Traders Are Rapidly Increasing Bets On $200 Oil

With oil prices having more than doubled in 2021 so far - and showing no signs of slowing - traders are doubling-down on bets that energy costs will go to the moon... by year-end.

WTI is currently at 7 year highs...

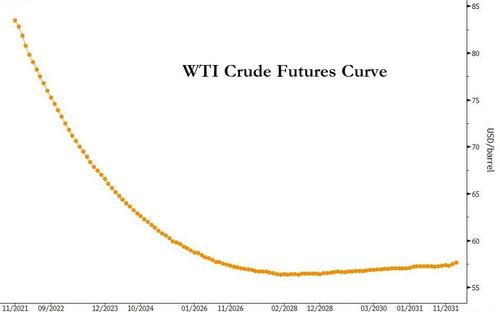

But, despite the futures curve being deep in backwardation...

Options traders are buying OTM calls with both hands and feet.

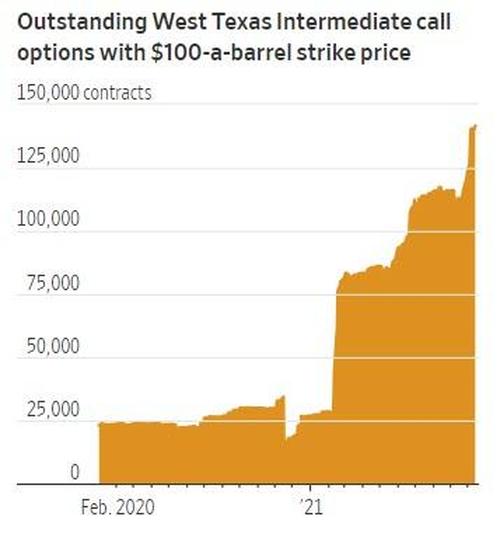

Wagers that WTI will top $100 by the end of 2021 have exploded in recent days...

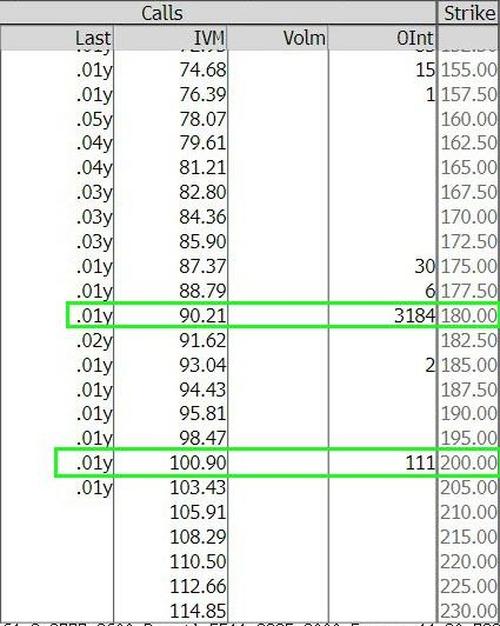

Furthermore, some traders are betting that oil will reach $180 or even $200...

In fact, as The Wall Street Journal reports, the surge in bullish bets amounts to a gamble that supply-chain disruptions and regional shortages will keep pushing energy markets higher, despite a slowing global economic expansion and concerns that higher oil and natural-gas prices will crimp consumer spending.

"I haven't seen crazy strikes like this in a long time," said Mark Benigno, co-director of energy trading at StoneX Group Inc., referring to the price in the underlying asset at which the options become exercisable. "The momentum and trend is higher."

Additionally, WSJ notes that the wagers also show that investors drawn by the small upfront investments and potentially quick payoffs of options trades are piling into energy markets, echoing trades in the stock market this year.

"It's just a bit of a wild market right now," said John Gretzinger, a partner at Flashpoint Energy Partners, who has been trading oil options.

Not everyone is so exuberant about the price of crude.

"Oil fundamentals could ultimately disappoint the hype," wrote JPMorgan analysts in a note earlier this month.

"We also think downside risks are underappreciated."

President Biden better hope they're right, with The White House desperately begging OPEC+ to re-ramp up production (and threatening to unleash the SPR), we wonder just what would happen to the president's approval rating if Gas prices at the pump reached $4 (at $100 WTI) or $7 a gallon (at $200 WTI)...

Source: Bloomberg

Better start making some more calls Joe?