Top Ten Trends Lead to Gold Price / Commodities / Gold & Silver 2019

The year 2018 was a memorable year of greattransitions. They involved changes in the political arena. They saw enormouschanges in the debt picture, for both the USGovt and the major Western corporations.They saw a struggle to terminate the QE bond monetization, laced with hype-inflation.They offered staggering damage to California, whose effects are easily 100times greater than the World Trade Center fallout. They offered resistance tothe US-led bully tactics, in slapping sanctions even on the US allies, aforecast by the Jackass two years ago. The globalist cabal agenda has been dealta powerful damaging blow, perhaps lethal, during a year of great exposure fortheir criminality. The transitions offered a complete shift away from the perceptionof USMilitary full spectrum dominance. But the most important changes have comein the finance & economic sectors.

The year 2018 was a memorable year of greattransitions. They involved changes in the political arena. They saw enormouschanges in the debt picture, for both the USGovt and the major Western corporations.They saw a struggle to terminate the QE bond monetization, laced with hype-inflation.They offered staggering damage to California, whose effects are easily 100times greater than the World Trade Center fallout. They offered resistance tothe US-led bully tactics, in slapping sanctions even on the US allies, aforecast by the Jackass two years ago. The globalist cabal agenda has been dealta powerful damaging blow, perhaps lethal, during a year of great exposure fortheir criminality. The transitions offered a complete shift away from the perceptionof USMilitary full spectrum dominance. But the most important changes have comein the finance & economic sectors.

TheGold Standard has seen a paved road for its implementation, arrival, andacceptance. The road can be identified for its several major constructed arteries.The pathways are built by the Eastern nations, which will continue to champion thefinancial reform, and thus wrest global control from New York and London. Historyis being made. It will still take time, but the momentum is gathering in anotable and convincing manner. The common theme of all the leading factors isthe movement away from the USDollar, a theme so popular and widespread that ithas been given a name, de-Dollarization. In the next year, even the compromisedcorrupted Wall Street bank community will openly discuss that Gold must be thesolution to the unresolved crisis.

TOP 10 FACTORS& EVENTS OF 2018, EACH WITH IMPORTANT IMPACT ON THE NEW YEAR TOWARD THEGOLDEN DIRECTION:

USGovt debt volume over $22 trillion, which grows well over $1 trillion annually, with no prospect of repayment except from criminal elite asset seizures, amidst high volume dumping of USTreasury Bonds. The future Gold price estimates are flowing in, with Jim Sinclair posting a $20,000/oz estimate based solely upon foreign holdings of USGovt debt. The USDollar money supply has tripled since 2008, with no gain yet in the Gold price. It is a coiled spring, ready to respond to the current crisis.Gold as the best performing asset in 2018, but with almost zero gain in value, which will next become a major beneficiary of the nascent Global Financial Crisis, part 2. The crisis is unfolding in full glory after six years of QE monetary excess, which has transformed the USTreasury Bond into the new global subprime bond. Its failed structure and horrible integrity demand the new Gold Standard in full spectrum.USMilitary in retreat on a global basis, after full displays of no superiority on the battlefields, thus removing the ultimate support pylon for the USDollar. The USNavy is in port for the first time in a century. The United States is departing from its absurd role of global police and international bully. Without such violent USDollar support, the Gold Standard has much less resistance for its broad implementation, even if in numerous pockets.Saudi Arabia breaks ranks from official US support, their $3 trillion in USTBonds confiscated at the ESFund within the USGovt, their gold pilfered in Swiss bullion banks. Even their dirty Yemen War is no longer supported. The recent Saudi budget is a laughable absurdity, which depends upon an $80 crude oil price. With the US having lost its Petro-Dollar ally, the Gold Standard lies directly ahead, aided by gravity, pushed forward by the Russians and Chinese.Potential failure of large Western banks and financial firms, led by Deutsche Bank, General Electric, and possibly a couple Wall Street banks. Do not ever overlook the contagion impact to the French banks, which will fall quickly upon any Italian banking system collapse. Expect around $1 trillion in Western corporate bond downgrades this year. The events will let loose a panic, which will call for the Gold Standard as remedy.The Belt & Road Initiative blossom, as the biggest development effort since the Marshall Plan, many times larger. It continues to be led by China, joined by dozens of nations with perhaps $6 trillion in slated projects to come. The grand feature of the BRI cornucopia of large-scale projects is that all are to be non-USD in trade and payment systems. They will form a massive cascade of industry and commerce, outside the USD realm. Worse, many BRI projects will be funded by the Chinese, who dump USTBonds en masse. With commerce comes banking procedural changes, leading to the Gold Standard.Rosneft Oil Cartel emergence to fill the OPEC void, as the Russians develop their oil consortium for mixture and purity standards. The Russian Rosneft is joined by Saudis, Iran, Venezuela, and soon Mexico, all to be non-USD in trade and payment systems. The Russian initiatives also enable greater liquidity for nations set in opposition to the United States. Couple the Russian initiatives with the Chinese recent practice to grant national loans based in USTBonds ,like to Angola. The result is grand momentum in the direction toward the Gold Standard eventually.Rising price inflation, with major factors being monetary expansion, trade war, supply decrease, and ineffective asset allocation are added strain to the global financial system. The response will be a call to Gold as a safe haven, while the USTBond loses the status as a haven of security since its debt load is too great and its prestige is long gone. Besides, the hidden derivatives to produce its fake demand are being exposed.Rise of global trade outside the USDollar, often called de-Dollarization, in avoidance of pressured rules, in workarounds of US-led sanctions. The result of seeking a fair trade payment system will be the pursuit of the Gold Standard. The USTBill payment structure will yield to the Gold Trade Note even in the energy sector. This revolutionary vehicle will usher in the Gold Standard, first in trade, next in banking, and finally in currencies. Note that the third and final step in sequence is not required.Exposure of global banker cabal, complete with their fascist corporate network of high level criminality in child murder, trafficking, racketeering, genocide, and counterfeit will remove the crucial upper layer in the many hidden control rooms. They thrive on USD self-dealing and gifts to themselves, as well as major monopolies. Their control room has long been the central bank franchise system. With both King Rothschild and King Rockefeller gone to dwell with Lucifer, the roadway for the Gold Standard is visible, potential, within reach, and currently being implemented. It stands as the final remedy.FORECASTDIRECTIONS FOR 2019

