VIX Is Once Again on Wheels This Morning

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and his opinion on recent news from Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB).

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and his opinion on recent news from Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB).

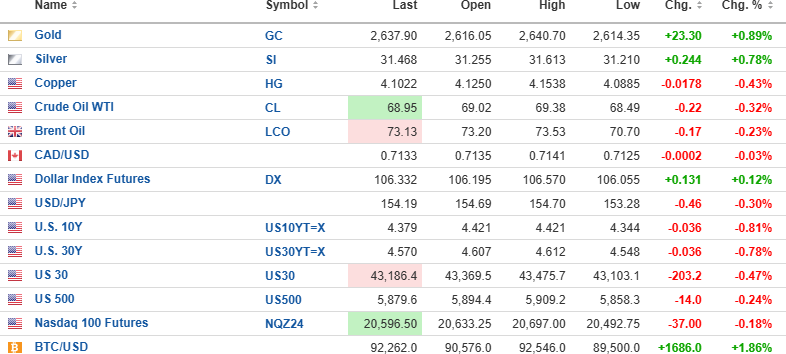

USD Index futures are up 0.12% to 106.332 this morning with the 10-yr. yield down 0.81% to 4.379%, and the 30-yr. yield down 0.81% to 4.57%. gold (+0.89%) and silver (+0.78%) are continuing to rally, while copper (-0.43%) and oil (-0.32%) are lower.

Stock futures are lower, with the DJIA down 0.47%, the S&P 500 down 0.24%, and the NASDAQ down 0.18%. Risk barometer Bitcoin is up 1.86% to 92,262.

Volatility

The VIX:US is up 2.42% this morning with the UVIX:US called $0.30 higher to $3.89 as stocks are coming under pressure. I suspect things will be choppy until after the U.S. Thanksgiving on November 28, but with the MACD indicator for the S&P 500 executing a bearish crossover, the RSI coming off overbought status, the MFI turning down, and the 20-dma about to be snapped, I would hazard a guess that the trend is down until stocks approach an oversold condition.

However, seasonality, those record corporate buybacks, and Nvidia Corp. (NVDA:NASDAQ) earnings scheduled for release after the close Wednesday could represent offsetting bullish forces going into the end of the week.

I am certainly in the "contrarian" camp this morning because the "Trump Bump" post-election has taken valuations from the ridiculous to the sublime. The Buffett Indicator, the CAPE ratio, price-to-earnings, price-to-book, and price-to-sales ratios are all in record territory, leaving very little room for imperfection.

Getchell Gold Corp.

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) recently shared an update on its preliminary economic assessment for its Fondaway Canyon Gold Project, Nevada. You can read the press release here.

Management knows full well how important the PEA is to the short-term performance of the stock and has given us clues as to the expected outcome. You cannot deliver the economic assessment without metallurgy, and while I can gnash and gnarl my teeth over the late start in launching the PEA, we know from this release that a positive result is expected and that the bulk of the sampling has come from the oxidized portions of the resource.

This is significant because lower-cost heap leach processing can be applied to the oxide cap, whereas it does not work with sulfide mineralization. If the design for the open pit as a starter operation includes treatment of the oxides, then this could be a very profitable operation and one that should propel GTCH/GGLDF to a much higher valuation. Once they have recovered the CAPEX through mining the oxides, a different circuit may be used to treat the higher-grade sulfide mineralization that has been reported at depth from the North Fork and Colorado SW zones.

Now, I am speculating here and will not know anything until the PEA arrives in early January, but as I wrote last night, I do not favor releasing a positive PEA outcome into the tax-loss harvesting period. I would rather accumulate the stock now and into early December with a view to seeing a sharp increase into January and beyond as it becomes apparent that the valuation gap is being eliminated.

By the middle of December, the gold and silver stocks should have largely completed their corrective moves and be ready for the next wave up.

We have all been inordinately patient with this investment, but 2025 should be the year that our patience is rewarded in spades.

| Want to be the first to know about interestingGold andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.