US Manufacturing Surveys Slump In October, New Orders Slide, Prices Surge

Markit's US Manufacturing PMI tumbled in October, from 60.70 in September to 59.2 in preliminary October data to a final print of 58.4, tracking the dismal disappointing slide in actual US macroeconomic data.

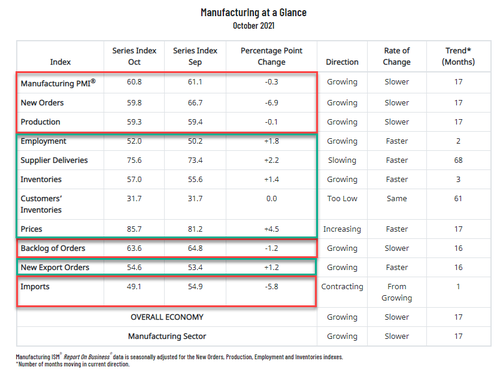

ISM's US Manufacturing survey also slipped lower in October (from 61.1 to 60.8) but printed better than the expected 60.5.

Source: Bloomberg

That is the lowest Manufacturing PMI since Dec 2021 as production growth slowed to the softest since July 2020 in October.

At the same time, firms continued to partially pass on higher costs to clients. The rate of charge inflation accelerated to the fastest on record.

On the bright side, the cost of wood is lower... so maybe we should all switch to that to heat our homes this winter... (because every other commodity's prices is higher)...

Chris Williamson, Chief Business Economist at IHS Markit said:

"October saw US manufacturers report yet another near-record lengthening of supply chains, with shortages of components constraining production growth to the lowest since July of last year. Around half of all companies reporting lower production in October attributed the decline to a lack of supplies. However, a further one-in-ten cited a lack of labor, and one-in-four reported that demand had fallen, often as a result of customers either lacking other inputs or pushing back on higher prices.

"Although production growth has now slipped below the pre-pandemic long-run average due to the supply and labor constraints, demand growth - as measured by new order inflows - remains well above trend despite easing in October, hence producers saw another steep rise in backlogs of uncompleted work. This shortfall of production relative to demand was the principal driving force behind a survey record rise in manufacturers' selling prices, suggesting that inflationary pressures continue to build and look unlikely to abate to any significant degree any time soon."

ISM confirms Williamson's note with a big surge in Supplier Deliveries (which, as a reminder, is actually seen as a positive attribute for the overall index because "demand" as opposed to the negative reality due to supply chain disruptions)...

ISM data also shows stagflationary threats re-appearing with new orders tumbling as prices paid resurges...

Finally, the future doesn't look bright as output expectations dropped to a 12-month low in October amid concerns regarding inflation and supply-chain disruption.