Undervalued Canadian Miner Has 'Blue Sky' Potential

In this interview with Rana Vig, the CEO of Blue Lagoon Resources, Peter Epstein of Epstein Research explores the company's options for producing high-grade gold, silver and copper, as well as its exploration potential at its British Columbia project.

In this interview with Rana Vig, the CEO of Blue Lagoon Resources, Peter Epstein of Epstein Research explores the company's options for producing high-grade gold, silver and copper, as well as its exploration potential at its British Columbia project.

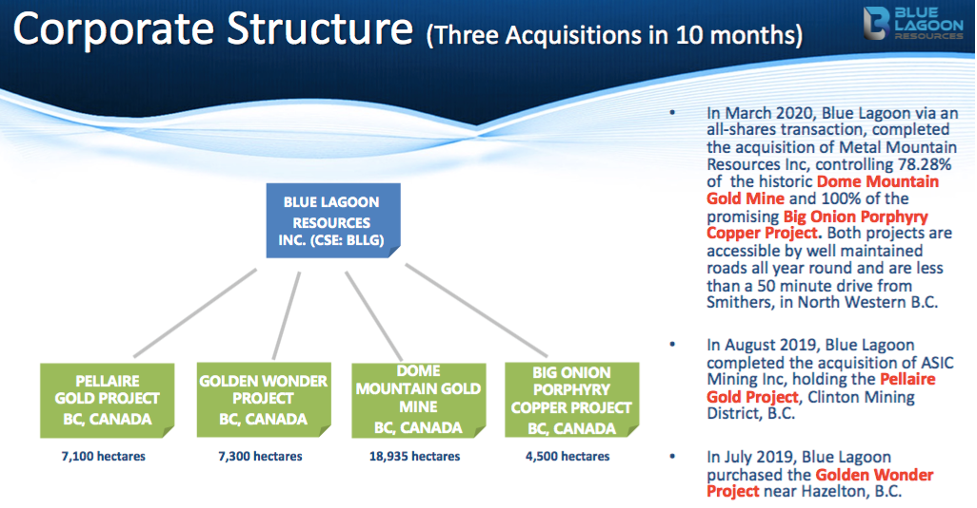

Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB) could be the next gold-silver producer in British Columbia, Canada, toll-milling high-grade, stockpiled ore from two properties (~30,000 tonnes in total) starting as soon as April/May, then potentially operating at 100 tonnes per day (tpd) from its flagship Dome Mountain project this winter.

In 1H/2022, the company hopes to be running at 200 tpd. The permits allow for up to 75,000 tonnes/year. Depending on grades/recoveries, that could amount to >20,000 (20k) Au equivalent (Au eq.) ounces/year.

