Watch These Key Levels in Precious Metals

The precious metals sector appears to have started a correction.

It was roaring higher until natural resistance kicked in and the U.S. Dollar grinded its way higher, towards its 2019 high. Factor in the Fed decision this week and it has created a natural "buy the rumor, sell the news" event.

We cannot know for certain what the Federal Reserve will do or even more importantly, how the market will react. But we can take note of key levels in these markets.

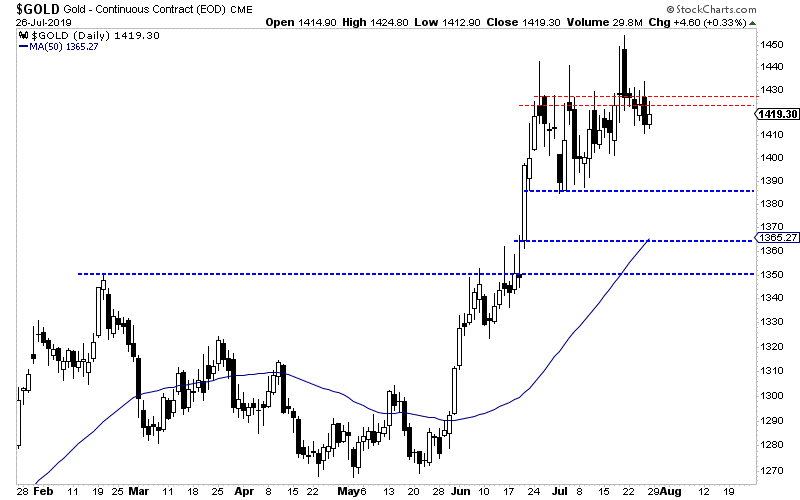

Gold has held above $1400/oz but has been unable to break past resistance at $1420-$1425/oz. A retest of $1385/oz is quite possible and so is a test of $1365/oz.

Silver has outperformed Gold since it broke above its 400-day moving average, which provided strong resistance dating back to the end of 2017.

Silver encountered resistance at $16.60-$16.70/oz and could test initial support at $16.20/oz. Below that is strong support at $15.95/oz.

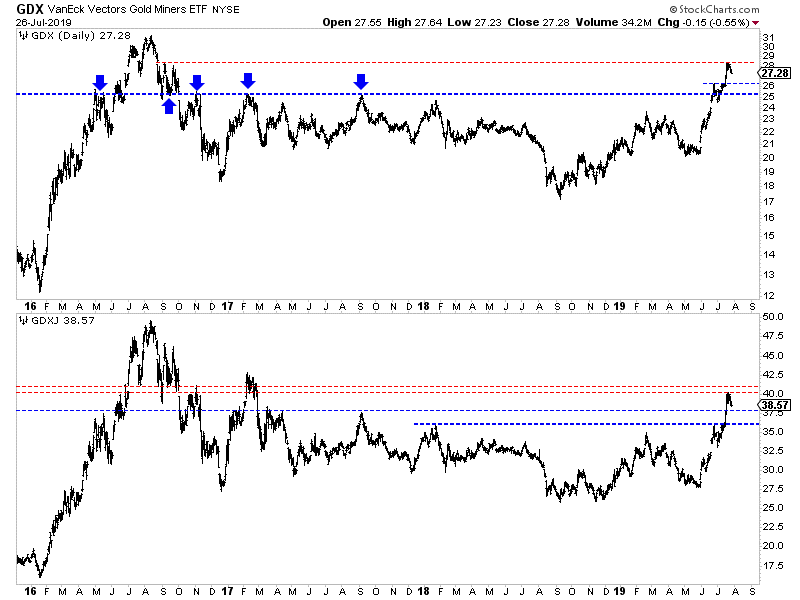

Turning to the gold stocks, we find a clear setup between support and resistance.

GDX, the ETF for large gold producers has resistance at $28 but good support above $25.00, which was previous resistance for nearly three years. Look for initial support around $26.00.

GDXJ, the ETF for the "senior" junior companies, faces resistance at $40-$41. It has initial support around $37.50 with strong support at $36.00.

Regardless of what the Fed does or says, my expectation is precious metals will test these levels and ultimately hold them. The Fed and global central banks want to ease policy and this figures to be more than a one-off.

Precious metals became overbought and a correction is in order.

Investors who smartly positioned in recent months should continue to hold their winners. If the sector continues to correct then look to be a buyer at the aforementioned support levels.

Look to focus your capital on fresh opportunities and value plays that are not very overbought or extended. To learn the stocks we own and intend to buy on this weakness that have 3x to 5x potential, consider learning more about our premium service.

Jordan Roy-Byrne CMT, MFTA

July 30, 2019