The USTreasuryBond will seek continued status as safe haven asset, but the struggle will beon full tilt. The USGovt debt continues to grow without control. The globalreputation of the USTBond as safe haven is being dismissed, primarily in theEast. The global dumping of USTBonds is magnificent, whether in normal sales orfrom Indirect Exchange. The image and role of the USDollar as global reservecurrency has been irreparably damaged. The main demand for USTBonds is from WallStreet, the USFed, and misled investors exiting the stock market. Withoutderivatives forcing the way with fabricated demand into the false safe haven,the USTBond would skyrocket in yield, as in, it would rival what Greece andItaly showed in 2010 bond yields.

Big Western banksare extremely vulnerable to failures. Their insolvency renders them weak andunprepared for further portfolio losses. Their easy game of bond carry tradehas ended with a full year of interest rate hikes. The have little or no bondissuance business segments. Their exposure to the energy sector is astoundingand enormous. A bond convexity problem might arise from the carry tradereversal, which could push bond yields much higher. However, it would bemanaged by the JPMorgan derivative control room. The contagion factor is veryreal, ready to catch fire when any big bank or national banking systemundergoes failure. As Bill Holter states, if any one big Western bank goesunder, they all go under. True indeed!

The Western globalistbanker cabal has lost its former formidable power, still with residual power.Their kings of Rockefeller and Rothschild have departed this world. Their middlelevel captains have been depleted in ranks, whether by conversion (flipped) tojoin the reform, or by lost wealth (stripped) in majority of assets, or by elimination(killed) by the White Dragon enforcers known as the TRIAD. Their inadequateranks make their agenda impossible to carry out, and their vengeance impossibleto occur.

USMilitary retreathas been global after full scale ignominy, following displays of inferiorweapon systems. Refer to jet fighter aircraft, to missile systems, toanti-missile defense systems, to targeting systems, to jamming methods. ThePentagon weapons system funding and appropriation methods are a massive fraudcenter and gigantic crime scene, resulting in over $6 trillion in missingfunds. The result has been both retreat from the global police sentry role by theUnited States, and possibly an accord toward a termination to the endlessWestern war agenda which serves the military industrial complex. The USGovtmight actually seek a better more productive usage of $billions in annualbudgets, after having squandered $25 trillion in the last 40 years. The tragic resultof four decades of wasteful military spending has been a crumbling US infra-structureand numerous alienated allies.

Advent of the GoldStandard adoption on a global basis. It begins with the gold basis for tradepayments, soon to be seen in the Gold Trade Note. Expect the GTNote to belaunched by China, for purchase of Gulf Region oil, from both Arab monarchiesand Iran. The emerging standard continues with gold bullion playing a primaryrole in bank reserves management, which requires the sale of USTBonds and thepurchase of Gold bullion. The final step will be the launch of gold-backedcurrencies, which carries with it many complications.

The last forecastis the most important, since all the above forecasts merge into the GlobalFinancial Crisis that has begun to unfold. It will be at least three to fivetimes more powerful and widespread than the Lehman crisis in 2008. It willfeature numerous crisis fronts simultaneously, and all these fronts willpresent intractable problems. No solution will be seen, and none offered willbe viable. Nothing was fixed. The solution of monetizing every dead decrepitfinancial entity will be proposed, which will ignite the Gold price. The entireKing Dollar Realm stands atop the USTreasury Bond, which is a haggard relic ofits past.

