Victoria Gold Starts To Deliver

Victoria Gold poured first gold on September 17.

The mine should produce around 190,000 toz gold at an AISC of $750/toz on average, over its 10-year mine life.

Victoria Gold should be able to generate an annual free cash flow of more than $130 million, if everything goes well.

A conservative scenario shows more than 100% upside potential.

The coming months will be highly important, as various issues may emerge during the production ramp-up process.

I wrote my last article about Victoria Gold (OTCPK:VITFF) back in March of 2019, shortly after the completion of the Eagle Gold Mine financing package. 18 months have passed, two more equity financings (worth C$1.68 million and C$32.5 million) were arranged, many encouraging drill results were released, and, most importantly, the mine construction was completed. The first gold pour occurred on September 17. Victoria Gold is in the middle of the ramp-up process right now.

On September 9, Victoria Gold announced that the mine was completed in July, one-month sooner than expected. The construction cost C$487 million ($367 million). Another good news is that the mining operations are well ahead of schedule and also the grade reconciliation shows positive results:

Over 1 million tonnes of ore have been mined from the Eagle pit, which is 60% ahead of schedule for 2019. A significant portion of material on the margins of the Eagle deposit that were previously characterized as waste has been determined to be ore through assaying the production drill cuttings as part of the grade control program. Within the deposit, the tonnes and grade reporting are reconciling well with actual mining results and the published resource estimate. With the acceleration of the construction schedule, over 3 million tonnes of ore will be delivered to the heap leach pad by 2019 year-end.

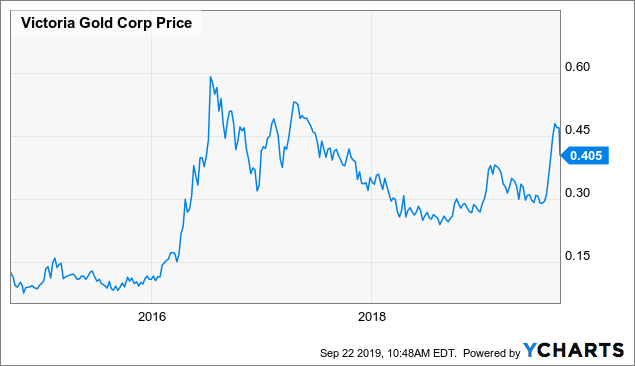

Data by YCharts

Data by YCharts

As can be seen above, Victoria Gold's share price reacted positively to the completion of construction activities. The share price was supported also by the growing gold price and as a result, it grew to $0.48. It reached 2-year highs, however, it peaked well below the summer of 2016 highs at $0.6. The reason is simple. The share dilution. The share count increased from 443.6 million as of May 2016, to 858 million, as of September 2019. Due to the share dilution, the market value of the company is much higher than in 2016, however, the share price is lower.

Right now, the question is, whether there is still some space for further share price growth left, or whether Victoria Gold's process of re-rating from developer to producer has been already completed. Victoria Gold's market capitalization equals approximately $334 million right now. The long-term debt equaled C$230 million ($173 million), as of May 31. It means that Victoria's enterprise value equals approximately $507 million.

After the mine gets in full production, it should be able to produce approximately 190,000 toz gold per year on average, over the 10-year mine life. The AISC was projected at $639/toz gold. However, as a part of the financing package, Victoria sold a 5% NSR royalty to Osisko Gold Royalties (OR). It means that the average annual production attributable to Victoria Gold should decline to approximately 180,000 toz gold, pushing the AISC higher. The newest corporate presentation mentions AISC of almost $750/toz gold. Although this value is notably higher than originally projected, if it is correct, we are still talking about free-cash-flow of almost $135 million per year, at the current gold price of $1,500/toz. After taking into account Victoria's gold price hedging, (40,000 toz gold in 2020 with a roof price of C$1,936/toz ($1,460/toz)), Victoria's realized gold price should be around $1,491/toz, resulting in free-cash-flow of $133 million.

But let's be a little more conservative. Let's say that due to the harsh weather conditions, the recoveries will be worse than expected and Victoria will end up with attributable production of only 150,000 toz gold per year, at an AISC of $900/toz. At the current gold price of $1,500, the free cash flow should be around $88 million per year.

Many of Victoria Gold's peers have price-to-free-cash-flow ratios higher than 10 right now. For example, according to GuruFocus, Centerra Gold (OTCPK:CAGDF) stands at 19.35, Pretium Resources (PVG) at 13.84, New Gold (NGD) at 13.4, Perseus Mining (OTCPK:PMNXF) at 10.81, Leagold (OTCQX:LMCNF) at 10.05, and B2Gold (BTG) at 9.45. At a free cash flow of $90 million and a more conservative multiplier of 8, the resulting market capitalization equals $704 million or $0.82 per share. It compares very favorably to the current share price of $0.4. It is also important to note that this calculation doesn't take into account the huge exploration potential and the possibility of production and/or mine-life expansion.

However, although the upside is still big, it is not warranted. Two main conditions must be met first. The gold price must remain approximately at its current levels (or higher) and the mine ramp-up must be smooth, without any significant negative surprises. In relation to the Eagle Gold Mine, the cold climate is often mentioned. The project is located in Yukon and the winters are usually long and very cold. The good news is that Victoria's third-biggest shareholder is Kinross Gold (KGC), a company with rich experiences with cold climate heap leaching operations. Experiences of Kinross may be very useful and they should help Victoria to overcome any potential issues. However, in the short term, any operational issues may unnerve the investors as they will delay the cash flows, limiting the working capital and increasing the probability of another share dilution.

The uncertainty surrounding the Eagle Gold Mine start-up could be seen also last week when many investors sold their shares right after the first gold was poured, pushing the share price from $0.47 to $0.36. Later, it recovered to the current level around $0.4. Due to the sudden drop in share price, the RSI cooled down significantly, declining to the level of 40. Although the 10-day moving average was broken pretty quickly, the 50-day moving average served as a support. It is possible to expect that a new support level will be created around $0.4. After it is completed, the share price will start to move back up (assuming that the mine ramp-up progresses smoothly).

Even if some less serious issues emerge, the impacts on the share price shouldn't be too harsh. The market capitalization is $334 million. Using the conservative price-to-free-cash-flow of 8, the company is valued for a free cash flow of $42 million right now. Based on the conservative scenario (150,000 toz gold attributable to Victoria at an AISC of $900/toz), Victoria Gold is valued for the production of approximately 120,000 toz gold attributable to Victoria Gold, at an AISC around $1,150/toz (resulting in the above-mentioned free cash flow of approximately $42 million). In other words, several negative news is already baked in the share price, which should provide some downside protection.

Conclusion

The Eagle Mine is finally built and the gold production is underway. Right now, it seems like the ramp-up process is progressing well, no negative information has been released yet. Victoria Gold has even announced that mining activities are ahead of schedule. However, the winter is coming and the next several months should prove whether the Eagle Gold Mine can be operated efficiently. If the answer is positive, Victoria Gold's share price should more than double quite easily. Especially at the current gold price.

Disclosure: I am/we are long VITFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Peter Arendas and get email alerts