Trump nominee Moore has a point: Focus on commodity prices

(Updated with chart) - Trump perma-critics should take a step back from their criticism of his nominee Stephen Moore. The latest attacks against Moore evolve around an opinion piece in the Wall Street Journal suggesting that the Fed focus on targeting stable commodity prices. If one believes that the Fed should be targeting consumer price inflation, a concept that is debatable on its own, focusing on commodity price inflation makes more sense than promoting asset inflation which is what the Fed, the Bank of Canada and other central banks have been doing for the past decade.

Stephen Moore: Fed should seek stable commodity prices (picture Gage Skidmore)

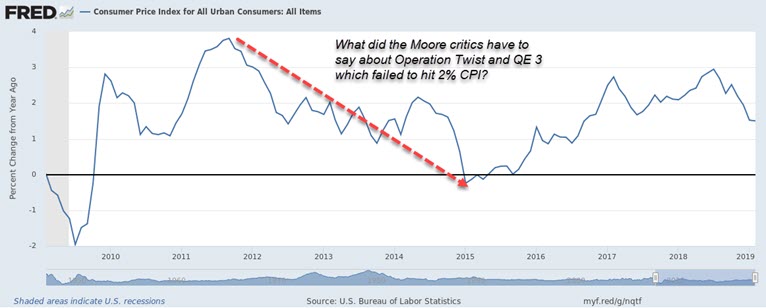

Moreover, where have the Moore critics been as central banking made a mess of asset markets while implementing policies that undermined their cherished goal of reaching 2% consumer price inflation?

One of the biggest Fed policy mistakes took place in September 2011 when it embarked on Operation Twist. At the time, I wrote (No Twisting by the Pool for Canadian Insiders or Investors) that the move likely put a top on commodity prices and would lead to another round of bond buying (QE3) as the twist policy failed.

The Fed's Operation Twist and QE3 were failures. Where were the Moore critics? (click for larger)

Indeed, gold peaked that month, QE 3 was launched the following year and inflation headed towards negative territory which it reached in 2015. Yet, central bankers are left off the hook even as critics jump all over Moore. As an aside, this type of ingrained anti-Trump media bias is one of the best things the president has going for him in 2020. The public can see right through it.

I have disagreed with Trump on many issues but on the Moore appointment his instincts are right. Central banking needs a shake-up. Stephen Moore is a start.