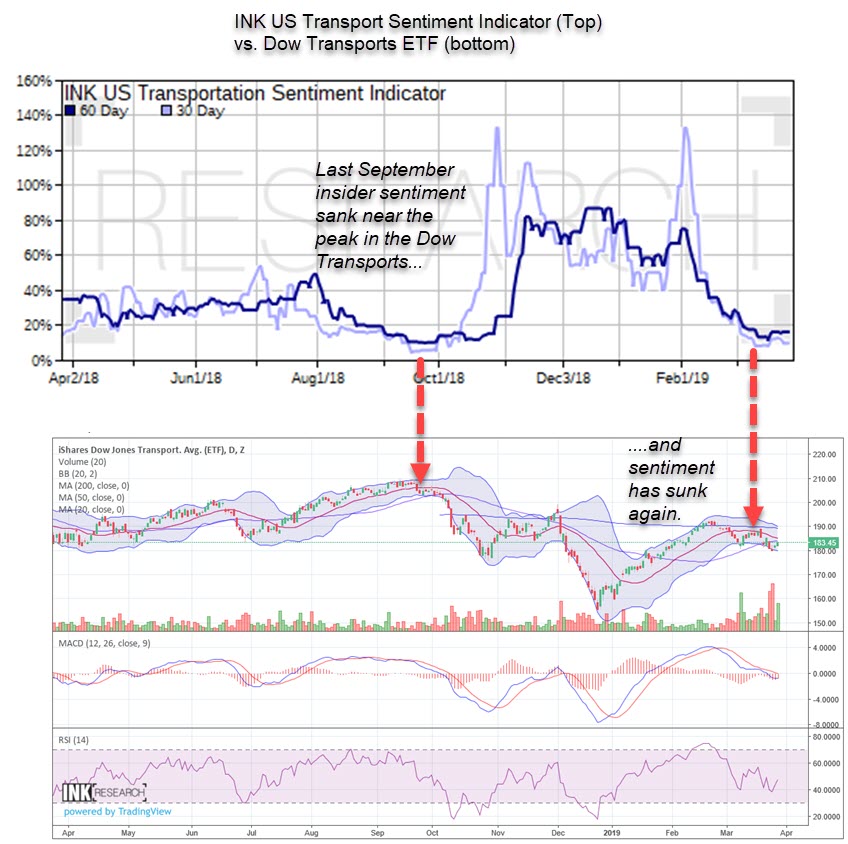

US transports insider sentiment is sinking again

In our March 27th INK subscriber US market update, we noted the divergence in insider sentiment between the Oil & Gas Exploration and Production (E&P) industry and the Industrials sector. The former was behaving in a bullish fashion and remained at a healthy level with our indicator above 100%. That means there are more stocks in the group with key insider buying that selling. In contrast, sentiment in the Industrials was depressed, with our sector indicator in the danger zone below 20%. Industrials insiders were taking money off the table while E&P insiders were adding to their positions.

US transportation stock insider sentiment is at a depressed level

The Industrials sector is home of transportation stocks, a group followed by many market participants. Drilling down to this industry level, we see that insiders in transportation stocks are in profit-taking mode. In fact, our Transportation Indicator is back to the depressed levels we saw early last fall, right around the time the iShares Dow Jones Transportation ETF (IYT) peaked.

So far this year, insiders have been eager sellers into the rally. Initially, insider selling into a rally is typically a positive sign as it confirms broad momentum is building. However, at some point the selling becomes strong enough to send a warning sign and that is what we see now. If the signal is right and transportation stocks stumble or head into reverse, they could be reflecting weaker economic growth ahead. Such an interpretation would be bearish for the overall market.

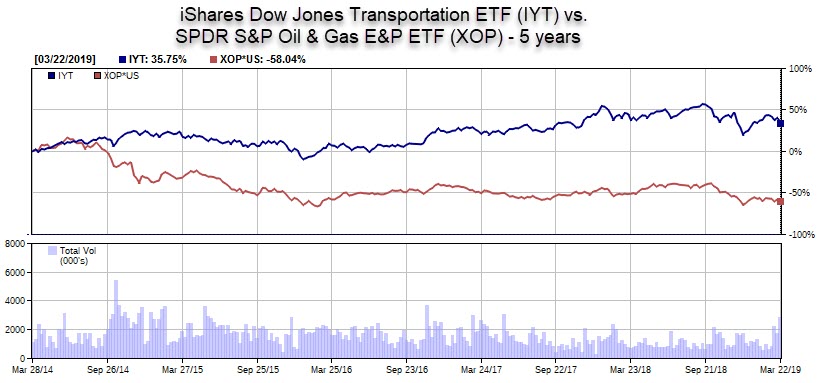

There is an alternative positive scenario that could be at play. If E&P insider bullishness foreshadows stronger oil & gas prices, global economic growth may well be set to beat expectations. However, higher fuel prices could hurt profit margins of transportation companies which could see them give up some of the relative outperformance they have enjoyed against the E&P group. Over the past 5 years, the IYT ETF is up 35.8%, while the SPDR S&P Oil & Gas E&P ETF (XOP) is down 58%.

Insiders signal that exploration & production stocks may be set to retake some ground against transportation stocks

Increased selling among transportation insiders may reflect concerns that the group's relative good times may be at risk of running out of steam if margins get squeezed via higher fuel prices. Transport pain may end up being E&P gain.

While today a Trump tweet has injected some pain into the Energy sector by sending crude oil lower, traders may be over-reacting. Perhaps the latest Trump tweet encouraging OPEC to boost production is a bullish sign for the E&P group, if it reflects steady growing global demand for crude products.

This post first appeared on INKResearch.com.