U.S. Gold Corp.: De-Risked Junior Gold Miner

U.S. Gold continues to develop multiple attractive gold mine assets.

Recent PEA on Copper King project shows a nice bump to NPV that far exceeds stock valuation and de-risks the investment opportunity.

Leadership of a legend geologist with a proven track record provides another solid catalyst for a potential gold gem.

About six months ago, U.S. Gold Corp. (USAU) popped onto the scene as a new junior gold miner with a promising asset base and a prominent gold geologist leading the exploration program. Investors that bought up the stock in the impending slide to end 2017 have plenty of reasons to smile as the original promises are starting to play out.

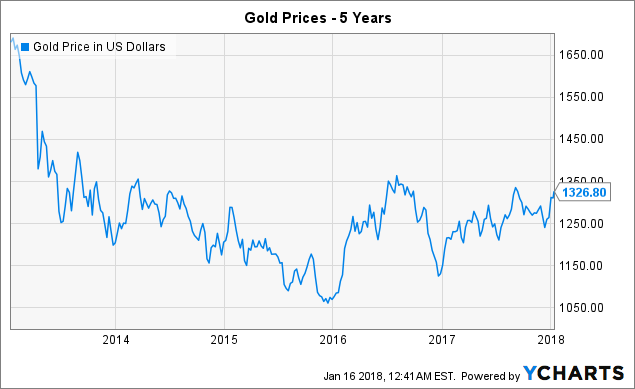

Commodity Price Boom

One of the basic themes for owning U.S. Gold was that gold and copper commodity prices were at the recent lows. Both have rebounded with gold now trading for over $1,326/oz and copper surging above $3/lb.

Gold Price in US Dollars data by YCharts

Gold Price in US Dollars data by YCharts

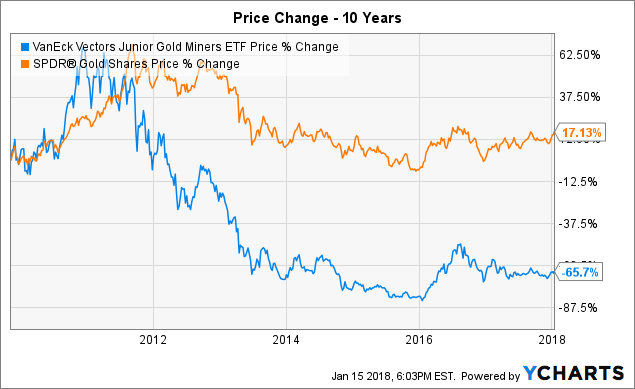

While gold prices weren't the specific thesis of the story, the weakness in junior gold miners was a big part of the reason to dip into the sector with U.S. Gold as under the radar gem. At the time, the VanEck Vectors Junior Gold Miners ETF (GDXJ) had far trailed the SPDR Gold Shares (GLD). Both have rebounded the last six months, but the junior gold stocks are down substantially since the end of 2011 while the GLD is actually up.

GDXJ data by YCharts

GDXJ data by YCharts

Considering a good portion of stock gains are related to the environment for the related industry, U.S. Gold is situated in a promising sector with the junior gold miners poised to rally as gold prices maintain levels above $1,300/oz.

Though this stock isn't guaranteed to rally, positive momentum in the sector and commodity prices sure helps.

Diversified Asset Base

The U.S. Gold Corp. story is ultimately based on multiple gold mine assets and legendary geologist Dave Mathewson. The latest assessment of the Copper King asset in Wyoming justifies an investment in the stock alone with the Keystone and Gold Bar North projects and work of Dave Mathewson in Nevada each thrown in for free.

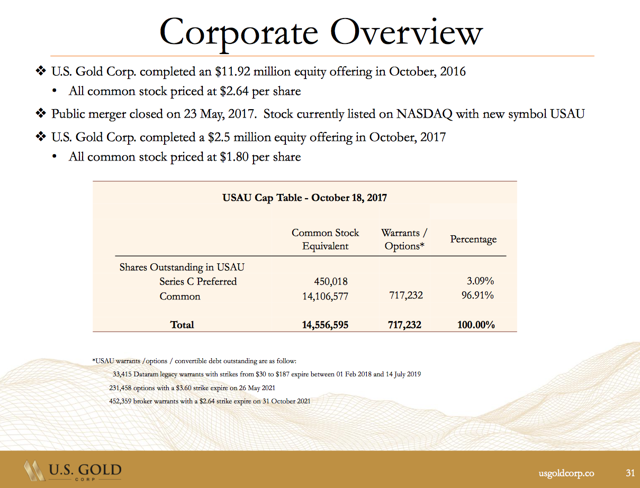

More on those assets later, but the quick corporate recap shows the stock valuation at roughly $43 million with a stock price at $3. The company recently raised $2.5 million from a small equity offering.

