Trillion-dollar US infrastructure plan will draw in plenty of metal / Commodities / Infrastructure

Donald Trump appears tohave torn a page from Ahead of the Herd’s manual for recharging the USeconomy.

In an earlier article we said what the globaleconomy really needs, in this low-growth, spending-stalled environment broughtabout by the pandemic, is a push - something big that will attract hugeamounts of investment, and workers. As we have suggested, this could be a massiveinfrastructure spending program, on the scale of President Roosevelt’s “NewDeal”.

Not coincidentally - welike to think Trump reads AOTH - the administration is said to be preparing anearly $1 trillioninfrastructure proposal – some of the dollars are geared toward 5G/ Broadband - as away of spurring the world’s largest economy back to life. US GDP growth fell 5%in the first quarter and when second-quarter economic output figures arereleased, they will be far worse, likely double-digit.

Fortune Magazinereported A preliminary version being prepared by the Department ofTransportation would reserve most of the money for traditional infrastructurework, like roads and bridges, but would also set aside funds for 5G wirelessinfrastructure and rural broadband, the people said...

Trump is pushing torev up the U.S. economy—which four months ago was the centerpiece of hisargument for a second term—as he trailsDemocrat Joe Biden in most national polls. The White House has explored ways toshift the next round of federal virus aid from personal financial support togrowth-fostering initiatives, such as infrastructure spending.

And hes not alone.

The European Commissionhas released a €1.85 trillion recoveryplan focusing on “EU Green Deal” initiatives aimed at reaching the eurozone’s netemissions by 2050 target.

The Chinese have beentouting their own form of blacktop politics as a way of restoring theireconomy, particularly manufacturing which has been hurt by thecoronavirus.

Among the projects thatcould receive a huge boost in investment, courtesy of a $700 billion stimulusprogram, are a $44.2 billion expansion to Shanghai’s urban rail transit system,an intercity railway along the Yangtze River ($34.3B), and eight new metrolines worth $21.7 billion, to be constructed in the virus epicenter city ofWuhan.

Beijing recently kickedoff a widely anticipated program focused on “new infrastructure” and “newurbanization”.

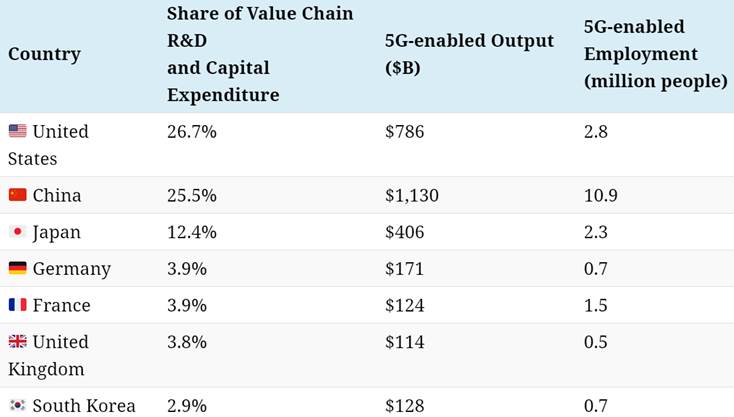

“Developing 5G networks andimplementing them into the many industries of the global economy is a massiveundertaking, and just seven countries are expected to account for 79% of all5G-related investment.

By2035, here’s how these countries are expected to rank.”

Visual Capitalist, Where 5G WillChange the World

According to BMO, newurbanization refers to refurbishing old urban housing stock, railways,airports, and upgrades to power grids and local utilities, while newinfrastructure includes 5G networks, ultra-high voltage power grids, EVcharging stations and data centers.

A global infrastructurespending push would mean a lot more energy metals will need to be mined,including lithium, nickel, cobalt and manganese for EV batteries; copper forelectric vehicle wiring and renewable energy projects; and rare earths forpermanent magnets that go into EV motors and wind turbines.

It’s an idea that hasbeen kicked around quite a bit by Trump and his Cabinet, along with HouseDemocrats.

In March, Trump talkedabout reviving a $2 trillion plan for improving the country’s roads, bridges,water systems and broadband Internet. Earlier in his presidency a $1.5 trillionplan for infrastructure spending became dead on arrival when Trump and theDemocrats failed to agree on how to pay for it. Politics was also alleged tohave played a role. Fortune reported Democrats said Trump walked out of a meeting on a $2 trillionplan and vowed not to work with them unless they stopped investigating him andhis administration.

