UBER Stock Could Keep Sliding

Uber stock just ran up to a historically bearish trendline

Uber stock just ran up to a historically bearish trendline

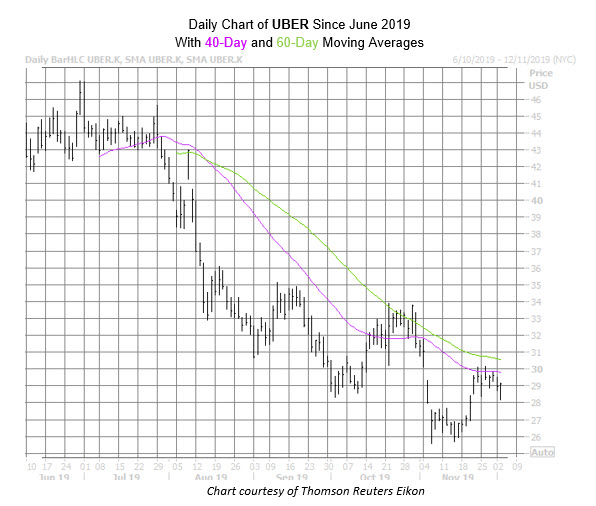

It's been a pretty dismal first year as a publicly traded company from Uber Technologies Inc (NYSE:UBER). The stock has been on a choppy path downward ever since it hit a record high of $47.08 in June. In the past few months, the stock's 60-day moving average, and a disappointing third-quarter earnings report in early November, had UBER bottoming out at an all-time low of $25.58. While the security was able to briefly rally back to the $30 region, this area, coupled with the stock's 40-day moving average, have created a stiff ceiling on the charts.

In addition, Uber's 40-day has had bearish implication in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White this signal has sounded just one other time. One month later, however, the stock had shed 14.2%. From its current perch at $28.80, a similar move would put the ride share concern at $24.71 -- right below its all-time lows.

A round of downgrades from the brokerage bunch could spark even more headwinds on the charts. Despite all this recent negative price action, 25 of the 30 in coverage still call UBER a "buy" or better. What's more, the lofty consensus 12-month target price of $44.30 is a 53.2% premium to current levels.

Short sellers have been hitting the exits at an alarming pace. In the past reporting period, short interest fell 26.9%. The 38.92 million shares sold short now represent a slim 4.9%, leaving plenty of room on the bearish bandwagon.

Optimism has spread throughout the options pits too, with 3.53 calls picked up for every put on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) during the last 10 days. Options traders are pricing in relatively low volatility expectations, as evidenced by UBER's Schaeffer's volatility index (SVI) of 42%, which ranks in the 12th percentile of its annual range. In other words, options premiums are low right now.