Verizon Tailwinds Help Dow Muscle to a Win

It was a quiet day of trading ahead of the Fourth of July holiday

It was a quiet day of trading ahead of the Fourth of July holiday

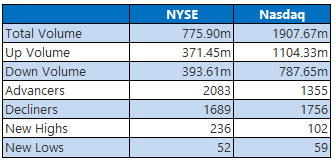

It was a quiet day of trading ahead of tomorrow's abbreviated session and the Fourth of July holiday on Thursday, with the Dow exploring a relatively tight 117-point range on both sides of breakeven. Most of the action was to the downside as Wall Street faded upbeat U.S.-China trade headlines from the weekend and reacted to the Trump administration's threats of a new round of tariffs on European Union goods, though the blue-chip index managed to settle just above the flatline on a strong showing from Verizon (VZ). The S&P also eked out a gain to nab a new record close, while the Nasdaq swung higher in the final minutes of the session.

Continue reading for more on today's market, including:

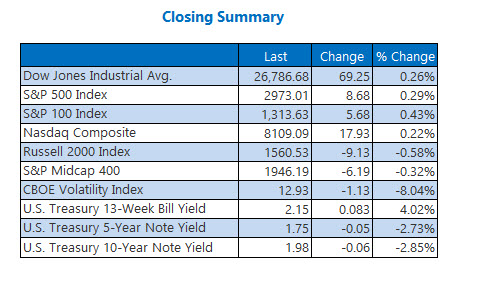

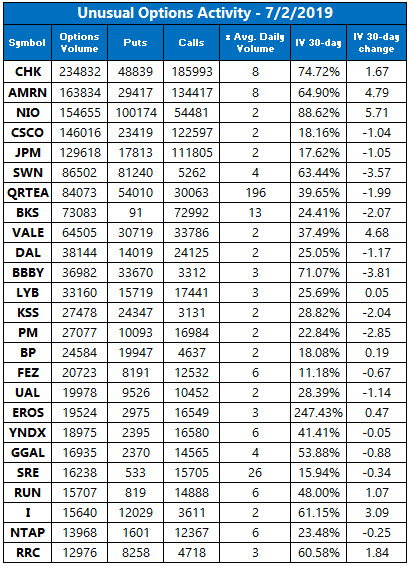

Use calls to play this tech stock's next pop.Behind the seven-figure Chesapeake Energy options trade.Plus, a bear signal just flashed on this chip stock; Johnson Controls looks attractive for bulls; and Amarin stock pops on upbeat Vascepa expectations.The Dow Jones Industrial Average (DJI - 26,786.68) gained 69.3 points, or 0.3%. Verizon (VZ) paced the 20 Dow advancers with its 2.4% pop, while Dow (DOW) led the 10 decliners with its 1.9% slide.

The S&P 500 Index (SPX - 2,973.01) added 8.7 points, or 0.3%, while the Nasdaq Composite (IXIC - 8,109.09) rose 17.9 points, or 0.2%

The Cboe Volatility Index (VIX - 12.93) fell 1.1 points, or 8%, for its lowest settlement since May 3.

5 Items on our Radar Today

At a summit of European Union leaders, current International Monetary Fund (IMF) Director Christine Lagarde was chosen as the front-runner to replace European Central Bank (ECB) President Mario Draghi when his term ends on Oct. 31. The group also tapped Germany's Ursula von der Leyen to replace European Commission President Jean-Claude Juncker. (MarketWatch)Arizona Governor Doug Ducey, a Republican, wrote via tweet he's "ordered the Arizona Commerce Authority to withdraw all financial incentive dollars" that were being provided to Nike (NKE) to assist in its plans to build a manufacturing plant in Phoenix. This followed the athletic apparel name's decision to pull its Betsy Ross American flag sneakers after former NFL quarterback Colin Kaepernick expressed concern over its historical association with slavery. (CNBC)This chip stock just flashed a bearish signal.Why Johnson Controls looks attractive for bulls.Amarin stock popped on upbeat Vascepa expectations.

Data courtesy of Trade-Alert

Gold Bounces Back as Dollar Cools

Concern over slowing global crude demand offset optimism over a crude supply cut extension from the Organization of the Petroleum Exporting Countries (OPEC) and its partners today, sending oil prices sharply lower. By the close, crude for August delivery was down $2.84, or 4.8%, at $56.25 per barrel.

Gold prices bounced back today, as the U.S. dollar cooled. August-dated gold settled the session up $18.70, or 1.4%, at $1,408 an ounce.