Nonetheless,infrastructure is back on the table, in a big way.

The Trump administrationsees an existing infrastructure funding law, up for renewal by Sept. 30, as a vehicleto push the initiative through a broader package, sources told Fortune. TheFAST Act authorizes $305 billion over five years. It could also be rolled intothe next round of pandemic relief.

Meanwhile the Democrats,who have a majority in the House of Representatives, have reportedly offeredtheir own proposal to renew infrastructure funding over five years. It includesinvestments in roads and bridges, measures that make facilities more resilientto climate change, and funding for public transit and Amtrak.

Fortune sums up,

Infrastructurespending has long held appeal for lawmakers as a way to spur growth, and thepandemic is renewing calls to fast-track roads and other projects.

What is 5G?

Upgrading cellularnetworks from 4G to 5G is expected to result in a vast improvement in Internetservice, including nearly 100% network availability, 1,000 times the bandwidthand 10 gigabit-per-second (Gbps) speeds.

We hear a lot about 5Glately, especially the disagreement between the United States and Chinesetechnology company Huawei, which is seen by many as a trojan horse for theChinese Communist Party, but before we go any further, what is 5G and what can it do?

5G is the next generationof mobile broadband that will eventually either replace or augment existing 4GLTE connections. The main benefits of 5G are its drastically improved uploadand download speeds. Latency, which is the time it takes devices to communicatewith wireless networks, is also much quicker using 5G.

Peak data rates under 5Gare unbelievably fast. They can hit 20 giga bytes per second (Gbps) under downlink and 10Gbps uplink permobile base station. These speeds however are not what a user would experience;they are the speeds shared by all users per 5G “cell”. Actual download andupload speeds for 5G are specified at a respective 100 megabytes per second(Mbps) and 50Mbps.

Unlike 4G, 5G operates onthree spectrum bands: low, medium and high.

Low-band spectrum, alsocalled sub-1Ghz, is what LTE wireless networks run on. While low-band spectrumoffers great coverage, and is therefore the primary band used by US LTEcarriers, it is also nearing the end of its bandwidth. Peak data speeds willtop out at around 100 Mbps.

Mid-band spectrum isfaster and has lower (ie. faster) latency than low-band, but it can’t penetratebuildings as well as low-band spectrum and peak speeds are only up to1Gbps.

High-band spectrum, ormmWave, delivers the best 5G performance. It offers lightning-fast peak speedsof 10Gpbs and has extremely low latency. The problem is it has low coverage andpoor building penetration, meaning to create an effective high-band 5G networkwill require many cells.

Currently AT&T and Verizonare rolling out high-band 5G spectrum. Until they can build out nationwidenetworks, these two carriers plan to piggyback off LTE. Once completed, 5Gnetworks are expected to support 1 million devices per square kilometer, whichis much higher than currently supported under LTE.

Experts say 5G is anabsolute must if we want to continue using mobile broadband Internet. Carriersare running out of LTE capacity in major cities and users are alreadyexperiencing slowdowns during peak periods.

Among 5G’s uses areautonomous vehicles, which will be able to communicate with other vehicles onthe road; public safety & infrastructure, such as widespread use of sensorsthat can track electricity usage, and can notify public works departments whenlights burn out or drains flood; remote control use of machinery such asautonomous haul trucks; health care such as improvements in telemedicine andthe facilitation of precision or even remote surgeries; and the Internet ofThings (IoT), a broad term that describes systems of interrelated computingdevices, mechanical and digital machines that have the ability to transfer dataover networks without requiring human input.

While some neighborhoodsalready have 5G access, others are still waiting. AT&T, Verizon and T-Mobilebegan deploying it in 2019. All the major carriers in the US and Canada areworking furiously to build out 5G networks; getting it all done will takeyears, although it’s expected that half of the US will have access to 5G by theend of 2020.

According to CNBC, the US FederalCommunications Commission (FCC) rolled out the 5G Fast plan in 2016 toaccelerate deployment of high-speed broadband in rural America, a programestimated to cost $9 billion The US government is paying around $10 billion tosatellite providers to fast-track the auction of 5G C-band spectrum by 2023.C-band spectrum has the ability to download speeds greater than 1Gbps.

