Watch For Gold's Currency Component To Strengthen

Demand for safety assets has diminished, undermining gold's price.

Yet gold's currency component is showing signs of strengthening.

A weaker dollar and commodity market rebound will boost gold demand.

Gold and gold mining stocks suffered a setback in the first half of September, thanks in part to diminishing trade war fears. But while gold's "fear factor" is on the wane, the yellow metal's currency component is showing signs of strengthening. In today's report we'll examine the increased prospects for gold to continue its rising trend in Q4 due to a combination of a weaker dollar and a stronger demand outlook for commodities in general.

After a needed period of refreshment following last month's sustained rally, gold has cooled off substantially and is no longer "overbought" from a technical standpoint. The December gold futures price still hasn't yet confirmed an immediate-term (1-4 week) bottom as of Sept. 12, but there are preliminary signs that we could soon see another bottom.

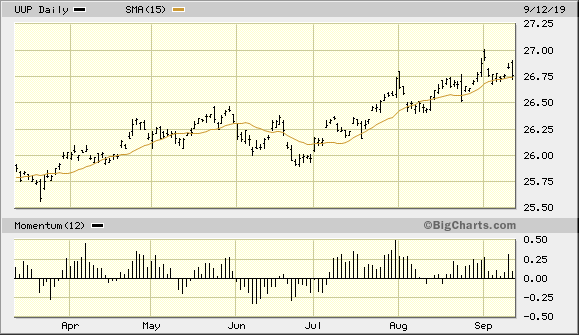

Gold's best chance for reversing its recent decline is likely to come from a weaker U.S. dollar index. Bullion prices managed to rally in August despite a strengthening dollar, yet it's clear that the strong greenback eventually made its presence felt by weakening gold's currency component earlier this month. Shown below is the Invesco DB U.S. Dollar Index Bullish Fund (UUP), which is my favorite dollar proxy. Despite remaining near its high for the year, the dollar has lost some interest among investors as a safe haven in the last two weeks. As global equity prices rally and investors rotate out of safe havens like Treasury bonds and back into riskier assets, the dollar ETF is beginning to show signs of strain.

Source: BigCharts

Source: BigCharts

If UUP closes under its 15-day moving average (above) in the next few days, then the gold bulls will have another excellent opportunity to regain control of the metal's immediate-term trend. A weaker dollar index would also have the effect of increasing the attractiveness of commodities in general among institutional fund managers, who are among the big movers and shakers in the gold market.

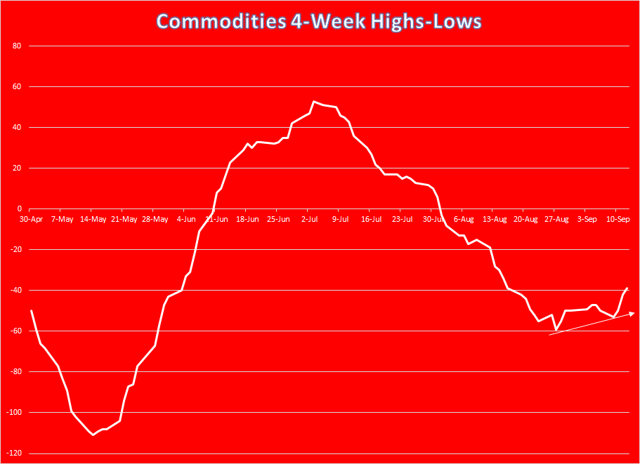

It's also worth mentioning that the selling in the broad commodity market this summer appears to be overdone, with the big drop in August likely the result of headline-driven panic. Panic selling is normally reversed in short order, and for this reason I expect to see more of an upward drift in commodity prices in general in the coming weeks. Another reason why I think commodities could see some short covering in the weeks ahead is illustrated in the following graph. This shows the 4-week rate of change (momentum) in the number of new highs and lows among all actively traded commodity futures contracts in the U.S. It's a simple way of aggregating the incremental demand for commodities and isolating the near-term path of least resistance for prices.

Source: Barchart

As you can see here, the 4-week new highs-lows indicator for the commodity futures broad market is in the process of reversing an extended downward trend. If this continues, participants should expect to see not only some increased upward pressure in other commodities, but also for the gold market.

