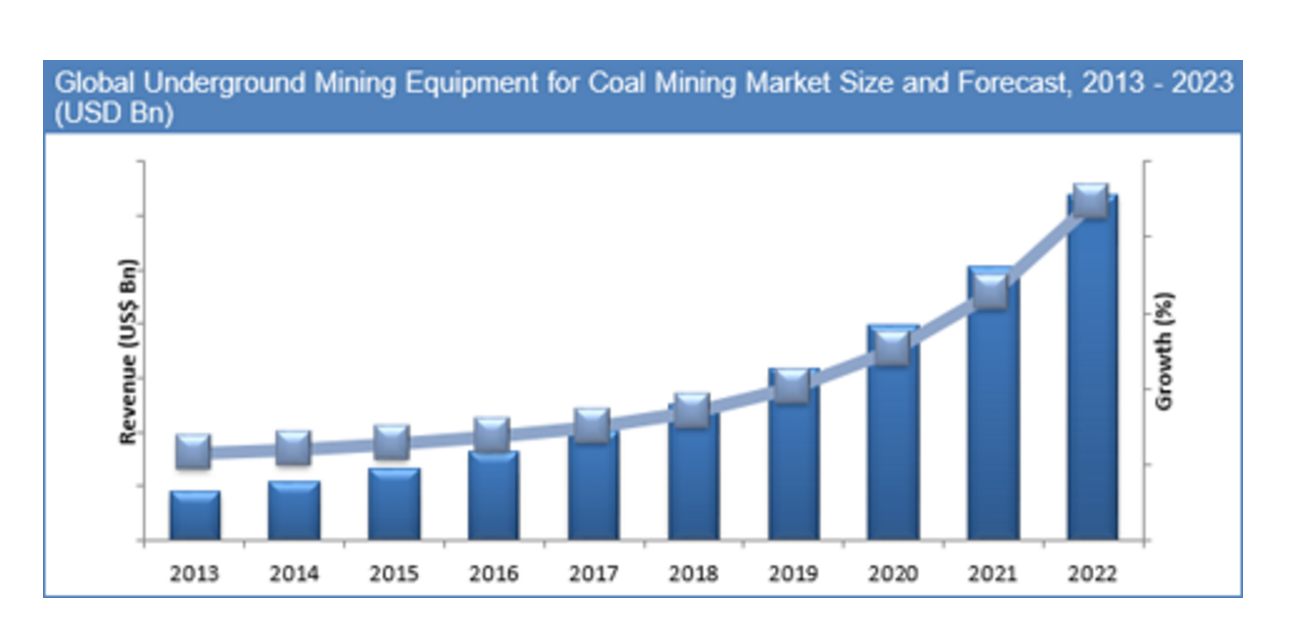

Underground mining equipment market to reach US$30.5 billion by 2023

Global underground mining equipment will reach US$30.5 billion by 2023 according to a market research study published last month by Credence Research.