About 5% of the USpopulation, more than 18 million Americans, lack access to high-speed Internet.Getting them connected is especially important now, considering many companieshave loosened up on work-at-home policies due to covid-19; imo, the future ofwork involves a lot more working from home, where a fast Internet connection isessential.

Two controversiessurrounding 5G are its potential health effects, and Huawei’s control over thetechnology.

Although Trump banned theuse of Chinese components in the US 5G network, amid suspicions the deviceswould be used for espionage, his administration appears to be softening itsposition.

This week the US CommerceDepartment posted a new rule allowingAmerican companies to work with China’s Huawei, to develop standardsfor 5G, an area in which Huawei is a leader.

Meanwhile Huawei ChiefFinancial Officer Meng Wanzhou continues to fight extradition from Canada oncharges of bank fraud and accusations she misled HSBC about the company’sbusiness in Iran. The daughter of Huawei founder Ren Zhengei was detained inVancouver in December, 2018, at the request of the United States.

A bizarre rumor that 5G either helpedfuel, or directly caused the coronavirus, has been debunked. The conspiracytheory that 5G radiation makes people vulnerable to covid-19 stems fromlong-enduring fears about mobile phone technology. As early as 1903 doctorstalked about “radiophobia”, in the 1970s there were concerns about power linesand microwaves, and in the 1990s opponents of 2G technology suggested radiationfrom mobile phones could cause cancer.

There was also the theorythat the coronavirus crisis was a ruse, deliberately created to keep people athome while 5G engineers installed it everywhere. Believers argued it was no coincidence5G was trialed in Wuhan, the city in China where the virus originated, eventhough the technology was already being rolled out in a number of locations.

The reality is thatlow-band and mid-band 5G networks operate at around the same frequencies asexisting networks. High-band 5G networks, which travel over millimeter wavefrequencies, are even less of a health risk, because they can’t penetratesurfaces such as walls, trees or human skin.

An example of amillimeter wave frequency most people are familiar with, is airport scanners.You know the scan doesn’t penetrate the body because the image seen on thescreen does not show organs or skeletal tissue.

Like FM radio wavesand visible light, radio frequency waves are a form of "non-ionizing"radiation, which means they don't have enough energy to damage the DNA insideof cells and cause cancer, unlike X-rays, for example. Decades of researchsuggest that the only way wireless technologies could interact with the body isby heating the skin, but power levels are so low that's not a problem, expertssay.

Criticalminerals

Future broadband servicesthat can handle large volumes of data transfer require a switch towards the useof new metal compounds in semiconductors, to achieve higher performance,compared to older silicon-based technologies.

According to Argus Media, which monitors metalsand other resource markets,

The high frequencywaves used in 5G networks have shorter ranges than the low-frequency signals in4G networks, and the need for a higher proportion of base stations will resultin the deployment of a large number of small cells rather than a small number oflarge masts. That will in turn require a larger volume of semiconductor materials.

Among the big winnerscould be gallium nitride (GaN), which operates at higher frequencies and powerrates. UK-based consultant Roskill says 5G “is expected to be the next bigcatalyst for radio-frequency GaN,” and in a recent study forecast the total GaNmarket is expected to grow 30% from 2017 to 2023.

Another gallium compoundlikely to be in high demand for 5G is gallium arsenide (GaAs), used insmartphones, military radar and other communications applications.

According to the USGS,China contributed 95% of primary gallium production in 2018, in a tiny marketof just 410 tons. The metal is on the US government’s list of 35 metals it saysare critical to national security. Gallium is produced solely as a by-productof bauxite and zinc mining and processing. Although there are up to 1 milliontons of gallium in the world’s bauxite resources and a considerable amount inthe world’s zinc resources, the USGS expects only 10% of the gallium isrecoverable.

5G is also expected touse up a lot of cobalt. According to BMO, the sale of 5G-capable cell phoneswill translate into more demand for cobalt, since mobile devices consume 35% ofglobal cobalt supply. Most of the world’s cobalt is mined in the DRC – whichhas come under intense scrutiny for unsafe working conditions and the use ofchild labor.

Cesium, not to beconfused with cerium, a rare earth element, is used in atomic clocks, makingthe rare metal essential for 5G networks. The “cesium standard” is howcommercially available atomic clocks measure time, which is vital for datatransmissions infrastructure of mobile networks, GPS and the Internet; withoutcesium, 5G doesn’t work - it means the difference between real-timeresponsiveness and 5G failure.

