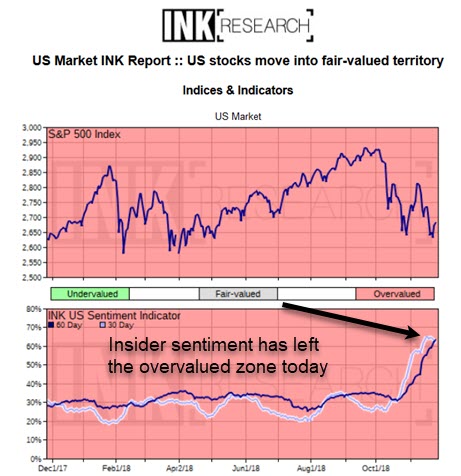

US stocks move into fair-valued territory

Our US market indicator moved above 60% over the past week. At that point, there are 6 stocks with key insider buying for every 10 stocks with selling. Once the US indicator moves over 60%, it leaves the overvalued zone and crosses into fair-valued territory. Generally, a fair-valued reading implies that investors can expect average returns over the next few years from here. However, it does not rule out stocks going lower in the short-term and moving into undervalued territory. Indeed, for value-oriented investors, that would be the ideal buying scenario.

Should the Fed continue on its tightening path into 2019, we may well see additional market weakness. In fact, unless Fed chairman Jerome Powell starts to clearly hedge his bets on rate hikes for the New Year, we expect stocks will continue to struggle. Mr. Powell will get his chance on Wednesday to set the stage for a more dovish 2019 when he addresses the New York Economic Club at noon. The event will be live streamed (see below).

If the embedded live stream isn't working, please click here

On balance, more value is emerging in the US market based on our insider signals. From here, our base case is further stock market weakness until we see a clear peak in our US Indicator. Such a peak could come as early as this week if the Fed becomes more dovish. However, if the Fed pushes its luck with a continued hawkish path, a bad accident could easily happen in capital markets, sending stocks lower.

This is an excerpt from the November 28th US Market INK report. The full version was made available to INK Research subscribers before the market open.