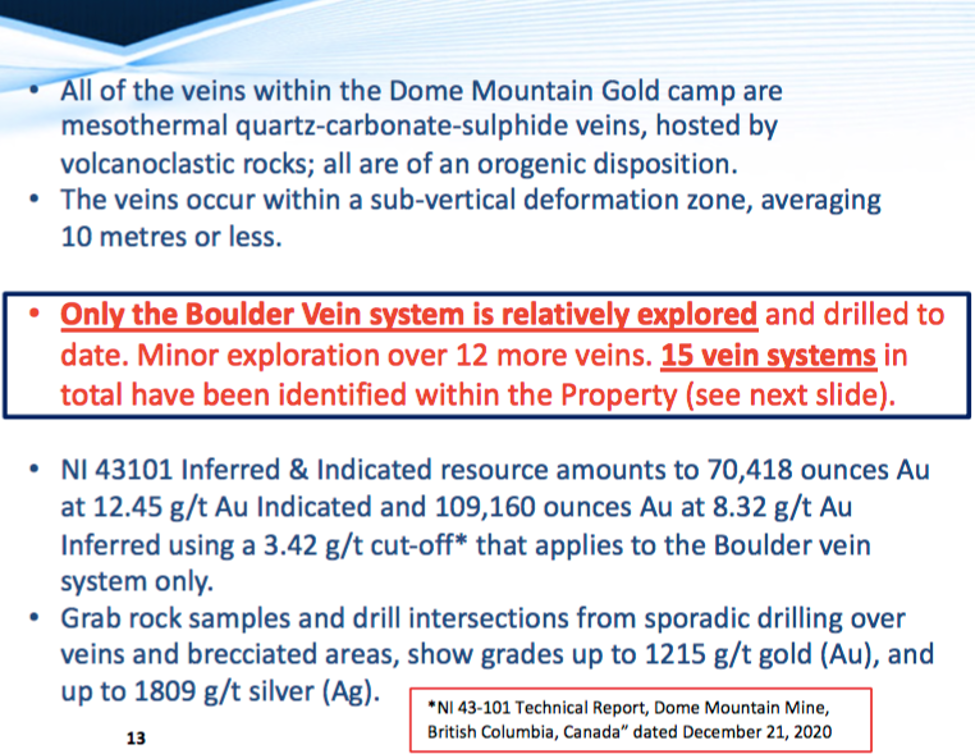

In today's dollars, >CA$100M has been spent on just a small portion of Dome's nearly 19k-hectare footprint. Management believes they can possibly deliver a new resource containing ~1 million (1M) high-grade ounces. That would be on 4,400 hectares. Pellaire hosts at least 10 high-grade, gold-bearing veins. Importantly, there's ~25,000 tonnes of stockpiled material at Pellaire at an estimated grade of 5.5 g/t Au Eq.

This is a fairly straightforward, multimillion-dollar cash flow opportunity (over a five- to six-month period)expected to start this summer.

PE: Thank you. So three prospective properties, all in BC, with the primary focus being the past-producing, high-grade Dome Mountain. Please tell us more about Dome.

RV: We're very excited because there's a lot of activity at Dome right now. Twenty one people are onsite supporting our permit amendment work and 20k-meter drill program. Labs have been slow, but initial drill results should be in hand this month. Readers should know, the intense focus at Dome is not just on drilling, it's on near-term production.

By the end of April we hope to have completed three corporate initiatives involving (underground roof bolting, upgrades to a water treatment facility and updated reclamation plans), to submit applications to amend key mining permits allowing us to operate at up to 75,000 tpy.

We also have permission to remove roughly 6k tonnes of high-grade, broken ore sitting in a mine tunnel at Dome. Shipping that ore to Nicola is expected to start this spring, so we could be pouring gold by June.

PE: On Feb. 24, Blue Lagoon put out a press release on prospecting and soil sampling done last year at Dome Mountain. What are the main takeaways?

RV: First, let me say that we're very happy with these prospecting results. I guess most important, we identified strong anomalous gold in soils zones, which will be followed up on this spring/summer. The best way to convey our excitement is to refer to our chief geologist's comments. Bill Cronk, P.Geo, said, "We identified multiple gold-in-soils anomalies and strong multi-element associations with that gold. This initial sampling program was focused on: 1) covering areas of known gold mineralization at Freegold, Boulder and the Forks veins, to provide an orientation of what results can be used to guide future programs, and 2). . .as a quick pass program to cover initial geophysical anomalies seen in our preliminary Mag & EM data collected from our 2020 airborne surveys. Both goals were achieved, and we plan to collect a minimum of 4,000 additional samples this year. . ."

PE: Blue Lagoon has $5.5M in cash. How much exploration/development can you do with that liquidity runway?

RV: Good question. Even after advancing our drill program and amending two key permits, we should have ~$4M in cash at the end of April. And, we have ~$5M in $0.50 warrants that could potentially be exercised. Some of those warrants are held by very supportive friends and family who we think we can count on to exercise if need be.

PE: Blue Lagoon has an Indicated + Inferred resource grading ~10.2 g/t Au eq. You've said the next resource estimate will be substantially larger. How well might that 10 g/t hold up?