In fact, all thehorrendous policies toward mortgage bonds have been directed to the USTreasuryBond. It is the new global subprime bond, but the globalist’s problem bondchild. As time passes, the obvious answer to the global crisis which will fester,grow, and intensify, will be the implementation of the Gold Standard. The majorchallenge with the true viable solution is that the Eastern nations are farahead in the process. They will continue to take charge of implementing theGold Standard with numerous non-USD platforms. Meanwhile the Western nations festerand face tremendous pressures to keep the system in place. In other words, theWest will strive to keep the political and financial oligarchies and elitecastles in power. They will fail. The East will face a clear pathway in puttingthe Gold platforms in place. They are the natural remedy, the veritable magicelixir, the remedy for debt suffocation and the toxic debt-based monetary system.It is not only upside down, but also rotten to the core.

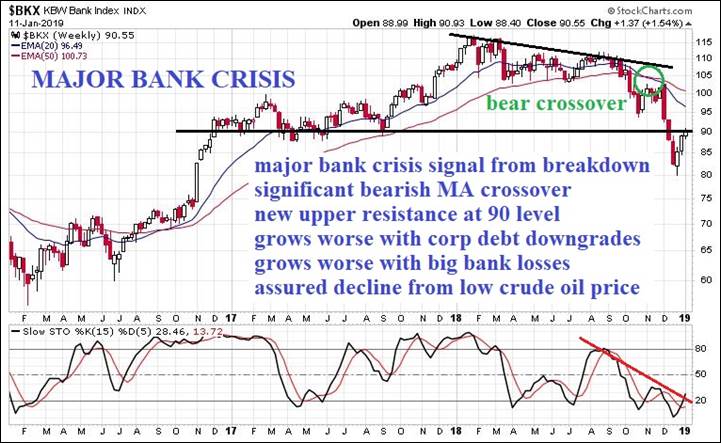

BANK STOCK INDEX UPDATE

Sometimes a single graph can tell a very bigand important story, even as a preview of what lies directly ahead. Sometimes apicture can tell a thousand words. In this case, a single stock index chart screamsa major financial crisis. It is the US big bank stock index BKX, which is indeep trouble. The Jackass featured the BKX two months ago, after a mere 15%decline. Since then the three consecutive weekly powerful declines have heraldedthe Global Financial Crisis, part 2. The entire gap from 70 to 90 must be filled,with deep groaning and gnashing of teeth amidst cries of pain in the pits. TheBKX had fallen by 30% since its January and March highs, now to have reboundedonly slightly. My name for the currentunfolding crisis has been steadily the Systemic Lehman Event, since nothing wasfixed, all the errors repeated on the monetary side, with exclamation point thefall in the BKX index itself. In fact, the USTreasury Bond has become the newglobal subprime bond. The banker stock index has recovered only to the previouscritical support level, which will next serve as critical resistance. Expectthe BKX to fall to the 2016 summer level with a 70 handle, another 20% belowthe current price posted. The next decline will shake the global financialoffices in a big way, and herald the full bloom of financial crisis. Recall thatnothing was fixed in the last ten years. Thus one can expect a bigger falloutfrom the broad nasty powerful diverse damage. It will loosen the elite powerstructure.

THE GLOBAL SUBPRIME BOND

QE was a grand failure. The bond supporthelped avert big bank failures. The bond purchases averted Treasury auctionfailures. The end result of the insanity of QE is a repeat global financialcrisis, marking the end of the multi-year hyper monetary inflation chapter. The USTBond has all the characteristics of notjust a subprime bond, but a Third World nation foundation bond to underpin itscurrency. Here ten years later, nothing has been fixed. In fact, all the abusesheaped upon the mortgage finance sector have been repeated in sovereign bonds. TheUSTreasury Bond has become a subprime bond, financed by pure monetization,almost no actual bonds buyers, $trillion annual deficits, auctions rigged, withhidden demand from the derivative machinery. It qualifies as a Third Worlddebt security. The major US corporate bonds are moving quickly to junk status,soon to be shed by the tens of $billions by pension and mutual funds in anendless parade. Expect some loud shrill sounds from afar very soon, as the $10trillion in Emerging Market loan defaults begin. The figure is in doubt onlyfrom the definition of Emerging Market, since all their debts are ready todefault from deadly currency declines. They were lured by low interest rates,but fell into the currency decline trap with spiked bamboo shoots barelycovered below. In the next few months,expect that QE will be resumed, in order to monetize the SIFI important bigWestern banks, the elite control rooms and power centers. They are almostall vulnerable to failure. The official return to QE will light a bonfire underthe Gold price, and invite debate toward the Gold Standard. It comes after thedamage is more visible, and the problems are concluded as intractable (notsolvable).

