URANIUM: NexGen says Arrow PEA has after tax NPV of $3.5B

SASKATCHEWAN - Vancouver's NexGen Energy has received the maiden preliminary economic assessment for the Arrow deposit at its Rook I uranium project on the rim of the Athabasca Basin.

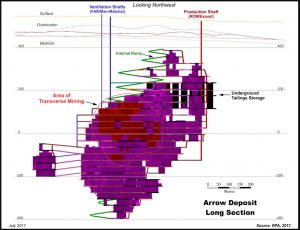

Long section of the Arrow deposit at the Rook I project. (Credit: NexGen Energy)

The after tax numbers include a net present value (8% discount) of $3.5 billion, an internal rate of return of 56.7%, and a payback of only 1.1 years. The capex is estimated at $1.2 billion to develop an underground mine with a 14.4-year life. Annual production in the first five years would be 27.6 million lb. of U3O8, and after than 18.5 million lb. per year. During years one to five, average operating cost would be $5.53/lb., and over the life of the project, $8.37/lb.

"The Arrow Deposit is one of the most strategically significant and economically powerful mineral projects I am aware of across any resource commodity," said NexGen CEO Leigh Curyer. "Yet, it is still in it's infancy in terms of ultimate resource size given the openness of mineralization and new discoveries in close proximity to Arrow highlighted in our recent drilling results. This PEA highlights Arrow's unique technical setting, grade and characteristics of mineralization, resulting in it hosting the potential to be a leading source of mined uranium in the world with a relatively low capital and operating cost per pound over the life of the mine."

The study was prepared by Roscoe Postle Associates based on an indicated resource of 179.5 million lb. of uranium oxide contained in 1.2 million tonnes grading 6.88% U3O8, and an inferred resource of 122.1 million lb. of U3O8 contained in 4.3 million tonnes grading 1.30% U3O8.

Replay the PEA conference call recording at www.NexGenEnergy.ca.