Visa Leads Dow as Stocks Pare Early Upside

The payments sector is in focus today amid major M&A activity

The payments sector is in focus today amid major M&A activity

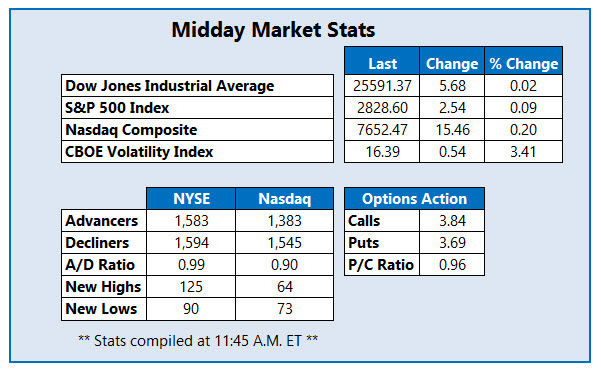

The Dow Jones Industrial Average (DJI) has pared its earlier gains, with stocks unable to maintain their positive momentum following downbeat trade comments from U.S. President Donald Trump in Japan. Visa (V) is the top Dow performer at midday, as payments stock rally in response to a big merger -- but the S&P 500 Index (SPX) is hovering around breakeven as investors monitor the sharp decline in Treasury yields. Elsewhere, the Nasdaq Composite (IXIC) is trading in positive territory thanks to strength in the tech sector.

Continue reading for more on today's market, including:

Expansion news boosts Beyond Meat stock. Goldman says to sell this big-name drugmaker. Plus, AMD bulls emerge on product unveiling; a $21.5 billion M&A deal; and Teva shares sink to new low.

There's unusual options trading on Advanced Micro Devices, Inc. (NASDAQ:AMD) today, after the company unveiled new Ryzen CPUs. AMD stock is trading up 9.6% at $28.96, and short-term call options are hot. New positions are opening at the weekly 5/31 28.50-, 28-, and 29-strike calls, while the the weekly 6/7 30-strike call is popular, as well. The chipmaker's front-month gamma-weighted Schaeffer's put/call open interest ratio (SOIR) is 1.27 -- so short-term options sentiment seemed bearish coming into today, since this reading shows put open interest outweighing call open interest among near-the-money strikes in the June series.

One of today's big winners is Total System Services, Inc. (NYSE:TSS), as the company has agreed to be bought by Global Payments Inc (GPN) for $21.5 billion in stock. TSS stock is trading up 6.5% at $120.79, putting its market cap right near the value of the deal.