Trying to build a base for the broad market and pot stocks

Although one week does not make a trend, given recent market carnage, the bulls can be forgiven if they point to some positive developments in the Canadian market last week. Nicholas Winton who writes a weekly technical outlook for the INK Canadian Insider Index noted in his Monday write up that the index (-0.8%) outperformed US markets last week, including the S&P 500 (-4.6%). We would add that the Index also outperformed the large-cap S&P/TSX 60 Index (-2.8%). Both developments are notable. In 2008, stocks outside the United States started to stabilize first. Meanwhile, as we explained in our November 19th report (Are we close to turning the corner?), we will have more confidence that the global selling tide is over once the INK CIN Index starts to outperform large-caps which are seen as a relative area of safety during growth scares.

A potential catalyst for a revival in global equities could be a signal from the Federal Reserve that it has ended its tightening campaign. At this point, the central bank is trying to keep its options open for both a December rate hike and additional hikes next year. For investors, those options equate to uncertainty which is only being compounded by ongoing trade friction between the United States and China.

With that in mind, the relative outperformance of the INK CIN Index is still too tentative to draw any conclusions about a solid base for stocks being established. Moreover, it seems as if our indicator is trying to make up its mind whether or not more significant share price weakness is on the way. While a counter-rally from oversold conditions is overdue, we will need to see at least a month of INK CIN Index outperformance against the TSX 60 combined with a peak in our INK Sentiment Indicator to have firm conviction that a strong base of support for stocks has been built.

Last week, oil & gas and gold stocks led the INK CIN Index with Kirkland Lake Gold (Sunny; KL) +13.0%, Yangarra Resources (Mixed; YGR) +8.5%, and Wesdome Gold Mines (Sunny; WDO) +8.4% leading the way. Lagging was Calfrac Well Services (Mixed; CFW) -10.9% which announced a capital spending plan of $190 million for 2019. Most of the spending will go to maintenance capital outside of Canada. The oil & gas service company was followed by consumer stocks AutoCanada (Mostly Sunny; ACQ), -13.2%, and BRP (Mixed; DOO), -17.4%, which were not finding a lot of love on the prospect of higher rates and related fears of a potentially slower economy.

Core Theme Updates: #2 Taking a diversified approach to growth and #3 Watching for stock-specific opportunities in Healthcare and Technology

In some more encouraging news for the bulls, our Industrials Indicator has peaked, meaning that we have seen peak insider buying in the sector. Such peaks often coincide with important bases being formed. As such, we are upgrading the sector to undervalued. One of the stocks leading the charge in terms of insider buying in the sector is Morning INK stock Badger Daylighting (Sunny; BAD) which we featured on November 26th.

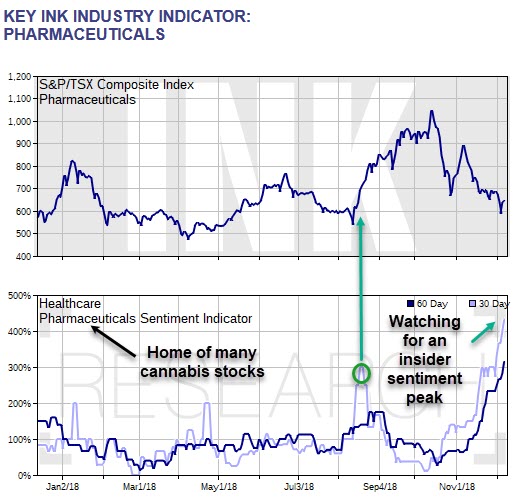

In the Healthcare sector, insider sentiment is soaring in the Pharmaceuticals industry, home of many cannabis stocks (see above chart). Our 30-day Pharma Indicator moved above 400% last week, the highest point since early September 2017. As we explained in our October Top 20 Gold Stock Report, the indicator seems to have a decent ability to time the group's highs and lows. In October, it turned down, signalling peak insider selling which correctly signalled an important near-term top established in the group. Now we appear to be close to just the opposite.

We are on the verge of peak insider buying which could mean that a tradable base is being built in the group. We are not quite there yet, but if we see a peak in buying during the week, we will report on it in our daily morning report and highlight one or two names in the group that make our screens.

This is an excerpt from the December 10th Market INK report. The full version was made available to INK Research subscribers and Canadian Insider Club members before the market open. INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.