Warning of another string of mining bankruptcies in 2016

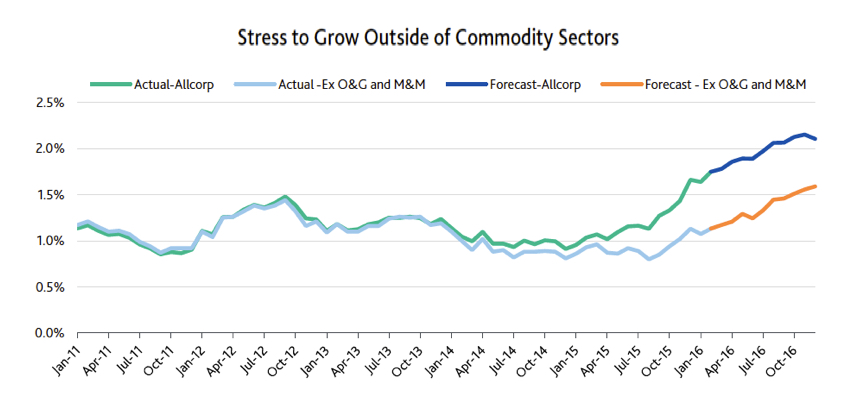

Already high bankruptcy and default rates in mining & metals and oil & gas will only accelerate this year as the prolonged downturn in commodities begin to spill over into other sectors.

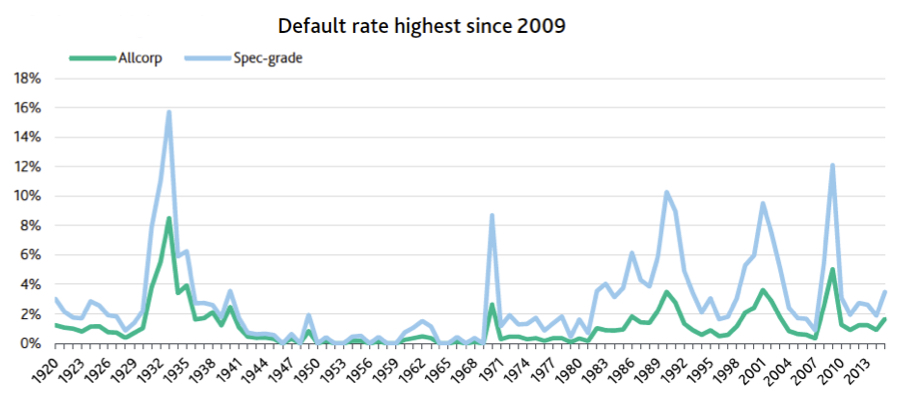

Overall, global speculative-grade corporate defaults will increase by more than 30% in 2016 and reach the highest level since 2009, says Moody's Investors Service in a new report.

And 2015 already saw close to a doubling of companies defaulting on corporate bonds or loans compared to 2014 with the total jumping to $97.9 billion according to the ratings agency's "Corporate Default and Recovery Rates, 1920-2015" report which covers more than 20,000 corporate issuer, released today.

Source: Moody's

What's different compared o the global financial crisis of 2009 is that defaults in this credit cycle are unique in that they are sector-specific.

Oil & gas accounted for 32% of all defaults and metals & mining around 14%, the second biggest contributor among non-financial sectors.

Oil & gas accounted for 32% of all defaults and metals & mining 14%, the second biggest contributor among non-financialsMetals & mining also suffered the highest default rate in 2015 at 6.5%, followed by oil & gas at 6.3%.

Alpha Natural Resources' chapter 11 in August was the biggest at $4.5 billion followed by Walter Energy's $3.7 billion in bonds and loans in July. Among the 13 defaulters were Indonesian Berau Coal's $950 million bankruptcy, Swiss-based Ukrainian iron ore firm Ferrexpo's $500 million bond distressed exchange, and rare earth miner Molycorp's $1.45 billion chapter 11 in June.

