Vindication for Oil Prices

The good wife is in Las Vegas for work this week, leaving me home to be the bachelor. I've never much liked Vegas. It is shallow, rude, and noisy. It is a system set up to rob the stupid.

And according to the latest numbers, it has undergone a tourist slump. For the first time in nine years, the numbers are down over last year.

It seems that Las Vegas isn't what it used to be. When I first showed up in Sin City 25 years ago, I was amazed that you could get free drinks while playing $2 blackjack. There were big signs everywhere advertising $1.99 buffets - "Pound of Pork: $1.99," they would say in red marquee letters.

That's all gone now. These days they overcharge for drinks. The food is name brand bland. You have to pay for parking and unpublished "hotel fees" that can add $60 a day to your trip. And, of course, the games don't pay out half as much as they used to.

I sat at the airport watching folks dump quarters in a machine for two hours. It never paid out. The constant ringing bells in the airport lounge are enough to make you put a chopstick through your eardrum.

Of course, for some reason, people want to live in the sweltering and dusty desert. Real estate prices have gone from the worst to among the best, rivaling the Bay Area's 12.6% growth.

Great Action

But the area with the best growth over the last month is Odessa, Texas, which topped the list with a 33.6% increase in average apartment rent, followed by Midland, Texas (28.2%).

This is because oil prices are high and getting higher. WTI just crossed the major psychological barrier of $70 a barrel. Brent is at $76.59.

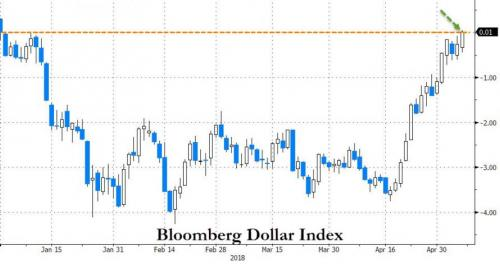

And get this: The oil price has rallied despite a surge in the dollar!

How can this be, fellow Energy and Capital reader, when historically, a strong dollar pushes down oil prices and vice versa?

Well, it seems that late-stage socialism in Venezuela is finally coming to a head, and President Trump is deciding on reimposing more sanctions on Iran by this afternoon.

The Best Free Investment You'll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

We never spam! View our Privacy Policy You'll also get our free report, Two Stocks to Play The Coming U.S. Oil Export SurgeOn top of this, the Houthi rebels and Iranian allies in Yemen have been shooting missiles at Saudi Arabia's oil production facilities. The Saudis intercepted these missiles, but given that they want $100 oil before the Saudi Aramco IPO, perhaps they should let them drop in with a bang.

There is also this little bit where Yemen is holding oil tankers hostage. According to Saudi media, the Yemeni Houthis have captured 19 oil tankers and are keeping them from entering the Hodeidah port.

That certainly adds to the high-priced drama.

It was not too long ago that I predicted oil would hit $80 sooner rather than later.

I pointed out three oil majors that had large dividends: "Exxon Mobil (NYSE: XOM), for example, has a P/E of 16.25 and pays a dividend of 4.11%. Eni S.P.A. (NYSE: E), the Italian oil major, has a P/E of 16 and a dividend yield of 5.15%. Total S.A. (NYSE: TOT) has a P/E of 17 and a yield of 4.87%."

Buy low, sell high.

Christian DeHaemer

Since1995, Christian DeHaemer has specialized in frontier marketopportunities. He has traveled extensively and invested in places asvaried as Cuba, Mongolia, and Kenya. Chris believes the best way tomake money is to get there first with the most. Christian is the founderof Crisis & Opportunity and Managing Director of Wealth Daily. He is also a contributor for Energy & Capital. For more on Christian, see his editor's page.