Currently there are onlythree pegmatite mines that produce it: Tanco in Manitoba, Bitika in Zimbabweand Sinclair in Australia. The first two are no longer producing, and cesiumstockpiles at Tanco and Sinclair are largely controlled by China.

Silver

Over 50% of silver demandcomes from industrial uses like solar panels, electronics, and the automotiveindustry.

5G is set to becomeanother major new driver of silver demand.

According to the SilverInstitute, The electronic components that enable 5G technology will relystrongly on silver to make the global 5G platform perform seamlessly. In afuture 5G connected world, silver will be a necessary component in almost allaspects of this technology, resulting in yet another end-use for silver in analready vast and versatile demand portfolio.

The group expects silverdemanded by 5G to more than double, from its current ~7.5 million ounces, toaround 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206%increase from current levels.

Copper

Copper’s widespread usein construction wiring & piping, and electrical transmission lines, make ita key metal for civil infrastructure renewal.

A report by Roskillforecasts total copper consumption will exceed 43 million tonnes by 2035,driven by population and GDP growth, urbanization and electricity demand. Totalworld mine production in 2019 was only 20Mt.

The global 5G buildoutand the continued movement towards electric vehicles - including cars, trucks,vans, construction equipment and trains - are two big copper demanddrivers.

Even though 5G iswireless, its deployment involves a lot more fiber andcopper cable to connect equipment.

Copper is also needed toconstruct base stations and data centers. China Mobile, the country’s largesttelecom provider, reportedly plans tobuild over 50,000 5G base stations requiring 600 tons of copper, @ 12kg of copper per station. A national 5G network would require about 6 millionbase stations, consuming 72,000 tons of copper, or 4.5% of China’s total copperproduction in 2019.

We already see copperprices reacting to news of infrastructure buildouts that can help put economieshit hard by the coronavirus back on track. On June 4th the red metal hit a12-week high of $2.50 a pound, on news of China’s $700 billion “newinfrastructure” and “new urbanization” rollouts.

As proof, BMO CapitalMarkets said data from China’s Ministry of Finance showed the value of bondsdestined for local government spending on infrastructure are already at themid-point of the year, more than the total allocated for the full year2019.

BMO cites the latestsurvey of copper wire and cable fabricators, showing operating rates in Mayhitting 101.7%, the highest level in the history of the survey - thanks mainlyto purchases by China’s State Grid.

According to TrafiguraGroup, one of the world’s largest copper traders, there are signs that coppercould emerge from the covid crisis even stronger than before.

Bloomberg quotes the company’s head ofcopper trading saying that demand is bouncing back in China, and stimuluspackages unleashed by countries across the globe are notably focused oncopper-intensive “green infrastructure” (like new solar and wind projectsrequiring kilometers of new transmissions lines). On top of that, The coronavirus hasalso disrupted mines and delayed new builds, throttling current and futuresupply.

This year we have seeneither reductions in output, or temporary closures, due to government-imposedrestrictions to restrict the spread of covid-19.

Trafigura estimates thecoronavirus crisis has so far reduced mined copper supply by 400,000 tonnes,which is 2% of annual global production of around 20 milliontonnes.

The best evidence oftightening supply can be seen in plummeting copper inventories. Indeed therecent surge in copper demand appears to be being met, to some extent, bystored copper.

Conclusion

Many copper watchers wereexpecting the essential industrial metal to take a big hit from thecoronavirus, but if current market fundamentals continue, we might even seecopper posting a 2020 gain on economic recovery momentum.

The same goes for silver.Its hundreds of industrial applications make silver very responsive to thecondition of the global economy. It also functions as a safe haven, givinginvestors an option to park their cash in times of economic distress. Sincesliding under $12/oz in mid-March, silver has gained 46%!

Improved economicconditions resulting from countries successfully reopening from coronaviruslockdowns, would be great for copper and silver explorers, and their investors,who know the best leverage against rising metals prices is to own anearly-stage junior with a sizeable and scalable deposit in a mining-friendlyjurisdiction.

As smart resourceinvestors, we want to be investing in metals, and companies, that are at the leadingedge of a trend. At AOTH we see 5G as a major new driver of demand for copper,silver and critical minerals including cobalt, gallium and cesium.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.