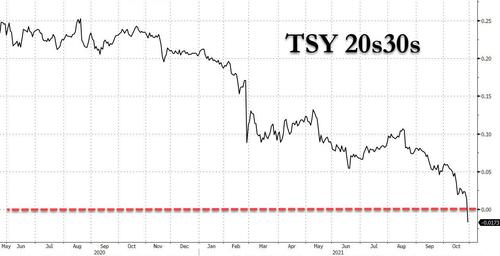

VaR-Napalm Misery As US Yield Curve Inverts At Long-End

Last night we noted the Czechs had the dubious honor of suffering the first yield curve inversion of this cycle...

The first inversion of many pic.twitter.com/wNPpbhcbM6

- zerohedge (@zerohedge) October 28, 2021Then overnight saw the stress spread to Australia's bond market, as a massive move higher in 2Y Yields undoubtedly triggered chaos in risk control departments.

And that VaR shock is now spreading to the US, where for the first time ever the yield on the 30Y UST is below the yield on the 20Y UST...

Source: Bloomberg

Picking up where we left off with our commentary on the 5-sigma VaR shock inducing move in the Aussie short-end, Nomura's Charlie McElligott warns of "VaR-napalm emanating from Macro HF pods with fresh Rates calamity overnight" and adds that "this continues to be a disaster with trapped / bad positioning from clients, and Dealers largely unable to provide liquidity in light of event-risk (i.e. ECB) and VaR constraints, further exacerbating the stop-outs in both USD and EUR short upper left and steepeners seen seen recently."

Drilling into the flattening mechanics, he notes that the extension of the front-end selloff has again fueled another bout of impulse-flattening in global Sovy Bond curves (e.g. UST 5s30s now a 3.6 z-score move 'flatter' over the past 2.5 weeks, 2s30s a 3.0 z-score move same period), while the long-end stays anchored by "policy error" impact on slowing growth impact and softer Crude -1.5% overnight.

Meanwhile, as opposed to the front-end sell-off still extending on the "CB hawkish panic" with regard to inflation catch-up, global bond futures 10Y-and-out are holding the painful multi-day short-squeeze rally, as a result of the unprecedented crowding in bearish bond futures positioning, particularly from systematic Trend / Momentum strats-i.e. "it's not just "policy error" / slowdown" implications.

Finally, the Nomura quant notes that a "Bearish Bonds" trade is generally going to "work" for "Cyclical Value" when it is a bear-steepening, because the long-end is selling off on a "good" scenario of higher growth- and / or inflation- expectations; however in this case we are getting the "bad" outcome right now of market scrambling to price in aggressive Central Bank tightening, and soon-so the selloff is massively concentrated in the front-end as a "flattener," which is triggering concerns of negative "growth" impact / "policy error."