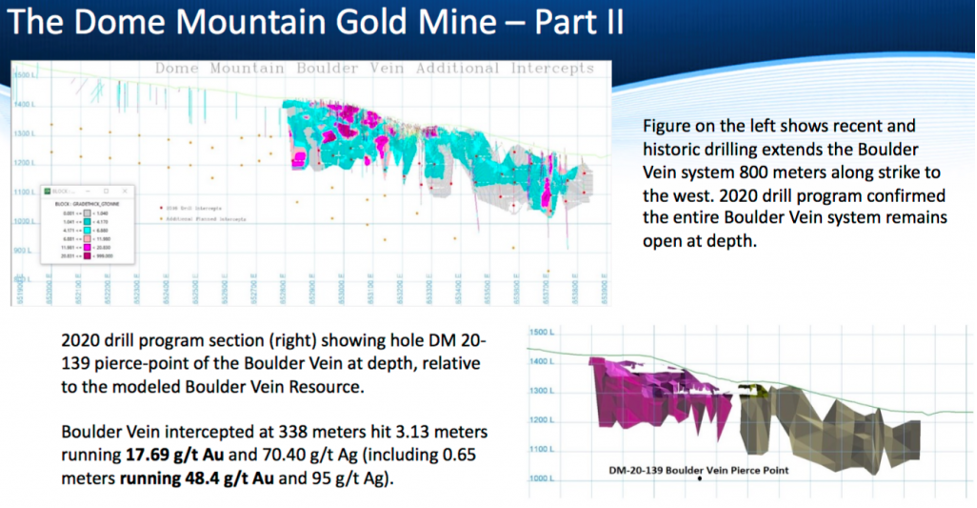

RV: In looking at historical data, including work done in 2016 and last year, we have no reason to believe the grade will change all that much. Generally, grades improve at depth, and we're drilling deeper than the 304 holes used to calculate our existing resource.

PE: As CEO, readers see you in video clips and read quotes attributed to you in press releases. Please name a few other critical team members.

RV: Thank you for asking. Yes, we have a tremendous team, plus advisors, at Blue Lagoon. I like to surround myself with people who are smarter than me. I think I've succeeded here.

Our chief geologist, Bill Cronk, P.Geo, has >25 years' experience as a geologist/manager of exploration programs for precious and base metal deposits. He has worked in Africa, Europe, North and South America. Bill's an expert mining executive in areas ranging from grassroots reconnaissance to advanced-stage exploration and prefeasibility work. Mr. Cronk has worked for mining industry leaders such as Dundee Precious Metals Inc. (DPM:TSX), where he was also chief geologist, and Northern Empire (acquired by Coeur Mining Inc. [CDE:NYSE]).

Yannis Tsitos is on our advisory board. He has over 30 years' experience, 19 with BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK). He has lived and worked in Sout Africa, Ecuador, Greece and the UK. Originally a physicist-geophysicist, he left BHP, where he had the title of New Business Manager for Minerals Exploration, in 2007.

Yannis has been instrumental in the identification, negotiation & execution of over 50 exploration agreements. Mr. Tsitos is president of Goldsource Mines Inc. (GXS:TSX.V) and sits on several companies' boards as an independent director.

Director Norman Brewster is CEO of Cadillac Ventures Inc. He has served on many public and private company boards. Prior to Cadillac Ventures, Mr. Brewster was executive chairman of Iberian Minerals, successfully financing, developing and putting into production the Aguas Tenidas Mine in Spain. He later led the eventual sale of Iberian to Trafigura Group.

PE: Historically, over $100M (in today's dollars) has been invested at Dome Mountain. Given its grade profile, why has it not been more actively mined by now?

RV: Great question. Prior operators did a fantastic job raising nearly $30Mover the past decade, in what was a terrible market. They simply ran out of steam, but not before obtaining key mining permits and completing a great deal of exploration and development work. Frankly, I was amazed at what they were able to accomplish.

One thing I've learned over the past few decades is that sometimes luck comes into play. I was at the right place at the right time to pick up Dome and Big Onion a year ago at highly attractive valuations. Other companies tried to purchase Dome, but the timing was never right.

We issued ~13.5M shares to acquire 78% of Dome when our shares were trading at ~$2.00. Today, with a nearly 20% pullback in gold since its all-time high in August, our share price is in the low $0.50s. We think Blue Lagoon is very undervalued, which is why I exercised options on 1M shares and have been buying in the open market.

PE: Yes, I see you've been building your position in Blue Lagoon. Why should readers consider following your lead?

RV: We think we're extremely undervalued. Are there better projects in Canada? I'm sure there probably are. But are they permitted? Clearly, the vast majority are not. In fact, I don't know of any pre-PEA (preliminary economic assessment) company that has any mining permits.

Blue Lagoon is truly in an enviable position. It can take over 10 years to get mining permits in BC! Another reason why we're undervalued is that we have three projects (Dome Mountain, Big Onion and Pellaire), but our valuation is tied to (the very considerable) work done on