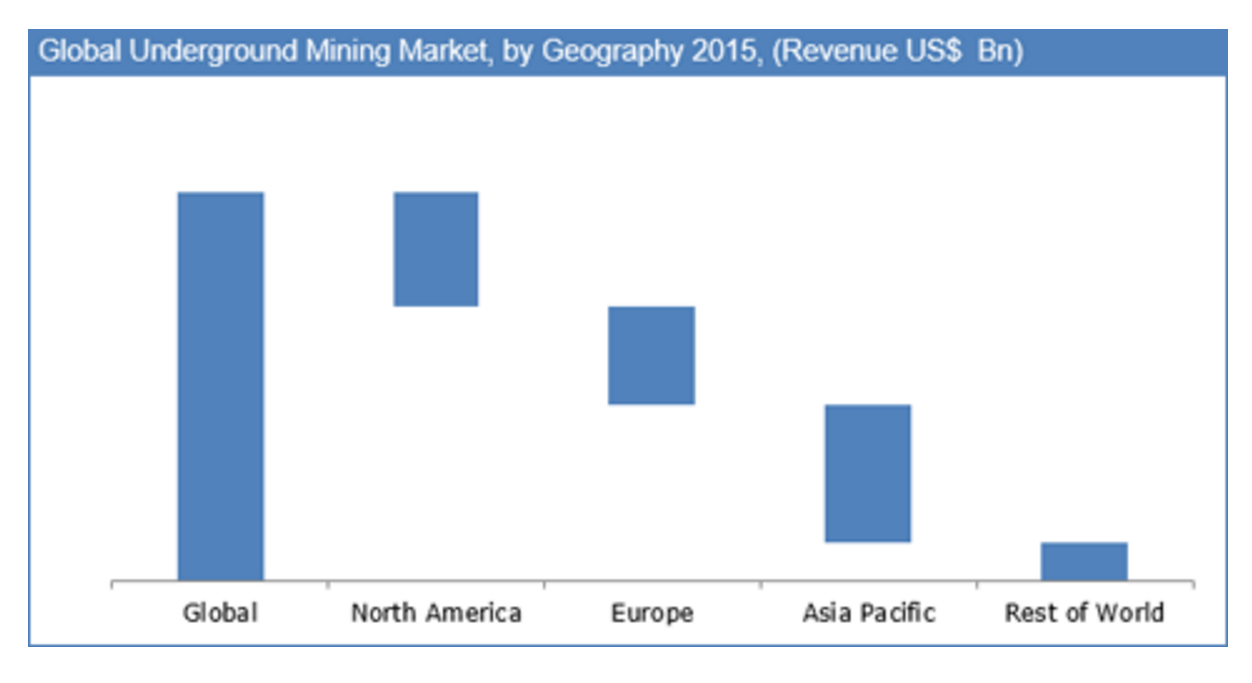

Based on what the firm calls a "comprehensive analysis of market influencing and inhibiting factors related to underground mining equipment industry," the report concludes that growing urbanization in the Asia Pacific region, the Middle East, Africa, and Latin America is driving up the demand for coal and coal energy.

Report shows that global underground mining equipment market is set to grow, reaching US$30.5 billion by 2023.Coal mining, in turn, is the main user of underground equipment. Only in 2015, this particular sector accounted for 40% of revenue share in the global underground mining equipment market.

The sector has also been affected by China's decision to increase its coal import volumes by 52% over the past year, which has impacted both supply and demand, as well as prices.

According to Credence Research, improving living standards and disposable income are increasing consumption of aluminum, copper, gold, and other commodities. Thus -they say- the outlook for underground mining equipment used in metal mining applications couldn't be better.

Source: Credence Research Inc.

The report says that demand for underground mining equipment is also rising in Europe, Japan and the US, since companies are replacing outdated machinery with more energy efficient solutions. They are looking to comply with labour safety rules and government regulations regarding greenhouse gas emissions.

Source: Credence Research Inc.

The report's positive outlook contrasts sharply with what's going on inside major companies in the underground mining equipment business.

The world's No.1 heavy machinery maker, Caterpillar, announced in early September that it may be closing its Gosselies, Belgium plant, leaving more than 2,000 people out of work. The giant is also considering shutting down its Northern Ireland facility, which could result in the loss of up to 250 jobs.

The moves are a result of CAT's weak sales in the mining and energy sectors. The giant even reviewed down its forecast for 2016 profit and sales twice in a three-month period ending in July.

Recently, Caterpillar also announced it will discontinue manufacture of its room and pillar equipment, such as continuous miners, feeder breakers, coal haulage systems, high-wall miners, roof bolters, utility vehicles and diesel vehicles, which are all used by underground soft-rock mining customers. This decision means that almost 200 workers will be laid off from different U.S. plants.

On the other hand, Joy Global, the largest independent manufacturer of underground mining equipment, announced in late July that it signed a $3.7 billion deal with Komatsu. By mid-2017, the Wisconsin-based company will be owned by the Japanese titan.

The sell-off is the result of challenging market conditions, Joy Global's Chief Executive Ted Doheny said at the time. The company's total bookings fell 17%, with service orders down 12% compared with the prior year quarter, while original equipment orders dropped by 46%.

And while the equipment sector adapts to the latest changes, analysts expect acquisitions on the equipment front to continue.