Trading Crude Oil ETFs in Foreign Currencies: What to Focus On / Commodities / Exchange Traded Funds

Trading energy ETFs outside of US exchanges can be tricky, as itoften means lower liquidity and some latency, but is it worth trying?Definitely!

Let’s do a comparative study between the WTI Crude Oil (CL) and anExchange-Traded Fund (ETF) tracking this energy commodity as the underlyingasset.

Prelude

In the previous two-part series (see PartI & PartII), we presented different ways to trade energies such as stocks,ETFs, CFDs and futures. We saw that picking the right instrument or vehicledepended on businesses, regions, risk profiles, psychology, etc. So, today, asan example, we will compare the well-known WTI Crude Oil (CL) futures contract(quoted in US dollars) with a 2:1 (2x) leveraged ETF traded in Toronto, inCanadian dollars.

Crude Oil (CL) Futures Vs.Horizons BetaPro Crude Oil Leveraged Daily Bull ETF

Here is a comparison table between the two products:

CME/NYMEX WTI Crude OilFutures Codes: CL (Standard), MCL (Micro) Currency: USD Specs: CME (standard), CME (micro) | Horizons Crude Oil 2xDaily Bull ETF |

WTI Crude Oil Futures: | Other Crude Oil ETFs(quoted in USD): |

Brent Crude Oil Futures: | Brent Crude Oil ETF: |

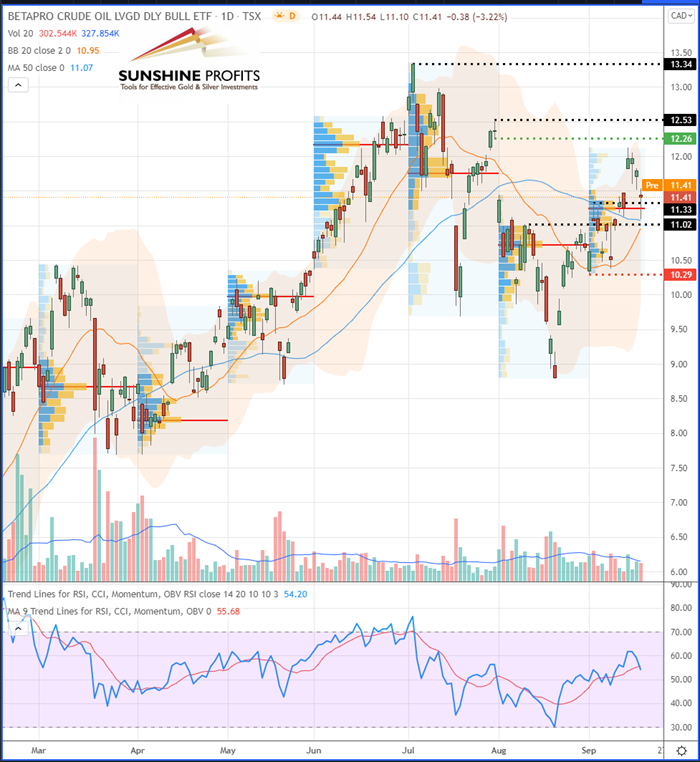

And here are the latest charts:

CL:

As an example, we take our last oil trading alert about CL Futuresthat we somehow “translate” into HOU (ETF). It is noticeable that the prices onthe HOU ETF are completely different from the Futures, even though thecorrelation coefficient is 1 since they are perfectly correlated. Therefore, ifboth assets move similarly together (as the ETF by definition tracks the WTICrude Oil futures), it is quite simple to draw the same levels that we give forCL to HOU (or any other ETF trackers).

However, some pricing discrepancies may appear on the ETF chartsometimes. Those are due to a delay in tracking the underlying asset, notablydue to the fact that the ETF tracker has to catch-up with the Futures prices atthe open (because there is no complete market close for the futures the latterbenefits from extended market hours). Some other slight discrepancies in theETF pricing are also present due to the fact that the fund offering the productautomatically processes to contract-rolling on the underlying futures. In short,we could equate the ETF to a hypothetical lagging (delayed) indicator of theWTI CL futures.

Volume Profile Accuracy

By comparing the volume profiles respectively for both products, wecan also notice some differences. For example, the Volume Point of Control(VPOC) is not always located at the same place, since there are much fewertrade prices (and obviously much less traded volume) for ETFs than Futures. So,the accuracy of Volume Areas and their respective VPOCs (red horizontal lines)could be discussed. However, would that make them less reliable levels forETFs? Not sure.

Actually, it may sometimes give another view of the market byremoving some noise - therefore, they could potentially be used to confirmlevels in a clearer way while ignoring/excluding the Asian-Pacific tradingsession as well as the first half (morning and early afternoon) of the Europeanone, since the HOU prices will be based solely on the Canadian trading sessionthat overlaps most of the Western region, including the U.S. trading session.

Dichotomy Method

A good way to spot the same levels on such a chart (of a productquoted in a different price scale or in another currency) could be to use somesort of “dichotomy” method: drawing the supports and resistance levels fromextremities to the center to mark the swing lows/highs and then recentre thescope by taking some mid-point levels. For example, by drawing each support andresistance levels in the same manner as we provide them on futures charts to“translate” them into the desired correlated instrument such as an ETF. Thismethod could help spot the equivalent entry/exit levels, stop loss, targets,etc.

An alternative would consist of using the same indicators on bothcharts to show similar data at similar levels, like, for example, Fibonaccilevels, Ichimoku Kinko Hyo, Pivot Points, etc.

And finally, setting price alerts on the underlying chart in orderto enter the trade through a market order in the ETF is possible as well,however it’s not very convenient…

In conclusion, we exploredin this article the different ways to trade our Oil and Gas Trading Alertsusing a broader range of products: instruments with more or less leverage, inyour local currency, different time zones and other price scales. However, theabovementioned methods are practicable as long as the main condition isrespected: it requires at least a very high correlation between the maininstrument(s) for which we provide alerts and your favourite product(s).

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.