U.S. Stocks Fall From Records, Treasuries Flat: Markets Wrap

Mark Hawtin, investment director at GAM, talks about the impact of inflation levels on bond and equity markets.

Mark Hawtin, investment director at GAM, talks about the impact of inflation levels on bond and equity markets.U.S. stocks fell for the first time this year as shares that serve as bond proxies tumbled on speculation interest rates will continue to rise. Treasuries turned higher in late trading after demand at a 10-year auction was robust and Canadian officials were said to see rising odds that the Trump administration will leave Nafta.

The S&P 500 Index snapped a six-day rally that was the longest since October, with shares in utilities and real-estate firms leading declines. Chipmakers also slumped, while banks rallied on the prospect for higher rates. Canada’s dollar weakened and its two-year bonds surged on the trade-pact report. The 10-year Treasury yield ended little changed after a wild ride that took it toward 2.60 percent on reports that China is considering slowing purchases. Its descent from highs began after a measure of demand at the government auction showed plenty of appetite for the debt.

The Nafta news damped risk appetite in the U.S. afternoon, halting a comeback for stocks that began the day on the wrong foot thanks to the news out of China. The S&P 500 Index hasn’t fallen this year, as investors speculate the American economy is poised to take off thanks to tax reform. Canadian officials, speaking Wednesday on condition they not be identified, said there’s an increasing likelihood Donald Trump will give notice about a withdrawal from Nafta, threatening the decades-old trade regime.

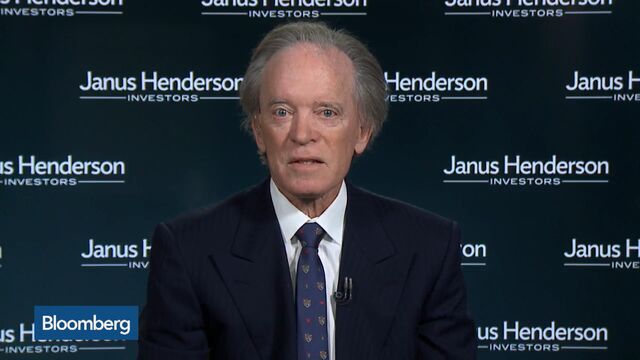

Bill Gross of Janus Henderson explains why he’s gone short on bonds.

Daybreak: Americas." (Source: Bloomberg)Here are some of the main events to watch for this week:

Terminal users can read more in our markets blog.

These are the main moves in markets:

Stocks

Currencies

Bonds

Commodities

— With assistance by Haidi Lun, Adam Haigh, and Natasha Doff

Before it's here, it's on the Bloomberg Terminal.LEARN MOREHave a confidential news tip?Get in touch with our reporters.Most Read