Source: U.S. Gold presentation

Source: U.S. Gold presentation

Dave Mathewson remains a prime focus of the investment story. The geologist recently presented at the AMEA conference on behalf of U.S. Gold. As my previous work detailed, his exploration work at Gold Standard Ventures (GSV) led to substantial shareholder gains in that stock. He aims to do the same for U.S. Gold though his exploration work isn't the only path to success.

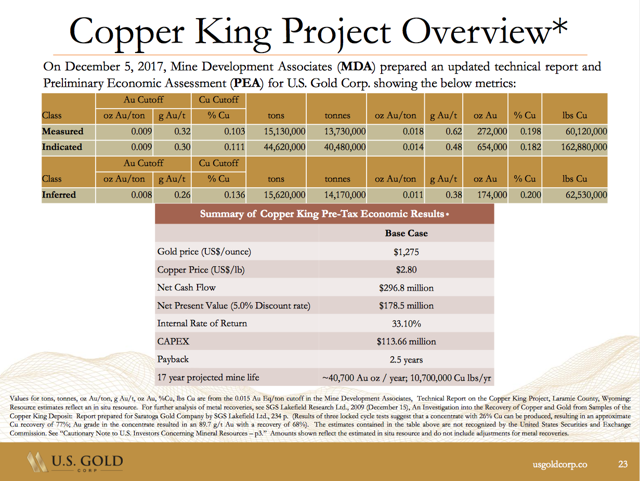

Copper Is King

Maybe the best part of the story is that the Copper King project de-risks the exploration work by Mr. Mathewson. His work in Nevada is only a bonus to a stock that justifies higher prices based on the proven reserves of the Wyoming project.

Last week, the Mine Development Associates (MDA) updated the Preliminary Economic Assessment (PEA) report. The net cash flow jumps to $296.8 million with the net present value of $178.5 million. The previous NPV was $159.5 million using $1,100/oz for gold so the project value jumped $19.0 million or nearly half the value of the current stock valuation in part due to using $1,275/oz for gold prices.

Source: U.S. Gold presentation

Source: U.S. Gold presentation

The PEA factors in about 1/3 revenue from copper, but the mineral is only forecast using a price of $2.80/lb on 182 million pounds of copper. Copper currently trades for around $3.25/lb and has shown the potential to breakout.

While the recent rally in copper provides solid upside to the NPV projection, the story still remains focused on gold. Projections of 692,000 ounces of recoverable gold plus the additional Keystone and Gold Bar North projects make for a compelling investment opportunity.

The Keystone Gold District project includes a controlled area of over 20 square miles with an initial target for over 1 million ounces of gold and a project potential of 10 million ounces of gold. The project sits in the key Nevada gold mining district long referred to the "Nevada Elephant Country" due to the numerous amount of projects that have produced sizable amounts of gold.

The story though isn't reliant on exploratory activities at Keystone due to the attractive value of the Copper King assets.

Financial Risks

The company remains in exploration phase so cash burn is the primary focus at this stage without any revenues coming in the door. U.S. Gold burned about $1.7 million in cash during the October quarter and had about $5.4 million in cash on the balance sheet at the end of October.

The company suggests the ability to operate for up to a year if needed on these cash balances due to the ability to control exploration expenses. U.S. Gold does admit to planning on raising additional capital, but the PEA on Copper King, involvement of Dave Mathewson and recent stock rally should make the capital raising a low risk. The company has the additional opportunity to find a partner or sell some of the assets to fund exploratory activities or fund moving forward with mining the Copper King project.

The company is still unproven from an operational basis having only formed in 2017. The ability to raise funds or find a partner at attractive prices is never guaranteed. Not to mention, additional risk exists that commodity prices dip substantially to levels that make the Copper King project not feasible or at the least significantly reduce the NPV of the project.

Takeaway

The key investor takeaway is that U.S. Gold continues to provide a compelling investment in a group of junior gold miners that are beaten down since gold peaked several years ago. The company has financial risk considering the limited funds and the risks that commodity prices could drop below the feasibility targets and reduce investor appetite to provide the needed capital. Though based on current prices, U.S. Gold has upside to the NPV of Copper King that vastly exceeds the current stock price and plenty of other catalysts for the stock that substantially de-risks the investment thesis with the stock trading around $3.

As always, the recommendation for a risky investment like this one is to only invest in a diversified portfolio with risk capital.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.