Troubling contradictions in Trumponomics

Economic growth is not a mystery. As Dr. John Hussman reminds us, economic growth always comes down to the sum of just two things: 1) more people working, 2) higher productivity. Add them up and you get the real growth rate. Everything else means nothing unless it contributes to these two factors.

Hussman assumes that the unemployment rate falls to an incredibly optimistic 2% by 2024 (from its current level of 4.7%). Built-in labor force demographics (slow population growth and an aging population) would limit annual growth in U.S. employment to just 0.7% annually at most. That's what this factor would contribute to the real economic growth rate...0.7%...which can only be altered by massive immigration and a new Trump administration certainly doesn't stand for that. In Reagan's day, the unemployment rate was above 10%; there were millions of people ready and willing to work. Now, the unemployment rate is less than half what it was in 1982.

Some analysts point to the fact that there are 95 million Americans of working age who are not in the work force; all they need is an opportunity to work. This is na??ve. More than 18 million have a "health problem or disability which prevents them from working or which limits the kind or amount of work they can do." Another estimated 30 million reportedly do not have marketable skills. Many more are at home looking after children or family members. How many are actually able and willing to work, especially at the low wages the market now offers for most jobs?

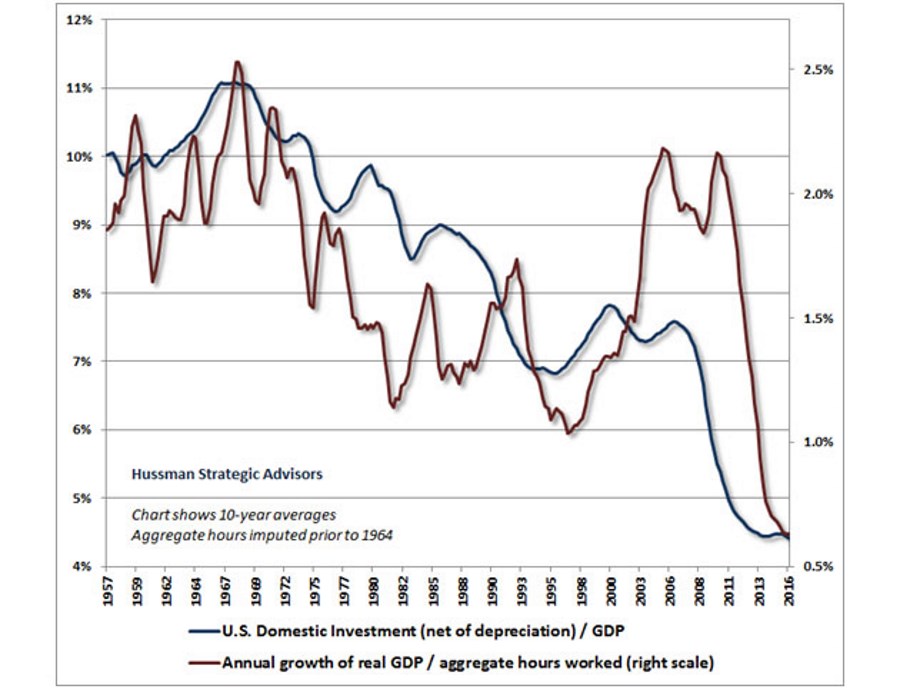

Therefore, any sustained acceleration in real GDP will have to come from the second factor, productivity growth. That, in turn, is highly dependent on gross domestic investment (broadly defined to include investments in education and job-training initiatives to boost labor productivity). But this is the component of economic growth that faces the largest downside risk in coming years. Gross domestic investment has been trending down for decades, and the Trump administration does not seem to understand that its policy proposals will make it worse.

Here's the trend. The red line (measured on the right scale) is the annual growth in real U.S. GDP. The green line (measured against the left scale) is U.S. Domestic Investment. The impact of declining investment is clear. Turning around this dual downtrend is the work of many years.

But the investment trend is not the fundamental problem. Investment depends on savings and America simply does not save enough savings to fund aggressive investment. U.S. gross domestic investment is always identical to the sum of household savings, government savings (or dis-savings), corporate savings and savings acquired from foreigners. The real problem is that weak household and corporate savings do not offset the enormous deficits (negative savings) that the federal, state and local governments are running, making the U.S. totally dependent upon importing foreign savings to fund investment.

Here's how the U.S. gets foreign savings. The U.S imports goods and services in excess of what it exports...running a trade deficit of more than $500 billion per year. This deficit is paid in cash to foreigners who invest it in U.S. securities, filling in the U.S. savings gap and enabling investment to take place. In effect, we obtain the savings of foreigners by exporting securities to them, rather than goods and services.

Here's the problem: Trump is proposing to bring production back home by taxing imports. Pursue a policy to reduce the trade deficit and you automatically pursue a policy to reduce the import of foreign savings. Now, that's fine if the domestic sectors of the economy are running savings surpluses. But that's nowhere near being true. In fact, Trump is talking about increasing the Federal deficit over the next few years to fund new tax cuts and additional infrastructure spending, thereby further cutting the domestic supply of savings and increasing the need for foreign savings.

The bottom line, as Hussman says, is that large and sustained increases in U.S. gross domestic investment have always been achieved by financing a substantial portion of the increase with foreign savings. Booms in U.S. gross domestic investment are always associated with a deteriorating trade balance. Trump's war on trade simply does not support the need for foreign savings required for more aggressive investment needed to generate the higher productivity required for faster growth in the U.S. economy. There is a basic contradiction at the heart of Trumponomics. That's just one reason why market expectations of a Trump economic miracle are vastly inflated, in our opinion.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders.

The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Disclosures:1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article.2) Seabridge Gold is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

Chart provided by the authors.

Source: Rudi Fronk and Jim Anthony for The Gold Report (1/17/17)