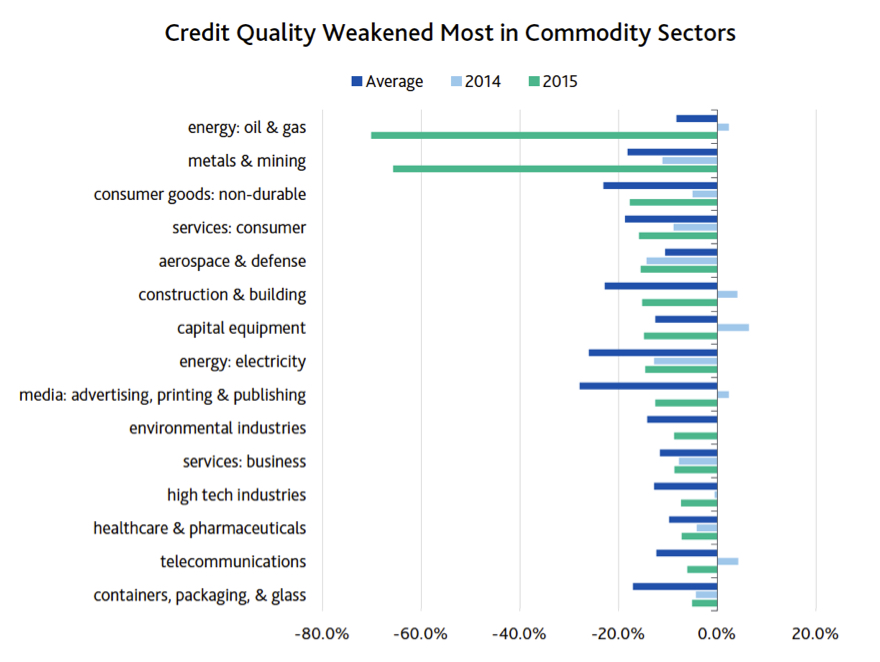

The credit deterioration was particularly stark last year. Oil & gas' rating drift (defined as the average upgraded notches minus the average downgraded notches) fell to -70.1% of a rating notch in 2015 from just -2.4% a year earlier. For metals & mining the decline was equally dramatic from -11.1 to -65.6% with no other sectors even in the same ballpark.

Partial graph. Source: Moody's

In 2016 credit conditions are expected to worsen, reflecting the effects of a prolonged downturn in the commodities sector, says Sharon Ou, Moody's Vice President and Senior Credit Officer:

"Although credit quality declined throughout 2015, the magnitude of ratings downgrades widened significantly in the fourth quarter.

"These factors, combined with the sharp increase in defaults and rising investor caution, indicate that the credit cycle is turning."

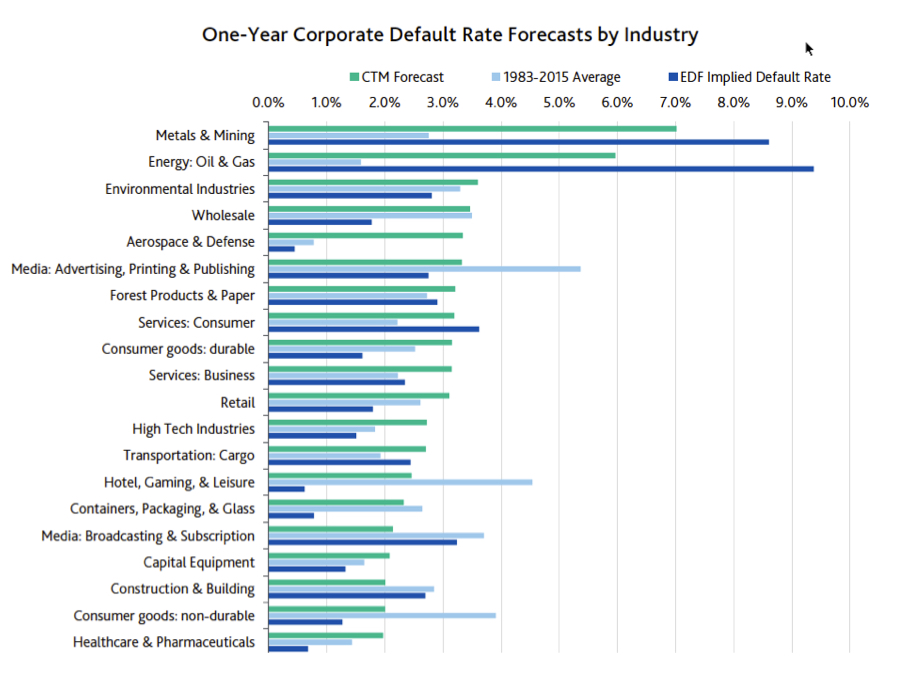

These forecasts, if realized, will be more than double and triple their historical averagesMoody's forecasts for mining and oil default rates in 2016 go as high as 8%-9% and according to their baseline forecast the outlook for metals & mining is once again the worst at 7% followed by oil & gas (6%). These forecasts, if realized, will be more than double and triple their historical averages.

That compares to a rate of 9.4% for metals & mining in 2009, which incidentally was followed by a zero defaults during the following two years. And keep in mind these are rates among all issuers, among speculative grade companies debt blow-ups will be much higher.

Partial graph. Source: Moody's

For oil and gas, 2015 was already the worst year since 1986 when defaults topped 8.3%Mining's worst ever years going back to 1970 was 1986 when nearly one in five issuers defaulted on debt followed by 2001 when defaults reached 13.5%. As for oil and gas, 2015 was already the worst year since 1986 when defaults topped 8.3%.

"Persistently low commodity prices, slowing economic expansion and widening high-yield spreads will send default rates higher in 2016," says Ou.

Commodity sectors will remain in significant distress in 2016 and sharp declines on global stock markets are reflecting "worries over prolonged commodity stress, uncertainties from geopolitical developments in Russia, the recession in the economies of several emerging market countries and the fear of a hard landing in the Chinese economy," says Ou.

Source: Moody's