Tilray Option Bulls Active Despite Wild Analyst Call

The analyst predicted 90% downside for the weed stock

The analyst predicted 90% downside for the weed stock

Weed stocks are lower today, as the sector sinks on an earnings miss from Canopy Growth (CGC). What's more, Vertical Group today weighed in on cannabis concern Tilray Inc (NASDAQ:TLRY), saying it's time to short the shares. The analyst issued a year-end 2020 price target of just $4 for TLRY shares, representing a 90% plummet from yesterday's close, and said he's rarely seen such a richly valued firm in his career. However, TLRY options traders today are betting on a bounce for the pot stock.

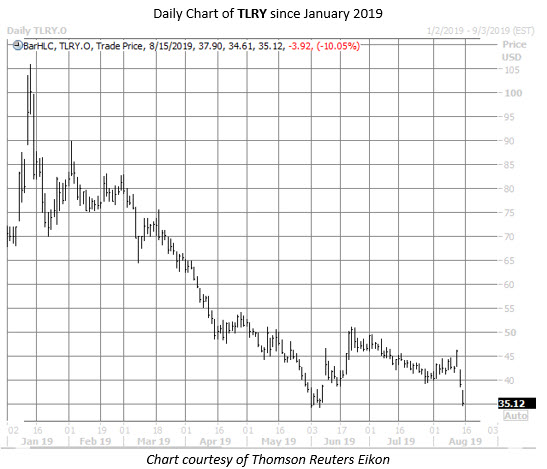

Tilray stock fell after the company's own earnings release yesterday, breaching recent support in the $40 area. The shares are extending that downside today, last seen another 10% lower at $35.12, and set for their lowest close since early June. In fact, a close below $34.66 today would mark TLRY's lowest of 2019. Already this week, the equity has surrendered more than 17.5%, set for its worst week since January.

So far today, roughly 19,000 calls and 11,000 puts have traded on Tilray -- three times the average afternoon volume. Among the most active is the weekly 8/30 30-strike call, which is seeing possible buy-to-open activity. By purchasing the calls to open, the buyers expect TLRY to remain north of $30 through the next couple of weeks. Meanwhile, more aggressive bulls are buying to open the weekly 8/16 36-strike call, with traders expecting a rebound north of $36 by tomorrow's close, when the options expire.

However, today's affinity for bullish bets is just more of the same for TLRY. On the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock has racked up a 10-day call/put volume ratio of 2.74. This ratio registers in the 90th percentile of its annual range, pointing to a much healthier-than-usual appetite for bullish options bets over bearish in the past two weeks.

Some of that call buying -- particularly at out-of-the-money strikes -- may have been attributable to short sellers seeking an options hedge ahead of earnings, though. Short interest represents a whopping 37.5% of Tilray's total available float, so nervous shorts may have purchased calls to reduce their risk in the event of a post-earnings rally for the shares.