SYSTEMIC LEHMAN EVENT

Regardless of the name, a major crisis hasbegun. Some call it the Everything Bond Bubble, since the QE monetary policyhas funded sovereign and corporate bonds. The major central banks have trulywrecked the entire global bond market. The debt downgrade process by debt ratingagencies has only begun. It will become an absolute firestorm. Some call it theGlobal Financial Crisis, part 2. The Jackass prefers the name of Systemic LehmanEvent, since it is part 2 with the exact same monetary abuse, bond fraud inunderwriting, with a longstanding QE chaser downed each year for seven full years.The Quantitative Easing is old fashioned hyper monetary inflation of the worstkind, unsterilized, meaning huge volume of funds added to the financial systemwith no extractions. The globalfinancial crisis is upon us, having entered an intermediate level of debt saturation,of bond issuance deep abuse, of market rigging corruption, of banking systeminsolvency at acute levels, and of economic rot setting in. The outcome ofthe unfolding crisis will be three to five times more magnificent that what waswitnessed in 2008 and 2009, since ten more years of the same recklessness hasendured, but on a grander scale.

Expect the current crisis to wreck a few big Western SIFI banks, collapseat least one national banking system, destroy at least five major Westerncorporations, and result in open discussion of the USGovt debt restructure,technically a default. The systemically important financial institutions (SIFI)cannot not be saved, since too many are insolvent, gigantic hollow reeds. Thedirty secret is that the big Western banks are dependent upon bond carry tradeeasy profits and narco money laundering fees. They rely upon hidden centralbank welfare, to cover their $trillion exposure to derivatives. As thePetro-Dollar dissolves, these derivatives become unmanageable. The derivatives focal point, ground zero,is Deutsche Bank. Nothing can save once mighty DBank. As a confirmation, theyannounce on a quarterly basis that they cannot any longer manage the mountainof nearly $50 trillion in derivatives. As additional evidence, notice themulti-$billion bonuses handed out to their executives last week. No way wouldthat happen if the big bank were to be brought back to a healthy remedial structure.Well then again, maybe they have inside word of a major new QE initiative tomonetize the big SIFI Western insolvent banks, best described as corruptedempty silos filled with Western elite excrement and stained confetti asgarnish.

HAT TRICKLETTER PROFITS IN THE CURRENT CRISIS.

“Jim Willie’s proprietary contacts in highly strategicpositions around the world help him better predict the future with anaccurately as high as 90%. That is astounding! The Hat Trick Letter is mysecret sauce to better understand what is really happening, so I can makebetter financial decisions during this tumultuous period.”

(PaulK in Kentucky)

"I have continued my loyal patronage of yourexcellent commentaries not so much because of my total agreement with yourviewpoints, but because you have proven yourself to be correct so often overthe years. When you are wrong, you have publicly admitted it. You are, Isuppose by nature, an outspoken and irreverent spokesman for TRUTH againstpower, which differentiates you from almost all other pundits on worldaffairs."

(PaulR in Hawaii)

"For over five years I have been eagerlyassimilating any and all free information (articles, interviews, etc) that JimWillie puts out there. Just recently I finally took the plunge and became apaid subscriber. I regret not doing this much sooner, as my expectations wereblown away with the vast amount of sourced information, analysis tied together,and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the onlyclear voice sounding the alarm of the extreme financial crisis facing theWestern nations. He has unique skills of unbiased analysis with synthesis ofinformation from his valuable sources. Since 2007, he has made over 17 correctforecast calls, each at least a year ahead of time. If you read his work orlisten to his interviews, you will see what has been happening, know what toexpect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Yourreports and analysis are historic documents, allowing future generations tohave an accurate account of what and why things went wrong so badly. There isno other written account that strings things along on the timeline, as yourwritings do. I share them with a handful of incredibly influential people whosedecisions are greatly impacted by having the information in the Jackass format.The system is coming apart on such a mega scale that it is difficult to wrapone's head around where all this will end. But then, the universe strives forequilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

Jim Willie CBis a statistical analyst in marketing research and retail forecasting. He holdsa PhD in Statistics. His career has stretched over 25 years. He aspires tothrive in the financial editor world, unencumbered by the limitations ofeconomic credentials. Visit his free website to find articles from topflightauthors at www.GoldenJackass.com.For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CBis a statistical analyst in marketing research and retail forecasting. He holdsa PhD in Statistics. His career has stretched over 25 years. He aspires tothrive in the financial editor world, unencumbered by the limitations ofeconomic credentials. Visit his free website to find articles from topflightauthors at www.GoldenJackass.com,which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.