Weak Demand Weighs on Alrosa Profit

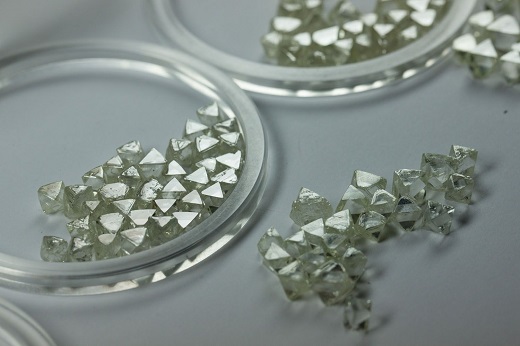

RAPAPORT... A challenging rough market in the first half of the year led to a decline in Alrosa's profit in 2019, despite a stronger fourth quarter.Profit fell 31% to RUB 62.7 billion ($874.6 million) for the year, as an oversupply of polished stones hampered rough demand, the miner said Tuesday. Revenue dropped 21% to RUB 238.2 billion ($3.32 billion). Diamond sales slid 23% to RUB 215.4 billion ($3 billion), as sales volume slipped 12% to 33.4 million carats. The average price for gem-quality diamonds fell 19% to $133 per carat. Alrosa derived the rest of its revenue from transportation, gas and social infrastructure. Belgium remained the miner's biggest market, despite a 23% decline in sales to RUB 100.38 billion ($1.4 billion). Domestic sales decreased 14% to RUB 45.93 billion ($640.1 million), while sales to India fell 9% to RUB 37.49 billion ($522.3 million)."In the first half of 2019, the diamond market was impacted by the excessive supply of polished diamonds and a decreased availability of funding for the Indian midstream segment," said Alrosa chief financial officer Alexey Philippovskiy. "Diamond producers were able to adjust their sales policy by reducing supply by 20%, helping improve the balance of demand and supply across the chain as early as the end of 2019."Production for the year rose 5% to 38.5 million carats, as the miner ramped up production at the Verkhne-Munskoye deposit, which it launched in the fourth quarter of 2018. It also increased output at the Botuobinskaya pipe from the processing of higher-grade ore.In the fourth quarter, revenue rose 5% to RUB 64.6 million ($900.8 million), as increased sales volume outweighed a 3% drop in the average price to $148 per carat. Profit surged 47% to RUB 11.7 billion ($162.6 million) as the company recorded foreign-exchange gains, it said."In the second half of 2019, consumer activity recovered across key sales markets, above all in the US," Philippovskiy added.Alrosa's diamond inventory grew 33% year on year to 22.6 million carats as of December 31, as the miner increased output, but sold less.The upturn in the fourth quarter continued into 2020, with February sales inching up 0.2% versus the previous year to $346.4 million. Rough-diamond sales rose 0.5% to $342.3 million, according to Rapaport calculations. Polished revenues slid 18% to $4.1 million.However, the month heralded a return to a challenging market amid concerns about the coronavirus around the world, Alrosa said."In February, the uncertainty with the spread of COVID-19 virus started to weigh negatively on demand and customers' activity," Alrosa deputy CEO Evgeny Agureev said. "However, we continue to pursue [a] 'price-over-volume' strategy to keep prices stable rather than increasing sales volumes."Image: Rough diamonds at an Alrosa sorting center. (Alrosa)

RAPAPORT... A challenging rough market in the first half of the year led to a decline in Alrosa's profit in 2019, despite a stronger fourth quarter.Profit fell 31% to RUB 62.7 billion ($874.6 million) for the year, as an oversupply of polished stones hampered rough demand, the miner said Tuesday. Revenue dropped 21% to RUB 238.2 billion ($3.32 billion). Diamond sales slid 23% to RUB 215.4 billion ($3 billion), as sales volume slipped 12% to 33.4 million carats. The average price for gem-quality diamonds fell 19% to $133 per carat. Alrosa derived the rest of its revenue from transportation, gas and social infrastructure. Belgium remained the miner's biggest market, despite a 23% decline in sales to RUB 100.38 billion ($1.4 billion). Domestic sales decreased 14% to RUB 45.93 billion ($640.1 million), while sales to India fell 9% to RUB 37.49 billion ($522.3 million)."In the first half of 2019, the diamond market was impacted by the excessive supply of polished diamonds and a decreased availability of funding for the Indian midstream segment," said Alrosa chief financial officer Alexey Philippovskiy. "Diamond producers were able to adjust their sales policy by reducing supply by 20%, helping improve the balance of demand and supply across the chain as early as the end of 2019."Production for the year rose 5% to 38.5 million carats, as the miner ramped up production at the Verkhne-Munskoye deposit, which it launched in the fourth quarter of 2018. It also increased output at the Botuobinskaya pipe from the processing of higher-grade ore.In the fourth quarter, revenue rose 5% to RUB 64.6 million ($900.8 million), as increased sales volume outweighed a 3% drop in the average price to $148 per carat. Profit surged 47% to RUB 11.7 billion ($162.6 million) as the company recorded foreign-exchange gains, it said."In the second half of 2019, consumer activity recovered across key sales markets, above all in the US," Philippovskiy added.Alrosa's diamond inventory grew 33% year on year to 22.6 million carats as of December 31, as the miner increased output, but sold less.The upturn in the fourth quarter continued into 2020, with February sales inching up 0.2% versus the previous year to $346.4 million. Rough-diamond sales rose 0.5% to $342.3 million, according to Rapaport calculations. Polished revenues slid 18% to $4.1 million.However, the month heralded a return to a challenging market amid concerns about the coronavirus around the world, Alrosa said."In February, the uncertainty with the spread of COVID-19 virus started to weigh negatively on demand and customers' activity," Alrosa deputy CEO Evgeny Agureev said. "However, we continue to pursue [a] 'price-over-volume' strategy to keep prices stable rather than increasing sales volumes."Image: Rough diamonds at an Alrosa sorting center. (Alrosa)