Toll Brothers Stock May Be the Next Big Winner for Bulls

Just one analyst recommends buying the stock, making it ripe for upgrades

Just one analyst recommends buying the stock, making it ripe for upgrades

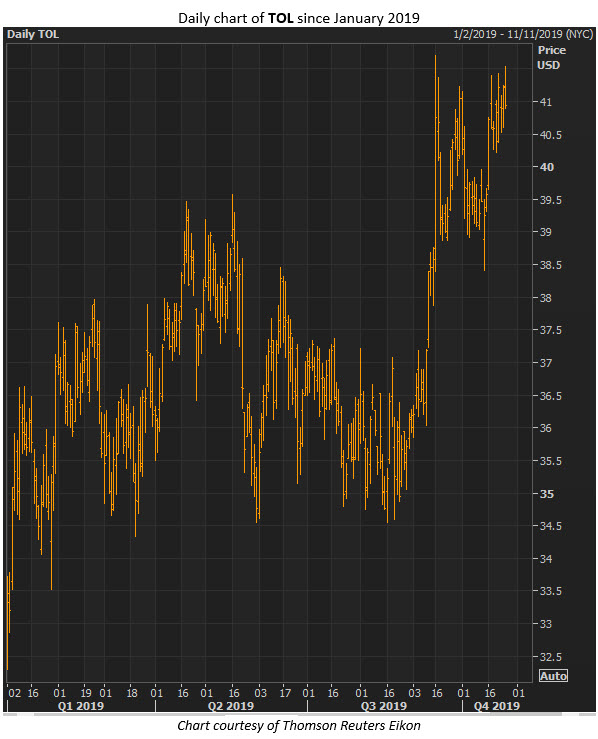

Homebuilding stocks have been one of the strongest groups in 2019, and Toll Brothers Inc (NYSE:TOL) has been no exception. The shares are up more than 24% in 2019, holding near annual-high territory, yet the sentiment picture remains extremely bearish -- setting up an ideal situation for contrarian bulls.

The easiest place to look for the Street's disrespect for TOL stock is in the analyst community. Right now, there are 13 brokerage firms in coverage, and just one of them recommends buying the shares. This would suggest the security's long overdue for a round of upgrades.

Covering from short sellers could serve as an upside catalyst, too. Short interest rose another 19.1% in the last two reporting periods, and now accounts for 6.2% of the equity's float. This means there's plenty of buying power on the sidelines that could come in and boost TOL.

Finally, our recommended call has a leverage ratio of 6.9, and will double in value on a 13.4% increase in TOL stock.

Subscribers to Schaeffer's Weekend Trader options recommendation service received this TOL commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters. Learn more about why Weekend Trader is one of our most popular options trading services.