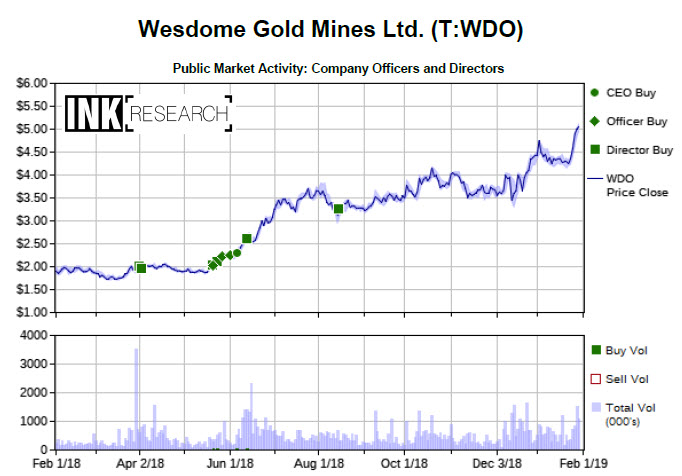

US debt ceiling problem plus new exploration boosting Wesdome Gold Mines

In his latest Discovery Watch interview, John Kaiser from Kaiser Research Online believes the share price of INK Canadian Insider Index member Wesdome Gold Mines (Mostly Sunny; WDO) is getting a lift from exploration at its Kiena Mine Complex near Val d'Or Quebec and gold's strength.

Wesdome Gold Mines shares benefiting from discovery news and production

Mr. Kaiser explains that back in late 2106 Wesdome did a deep drilling program in the Kiena Mine that has been shut down since 2013. It was on care and maintenance and the board even wanted to get rid of it because the remaining resources were not worth the trouble of mining at the prevailing gold price at the time. But, management had a theory about an S-structure zone and they drilled a hole that delivered a very high grade gold intercept.

After more exploratory work over the past 18 months, Kaiser suggests and notes:

There is speculation that this could end up producing a lot more ounces as they get more into it. Of course, the Kiena deep zone is considerably higher grade than anything that has been historically been mined in the Kiena project.

Stronger gold is also likely helping to drive interest in the stock. Kaiser believes gold is benefiting from the coming debt ceiling problem. He explains:

Last year they decided to suspend the debt limit but only temporarily so. In March they have to approve the debt ceiling, or the government will not be able to pay its bills. This is the problem we had in 2011 when the Tea Party gained control of the house...but now the tables are turned. It's the Democrats whot need to approve it. They are trying to get a bill done to prevent another government shut-down.

He goes on to warn:

The debt ceiling is going to have to be raised repeatedly based on projections of the debt expanding under the current Trump policies and this will probably be 7 trillion dollars in next four or five years of extra debt on top of the 20 trillion or so that already exists.

These fears are attracting new investors to bullion. Mr. Kaiser reports:

There is nothing going to change over the next two years, this debt is going to keep growing who knows where it will all end up. So, there is broad based buying we are seeing in the GLD ETF. There's been net accumulation or increase in its holdings. In the last quarter. In the last couple of days there were two large increases.

Mr. Kaiser believes we are in a solid gold trend. In this environment, it helps that Wesdome is a gold producer. Mr. Kaiser says:

It is sort of the next Richmont its goal is to end up being a 200,000 ounce a year producer and right now the Eagle River project is producing from an underground mine as well as the Mishi open pit mine.

Richmont was taken over by Alamos Gold (Cloudy; AGI) in 2017.

Kaiser believes that companies like Wesdome that have both discovery exploration and production will benefit from a higher gold price.

In the broadcast, Mr. Kaiser also reviews the Osisko Metals (Mostly Sunny; OM) upcoming drilling strategy at its zinc-lead Pine Point project in the Northwest Territories and comments on the stock overhang from a recent fund liquidation.

He also analyzes recent technical news from Nevada Exploration (Mixed; NGE) as it relates to the prospects for the widely anticipated assay results from recently drilled hole 6.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

This post first appeared on INKResearch.com. The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII), a 2017 & '18 Fundata FundGrade A+ (R) Award Winner.