises are revealed in 2018. Earnings SummaryFiscal year ended January 31, 2018 Net earnings -17% to $370.1 million Group sales +4% to $4.17 billion Same-store sales flatFourth quarter Net income -61% to $61.9 million Group sales +9% to $1.33 billion Same-store sales +3%

Another example that Chen cites was management's decision to change the name of its bridal category to "love and engagement," as a way to speak to younger generations whose definition of love has changed. Bogliolo implies all that was intentional, with management trying to be perceived as more youthful and joyful as it cements its position in the luxury market. "The luxury experience is changing as it's no longer equated with the formal, rich, traditional older people," he explained. "Today, luxury is meaningful to a larger audience, and in that respect Tiffany, because of its DNA or personality, is best set to define the new cost of luxury."Six-Point PlanTo achieve that and stimulate sustainable sales and earnings growth, the new CEO outlined six priorities that would be the focus of Tiffany's investment spending moving forward. They are to: Amplify an evolved brand message. Renew its product offering and enhance the in-store presentation. Deliver a more encompassing omni-channel customer experience. Cultivate a more efficient operating model. Inspire an agile organization. Strengthen its competitive position in key markets.The program will embody increased investments in technology, marketing, visual merchandising, digital and store presentations, which Bogliolo stressed are needed to generate long-term growth, even if it will hinder pretax earnings in the near term. Siegel was encouraged by the move, stressing that management was investing in driving revenue, rather than cutting costs. "When you think about marketing and improving the operation, it would suggest that expense growth is not conservative," he explained. "But you can tie that directly to future revenue."At the very least, the company will be looking to build on the stellar holiday season it recorded at the end of last year - not withstanding that its fourth-quarter earnings were dampened by disappointing January sales. The holiday results gave some validation for the direction management has taken, trying new avenues such as opening pop-up stores to connect with consumers who might not usually visit a traditional Tiffany location. While it will continue such experiments, Bogliolo stressed the company was more focused on its stores - both physical and online - to improve and modernize the customer experience. After all, he stressed, that's where customers can truly engage with the brand. Krakoff's new collection will provide the first meaningful opportunity to do so since the strategic plan was revealed in March. And while the products are expected to reflect the company's new-found whimsical personality, the launch will also be an important step in the company's strategic journey. That is, before more surprises are revealed in 2018. Earnings SummaryFiscal year ended January 31, 2018 Net earnings -17% to $370.1 million Group sales +4% to $4.17 billion Same-store sales flatFourth quarter Net income -61% to $61.9 million Group sales +9% to $1.33 billion Same-store sales +3% Sales by Region

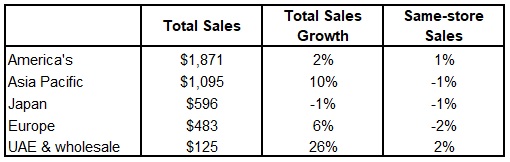

Sales by Region Sales increased in jewelry collections (high, fine, and solitaire and fashion jewelry) and designer jewelry. Sales decreased in engagement jewelry. Strong sales growth in China was offset by declines in other Asia Pacific countries. Europe benefited from positive effect of currency translation, new stores and e-commerce sales growth. Higher wholesale sales of diamonds.Nine stores opened and seven closed, for a total of 315 locations at the end of the year: US (94), Canada (13), Latin America (17), Asia Pacific (87), Japan (54), Europe (46), UAE (4).This article first appeared in the April edition of the Rapaport Research Report. To download a copy of the report, click here and login with your username and password. Not yet a subscriber? Learn more and subscribe today.

Sales increased in jewelry collections (high, fine, and solitaire and fashion jewelry) and designer jewelry. Sales decreased in engagement jewelry. Strong sales growth in China was offset by declines in other Asia Pacific countries. Europe benefited from positive effect of currency translation, new stores and e-commerce sales growth. Higher wholesale sales of diamonds.Nine stores opened and seven closed, for a total of 315 locations at the end of the year: US (94), Canada (13), Latin America (17), Asia Pacific (87), Japan (54), Europe (46), UAE (4).This article first appeared in the April edition of the Rapaport Research Report. To download a copy of the report, click here and login with your username and password. Not yet a subscriber? Learn more and subscribe today.