Two risks threaten commodities, one bullish, one bearish: Russell

It's not quite time to run up the red flags, but some recent developments in commodity markets suggest it may be time to start looking for them in the locker.

The are two main factors that appear to be emerging that may threaten an end to the current quite rosy picture surrounding demand for commodities such as iron ore, steel and the metals most exposed to the battery boom, cobalt, lithium and nickel.

On the supply side, there is a renewed rush of optimism that may set off another round of mining companies over-paying for assets or sinking way too much capital into projects approved on the back of too bullish forecasts.

On the demand side, the drums of a U.S.-China trade war are starting to beat a little louder, with Beijing announcing duties on up to $3 billion of U.S. imports on March 23.

That came after the Trump administration announced plans for tariffs on $60 billion of Chinese goods, in addition to import taxes on steel and aluminium.

While equity markets take the first hit in the opening salvoes of what markets fear may become a full-scale trade war, it is most likely that commodities will suffer longer and harder if the worst does come to pass.

Commodities are generally seen as more exposed to the global growth outlook, and a trade conflict will almost certainly result in economic growth being downgraded.

This is especially important for commodities, as they also tend to be the top performers when an economic cycle is mature, as is the case with the current global recovery in the decade since the 2008 financial crisis.

However, there is still a chance that trade wars remain mainly in the sphere of rhetoric rather than sustained damaging actions.

Whether the seeming optimism among major mining companies about the future results in a return to the bad old days of over-investment and poor deals remains to be seen.

Certainly, the company bosses seem at their most bullish in recent years, with the world's biggest miner, BHP, talking up prospects for demand for minerals.

Andrew Mackenzie, BHP's chief executive, told a conference in Switzerland on March 20 that the world may have to spend $3.7 trillion annually to develop and upgrade its infrastructure.

"If we look at China's Belt and Road Initiative, demand for steel is expected to increase by an additional 150 million tonnes over the next decade," Mackenzie said.

These figures were echoed by BHP's president of iron ore, Edgar Basto, at last week's Global Iron Ore and Steel Forecast Conference in Perth, in a presentation that went a long way toward justifying the company's planned $3.6 billion South Flank iron ore project in Western Australia.

While the new mine is mainly planned as replacement for depleting existing operations, BHP is far from alone in planning new operations, with rivals Rio Tinto and Fortescue Metals Group also looking at signing off on developments.

BELT AND ROAD BULLS

The industry is still a long way from undertaking the same sort of massive expansion it did in the years from 2010 in the flush of optimism over China's demand for steel-making ingredients.

But there are some similarities emerging, with Chinese demand once again at the forefront.

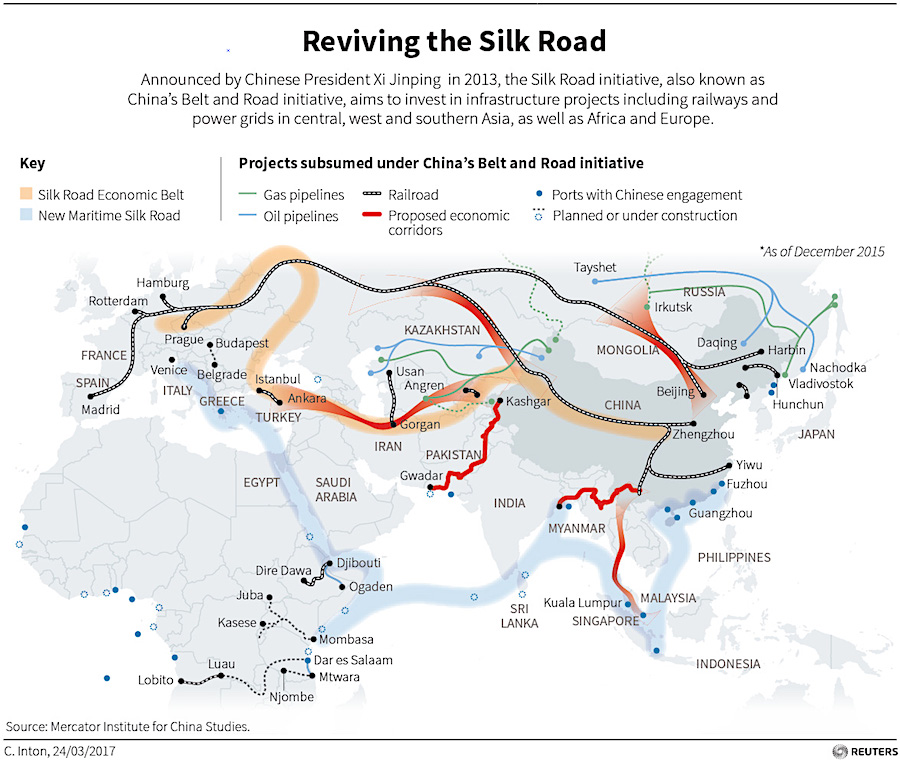

Both Mackenzie and Basto made much of China's Belt and Road Initiative (BRI), the government plan to build infrastructure and energy projects across Asia and Africa as part of a new Silk Road promoting trade and development.

The problem is that, for now, much of the BRI remains at the vision stage, and very little at the implementation phase.

If China was really undertaking vast infrastructure projects across South and Central Asia, as well as in Africa, it would be logical to expect that it was exporting significantly more capital, machinery and semi-finished materials such as steel.

Instead, foreign investment fell 2.7 percent in 2017 from the year earlier, and this accelerated in January with a drop of 3.1 percent in the prior 12 months, according to official figures.

Steel exports slumped 30.5 percent last year, and were down 27.1 percent in the first two months of 2018 compared to the same period last year.

Exports of cement and clinker dropped 27.9 percent in 2017 from the prior year, and while vehicle shipments did jump 43.1 percent last year, this was mainly because of an 83.6 percent surge in car exports, which is most likely not related to BRI spending.

BHP, Rio Tinto, Brazil's Vale and Fortescue all had sunk billions into expanding iron ore capacity, resulting in a collapse of the material's price.

It has since recovered, with Argus Media quoting benchmark 62 percent iron ore delivered to China at $64.15 a tonne on March 23, down from $74 at the end of last year, but still almost double the low of $37.30, hit in December 2015.

It took the price slump for BHP and Rio to somewhat reluctantly back away from their long-held forecasts that Chinese steel output would rise to 1 billion tonnes, and the risk is now once again the BRI reality may be somewhat less rosy than the current optimism.

More positive for miners looking to enter the battery metals space was the 8 percent increase in China's exports of storage batteries.

But as some mining executives have pointed out, doing deals at the right price in sectors the market sees as hot is challenging.

"There's probably about 5 percent of those opportunities out there that you can really add value with, " Mark Cutifani, chief executive of Anglo American, told the FT Commodities Global Summit in Switzerland last week.

"But in most cases you are going to pay high prices for assets so it's a hard way to make money," he added.

It's too early to say that the major miners are about to leap headlong into the old boom-bust cycle of expanding supply to meet overly-bullish forecasts, but the cash generated from the recovery in commodity prices over the past two years may be starting to burn holes in their pockets. (By Clyde Russell. Editing by Aaron Sheldrick)

The opinions expressed here are those of the author, a columnist for Reuters.