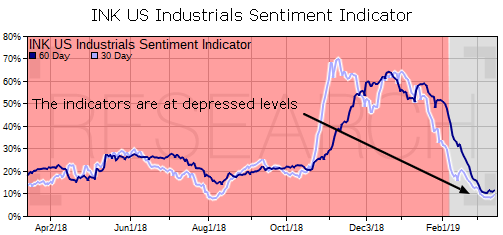

US Industrials insider sentiment a big concern

In my latest Howe Street interview with Jim Goddard I assess the likelihood that we are heading into a recession. While we may not be there yet, I explain that insider sentiment in the US Industrials sector is flashing a warning sign.

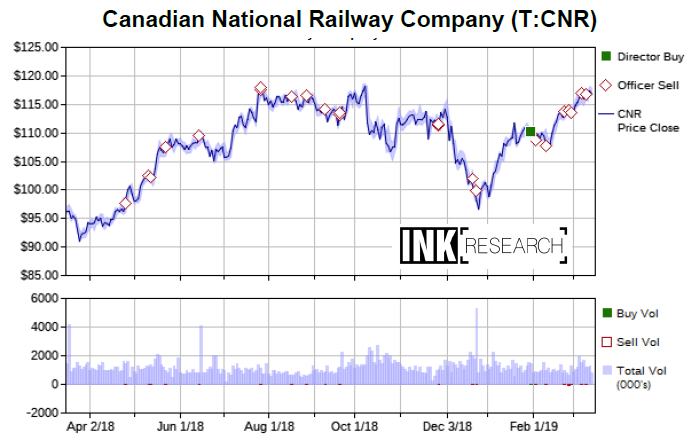

I also highlight how we have relatively bleak outlooks on Canada's two major railway stocks, noting insider selling has been taking place even as the companies have been buying back shares. That is a combination we do not like to see.

Insiders are selling at CN Rail even as the company buys back shares.

When asked about the outlook for the Canadian retail industry, I suggest it will be a stock picker's market and note that some companies may be better positioned than others. I discuss Canadian Insider Index member goeasy (Mostly Sunny; GSY) which outlined a case back on December 10th of last year that the non-prime borrower in Canada might not be as vulnerable to a downturn as widely assumed given their debt-to-income levels are relatively low and they are less exposed to real estate.

We also discuss the China-US trade dispute where I suggest markets have become too complacent about the risks of no-deal. In contrast, a no-deal scenario has been widely considered in with respect to Brexit. Moreover, Fed policy is likely to be a bigger driver than either of those events over the next few months. At this point, markets seem to be in a holding pattern as investors assess whether the Fed has tightened too much, or too little.

I did not suggest a third possibility that the Fed and the Bank of Canada have put perfect policies in place. Although I assign a negligible probability to such a scenario, it would be great for markets if Powell and Poloz did win the Goldilocks policy lottery.

I end off by suggesting that the oil & gas and gold mining areas appear to be the most attractive right now in Canada. The oil patch has a lot of bad news priced in, while gold stocks should find some support in the run-up to the 2020 US presidential election which should see plenty of gold-friendly policy ideas.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

This report first appeared on INK Research. Listen to the interview here on Youtube or below where you can also download it.

Your browser does not support the audio element. Download