Using Gold And Milk Prices To Gauge AUD/NZD Direction

Gold is an important export for Australia, while concentrated milk is an important export for New Zealand.

One can use the spot price of gold and skim milk powder futures prices together to gauge the potential for future AUD/NZD price action.

At present, further AUD/NZD volatility can be expected, as while the gold/milk ratio is ticking down, short-term AUD/NZD yield differentials are rising (from below the "zero bound").

A sustained rise in both the gold/milk ratio and short-term yield differentials could send AUD/NZD to over 1.11. If both make a sustained fall, this year's lows (in the region of 1.02-1.03) could easily be taken out once again, with further lows to be set below those levels.

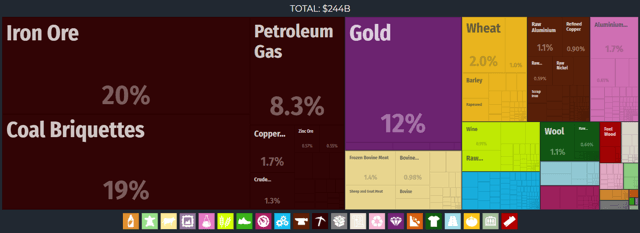

Gold is one of the larger exports of Australia. Per the OEC's website, it represents about 12% of the country's exports.

(Image source: OEC's page on Australia)

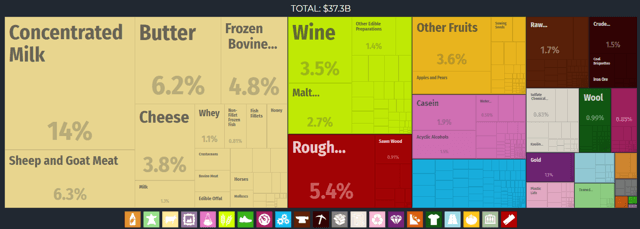

For New Zealand, interestingly, milk remains one of the most important exports; concentrated milk represents about 14% of the country's total exports.

(Image source: OEC's page on New Zealand)

The higher gold rises, the stronger the Australian dollar should be. That is, at least using ceteris paribus (all-else-equal) logic (which is admittedly fraught with risk). In any case, the same logic should follow for the milk prices and the New Zealand dollar.

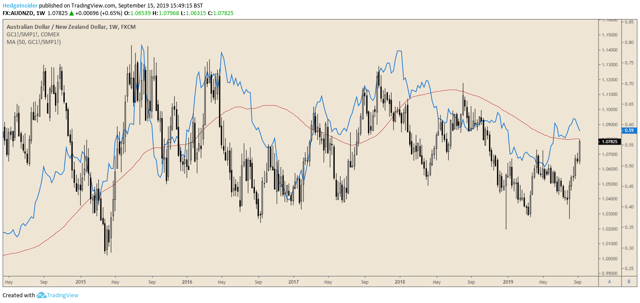

In this short article, I would like to present a simple idea for tracking the dynamic between AUD and NZD; or in other words, the price of the AUD/NZD currency pair using weekly candlesticks. The overlay (blue line) represents the ratio between the market price of gold (in USD terms) and NZX-listed skim milk powder futures prices. The red line is a 50-week smoothed version of this ratio.

(Chart created by the author using TradingView.com. The same applies to subsequent charts presented herein unless otherwise specified.)

As shown in the prior images, these two commodities are clearly not the sole drivers for Australia and New Zealand. But their significance is apparent not just as a percentage of the countries' total exports, but also as they seem to reflect changes in the strengths of their national currencies.

Interestingly, this ratio is currently ticking down on a weekly basis, heading towards the 50-week average, just as AUD/NZD is apparently spiking. This would provide us with a divergence signal; one might consider "fading" (counter-trading) this bullish price action, though a longer-term view would be needed, as further spikes might occur even until the gold-to-milk ratio heads below the 50-week average.

On the daily time frame, this ratio also appears to be indicative of future AUD/NZD price action.

The correlation on the daily time frame is far less obvious, which suggests that in order for the currencies to respect changes in this ratio, changes in the prices of gold and milk futures must be sustained. This does makes fundamental sense, as economies and currencies typically do not shift significantly over mere days, but rather weeks, months and years.

What I would take from the above two charts is that the currently bullish price action in AUD/NZD is possibly going to come to an end soon. While the pair has broken its recent trading range, this could be a "head fake" before the pair returns down to the lows of 2019, between 1.02 and 1.03 (current price as at September 13, 2019: 1.07825).

Having said this, the yield differential between the two countries' two-year bond yields too has broken to the upside. Per the chart below, we can see Australian two-year yields rising from a negative position to a positive position (-0.2289% on August 5, 2019, now 0.0108% as of September 13, 2019).

This is a crucial point for AUD/NZD. When the short-term yield differential between two currencies is so close to zero, changes from positive to negative can have very significant effects on price (as we have just seen). A break in one direction can change everything; if one currency starts yielding negatively against another, and the market trusts that this trend will continue, it will surely lead to pressure mounting on such currency.

In this case, that currency is New Zealand dollars (in terms of Australian dollars). Going forward, traders will need to watch to make sure that the short-term AUD/NZD yield differentials stay above zero. If the yield differential remains positive and finds higher highs, AUD/NZD (provided that the gold/milk ratio does not collapse) could find much higher highs (all the way to 1.1180 last seen in August 2018).

A collapse in the gold/ratio, combined with a return to negative short-term yield differentials, could send AUD/NZD easily below those aforementioned lows of 1.02-1.03. The time frame here is not so important, although a sustained rise or fall in the ratio and differentials should last at least two weeks for the new direction to become clearer.

For now, one should not necessarily place too much weight on the recent AUD/NZD ramp, as volatility can be expected at this time (in both directions).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Hedge Insider and get email alerts