URANIUM: Global Atomic publishes PEA results for Dasa in Niger

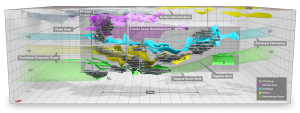

Dasa long section Credit: Global Atomic

NIGER - Global Atomic has released the results of a preliminary economic assessment (PEA) for its Dasa deposit in the Republic of Niger.

The study outlines the first phase of a larger underground mine at the site - with a 12-year life, this phase would extract the high-grade Flank zone and surrounding mineralization. With average annual production of 4.4 million lb. of U3O8 at all-in sustaining costs of US$18.39 per lb., the net present value estimate for the project comes in at US$211 million, at an 8% discount rate.

At 1,000 t/d, the capital cost estimate for this first phase is at US$203 million for a project using conventional uranium processing techniques. The PEA presents a mine plan extracting material from depths of 70 metres to 600 metres below surface; there are additional inferred resources outside of the plan at depths of 400 metres to 800 metres. The deposit remains open at depth and on strike.

"Our development plans is a low capex route into production that uses conventional underground mining and a processing technology similar to that used by the two existing uranium mines in Niger," Stephen Roman, the company's president and CEO, said in a release. "This mine plan also provides future access to the contained uranium inventory of over 200 million lb. in the mine's deeper horizons. The optimized phase 1 mine plan initially targets high-grade mineralization that starts from a depth of 70 metres below surface that, together with a mining friendly jurisdiction, positions the company as being the next entrant to the worldwide uranium supply chain."

Roman added that the next step for the company would be a Final Technical Report (FTR), incorporating impact assessment studies underway; the FTR document is part of the country's mining permit application process.

For more information, visit www.GlobalAtomicCorp.com.