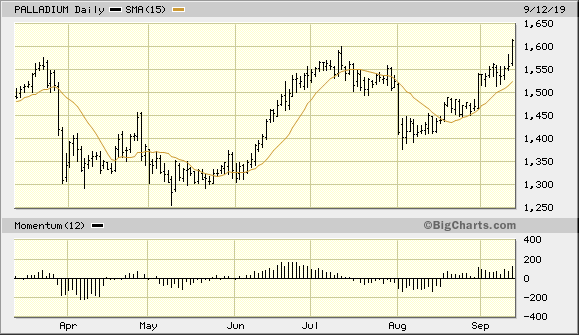

Another important consideration which argues in favor of gold's upward trend continuing into the fourth quarter of 2019 is the amazing strength in the palladium market. Palladium prices hit a record high on Sept. 12 due to supply-related concerns and possible labor issues among South African miners of the metal. Given that palladium has led gold at pivotal turning points in recent years, the powerful surge in palladium prices can't be ignored. For instance, when palladium prices showed sustained strength while gold prices were sagging last autumn, hedge fund and institutional money managers took this as their cue to begin buying gold. Their collective buying eventually pushed gold prices higher and encouraged smaller retail traders to join in. The palladium price rally is thus another potentially positive factor in gold's favor heading into Q4.

Source: BigCharts

Source: BigCharts

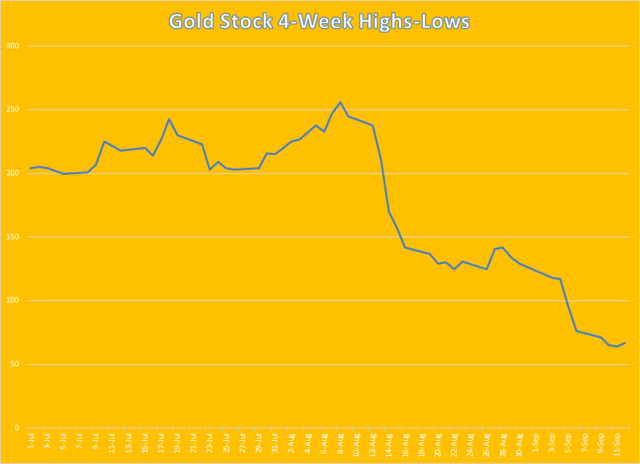

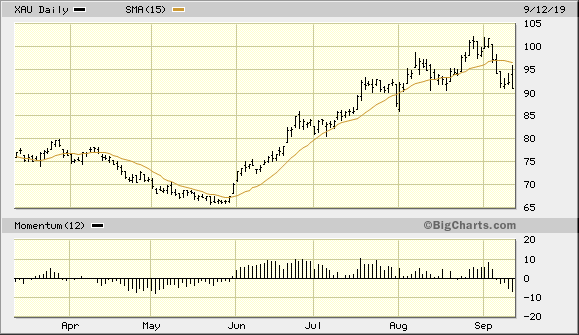

Meanwhile, the actively traded gold mining shares have remained in control of the bears from an immediate-term basis. This can be seen in the recent pullback in the PHLX Gold/Silver Index (XAU), the benchmark for U.S. exchange-listed gold stocks. A 2-day higher close above the 15-day moving average is needed to confirm a bottom for the XAU based on the rules of my technical trading discipline.

Source: BigCharts

Source: BigCharts

Once the next bottom for the gold stock market has been confirmed, we should also see a reversal in the internal momentum for the mining shares. Below is the 4-week rate of change in the new highs and lows for the 50 most actively traded gold stocks. A reversal of the downward trend in this indicator would suggest that the incremental demand for the gold miners has improved enough to warrant a sustained rally. For now, a defensive posture is still recommended until the needed improvement becomes apparent.

Source: NYSE

Although gold and gold mining shares have taken a much-needed breather in the first part of September, the factors discussed here suggest that the precious metals sector still has bullish potential in the coming months. All that is needed to catalyze a worthwhile rally for gold is a weaker U.S. dollar index. The odds are strong that we'll witness at least some weakness in the greenback in the coming weeks as investors shed their fears over the U.S.-China trade outlook and turn their attention away from safe havens and toward riskier assets. Commodities should benefit from the return of a "risk-on" approach among investors, and a strengthening commodity broad market bodes well for the gold price outlook. Investors can therefore maintain longer-term investment positions in gold and gold stocks.

On a strategic note, I was stopped out of my trading position in the VanEck Vectors Gold Miners ETF (GDX) after it violated the $28.00 level on Sept. 9. A 3-month rally in GDX and a gain of almost 30% made this a worthwhile trade. The recent pullback in GDX, however, puts me back in a cash position on a short-term basis as I await the next confirmed bottom and re-entry signal from my technical trading discipline. I suggest that short-term oriented traders also wait for an improvement in the momentum of the 4-week new highs and lows in the actively traded gold stocks, mentioned above, before initiating new long positions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts